https://www.zerohedge.com/markets/fed-injects-1042bn-overnight-term-repos-one-day-after-start-not-qe

Fed Injects $104.2BN Via Overnight, Term Repos One Day After Start Of "Not A QE"

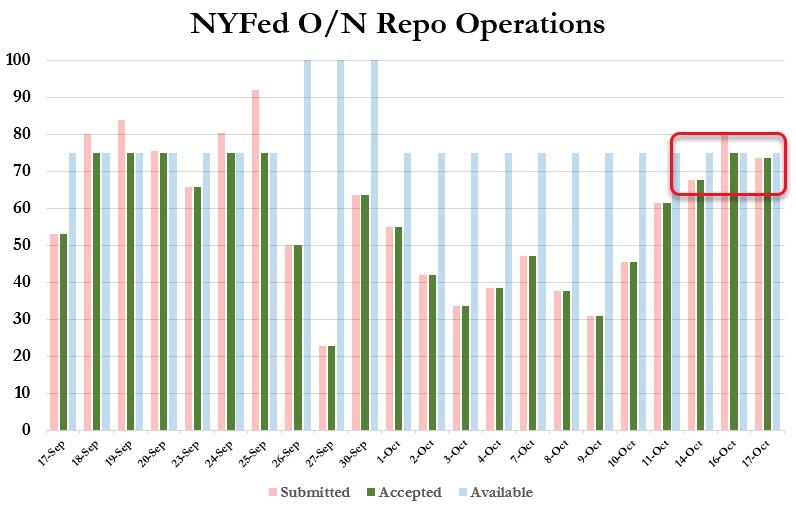

One day after the repo market appeared to lock up again, when the Fed's overnight repo operation was unexpectedly oversubscribed again, for the first time since September 25, moments ago - and one day after the Fed's first "NOT A QE" Pomo in which the Fed bought $7.5BN in a 4.3x oversubscribed open-market liquidity injecting operation - the Fed announced it had accepted over $104 billion in collateral as part of today's overnight and term repo operations.

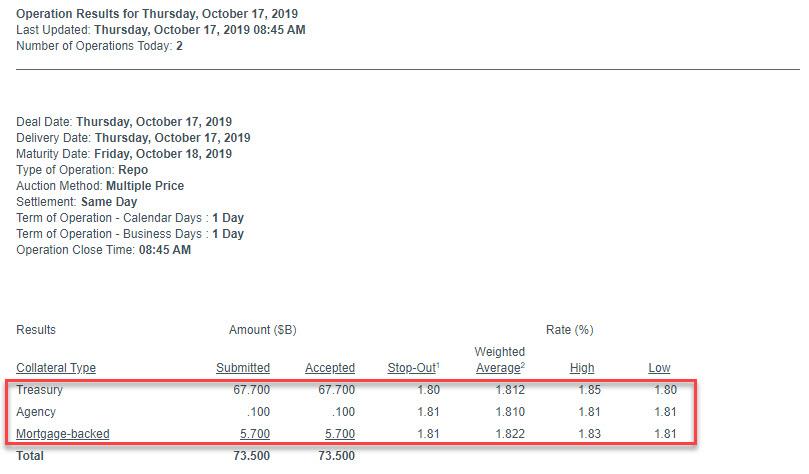

Specifically, the Fed accepted $67.7BN and $5.7BN in Treasury and MBS securities as part of today's overnight repo operation, which however topped out at $73.5BN, just shy of the maximum allotment of $75BN, sparing the Fed the humiliation of explaining why liquidity conditions remains beyond strained.

Yet coming one day after the Fed's O/N repo operation was oversubscribed (at $80.35BN), the drop was hardly as substantial as one would expect at a time when the Fed is now permanently expanding its balance sheet, having started to monetize T-Bills yesterday. Indeed, as shown below this was only the second most securities pledged at the Fed since Sept 25.

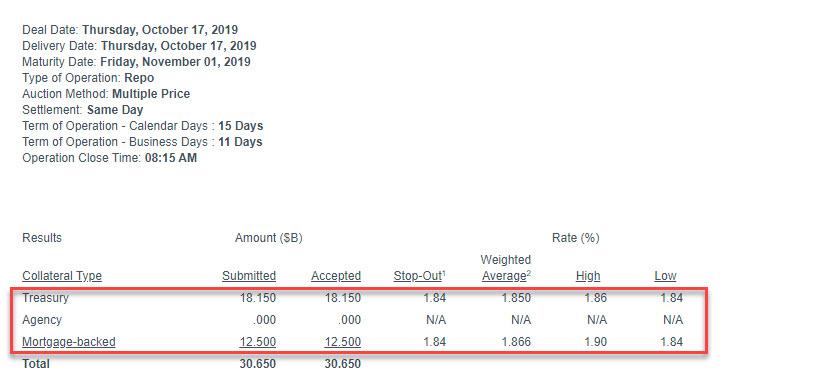

Perhaps a reason for the slightly reduced liquidity need is that just minutes before the overnight Fed operation, the Fed also accepted $30.65BN in a 15-day term repo, which consisted of $18.15BN in TSYs and $12.5BN in MBS.

Yet the clearest indication that something remains ominously broken with the repo market, came earlier today when ICAP reported that the day's first overnight general collateral repo traded at 2.04%/2.01%, both above the upper end of the Fed Fund rate corridor, and confirming that the liquidity shortage is persisting, which prompted us to note that

1) one day after an oversubscribed repo

2) one day after "Not A QE4" started

3) one day after a Fed president hinted strongly that a standing repo facility is coming

2) one day after "Not A QE4" started

3) one day after a Fed president hinted strongly that a standing repo facility is coming

... the repo rate was still abnormally above fed funds as repo market remains broken and banks refuse to lend to each other.

What is most concerning is that this is taking place as the Fed is now permanently increasing reserves again, which then begs the question: just why are banks so scared of lending money to each other - now that JPM's previously discussed reticence is also spreading to smaller banks - and choose to park their money with the Fed instead? What do they know that we don't.

No comments:

Post a Comment