Liquidity Panic Is Back: Fed's Repos Massively Oversubscribed Amid Market Turmoil

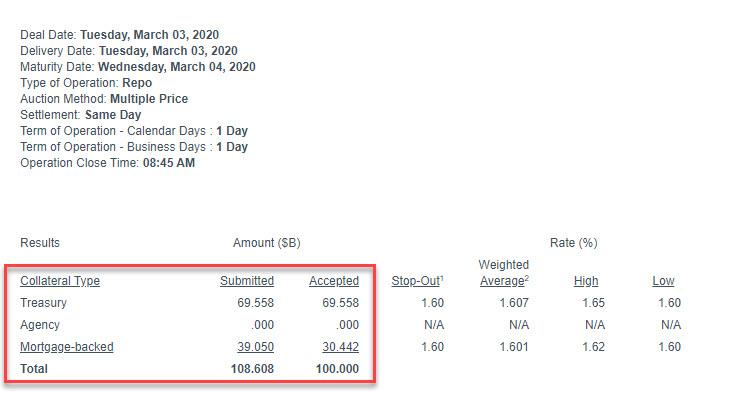

Update: Just in case we needed another confirmation that there was a sudden, unexpected liquidity clog in the interbank market, Dealers submitted a record $108.6BN in overnight repo, resulting in the first oversubscribed overnight repo operation since October (recall the total size of the overnight repo was reduced from $125BN to $100BN).

This means that, if going solely by the amount of securities submitted between the term and overnight repo, the overall liquidity shortage today was nearly $180BN, the highest since the start of the repo crisis, and a clear signal to the Fed that it needs to do something to further ease interbank lending conditions.

* * *

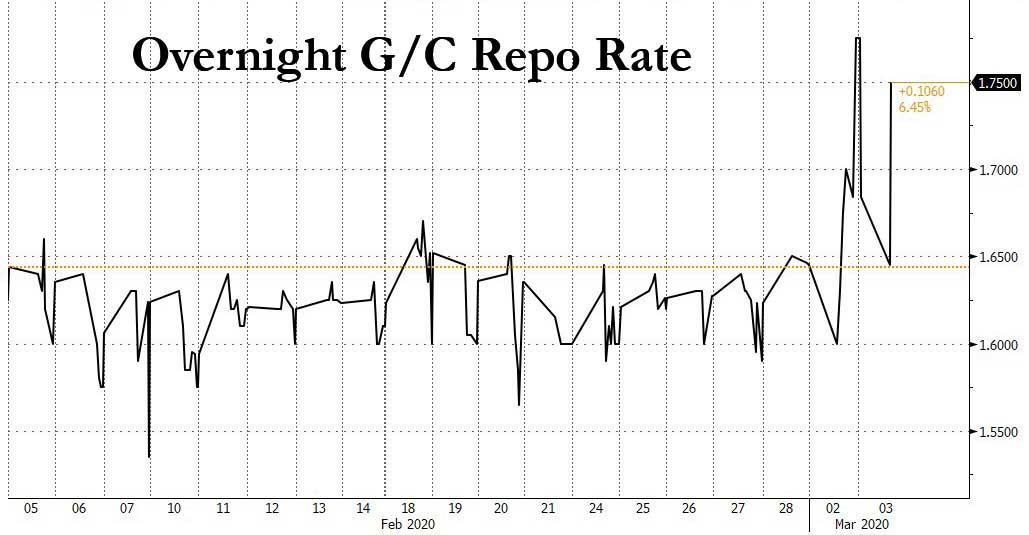

It did not take long for shock and awe of last week's market turmoil to hit the interbank market.

One day after the overnight general collateral repo rate unexpectedly soared to 1.80%, far above the effective Fed Funds rate, and an indication that last week's record market drop was once again causing interbank liquidity plumbing to clog up as banks had to pay far higher market rates to obtain overnight liquidity as the Fed's monetary policy was once again not making its way to the repo market...

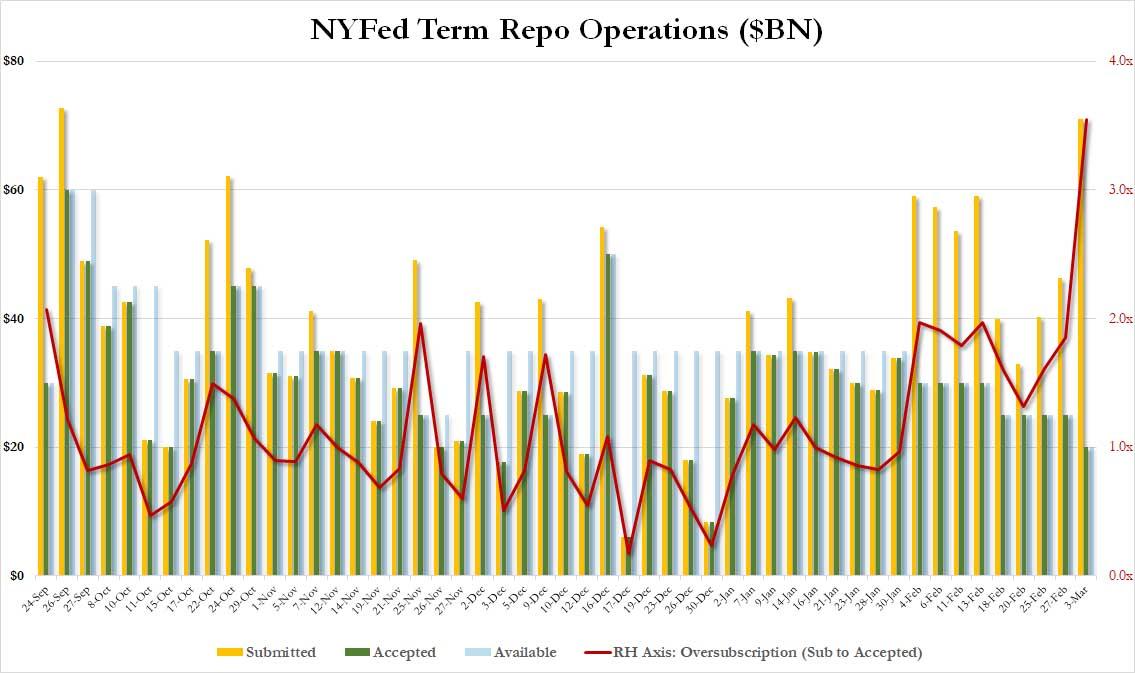

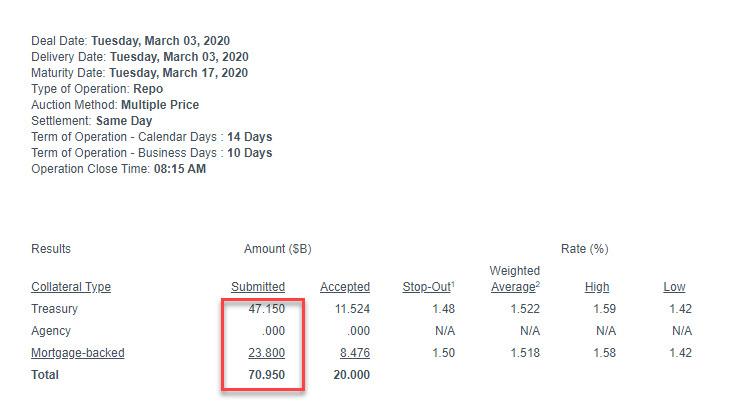

... moments ago we got a confirmation of just how bad the liquidity shortage really was, when the Fed announced that in its first term repo operation for the month of March, which as a reminder was also the first $20BN term repo as the Fed shrank February's $25BN term repos by another $5BN as part of its repo operation tapering, the operation was massively oversubscribed, with the submitted to accepted ratio soaring to a record 3.5x, the highest since the launch of the Fed's term repo operations in September, and confirming that there was once again a sharp drop in dealer funding prompting US financial institutions to scurry to the liquid generosity of the Fed.

To be sure, the oversubcription number was somewhat distorted due to the drop in the amount of accepted securities, yet even so, the notional of TSY and MBS securities tendered, at $71BN, was the second highest since September.

What does this mean? Simple: in addition to cutting rates, banks are now forcefully telling the Fed that it will also have to either boost the size of its repos, or expand its ongoing QE4 indefinitely as the plumbing issues in the US financial system have still not been resolved, some 6 months after the repo crisis started in September. It also means that a rate cut alone may not be enough to push stocks higher if indeed there remains a structural liquidity shortage in the US banking system, a shortage which today's repo result confirmed is still shockingly there.

No comments:

Post a Comment