https://www.zerohedge.com/news/2019-08-10/do-investors-realize-how-much-risk-theyre-taking

Do Investors Realize How Much Risk They're Taking On?

Do investors recognize how much risk they’re taking on at this stage in markets? I think it’s a highly relevant question as things may not be as well as they seem. On the surface all looks well as markets just made new all time highs in July and big cap stocks such as $AAPL are near trillion dollar valuations and show strong balance sheets.

But there’s something insidious going on underneath the valuation equation and that is: Investors paying higher and higher forward multiples not realizing that they do.

Why? Because corporate profits are actually not expanding. Not only are they not expanding they’re shrinking on an aggregate level.

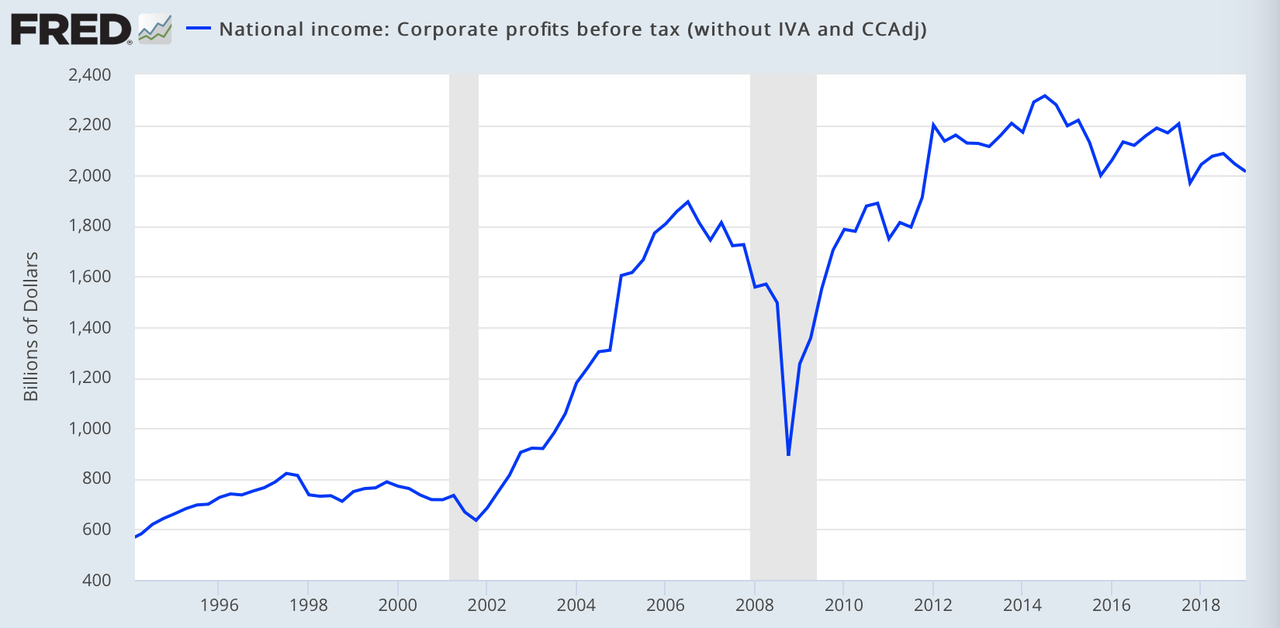

What if I told you corporate profits before taxes actually peaked in 2014, 5 years ago? Really, it is true:

And if you look closely you realize that this a trend that happens preceding recessions. Now this trend can last a few years as it has now, or in the period in the mid 90’s leading to the 2000 top, or it can happen more quickly as in the 2006 – 2007 time frame.

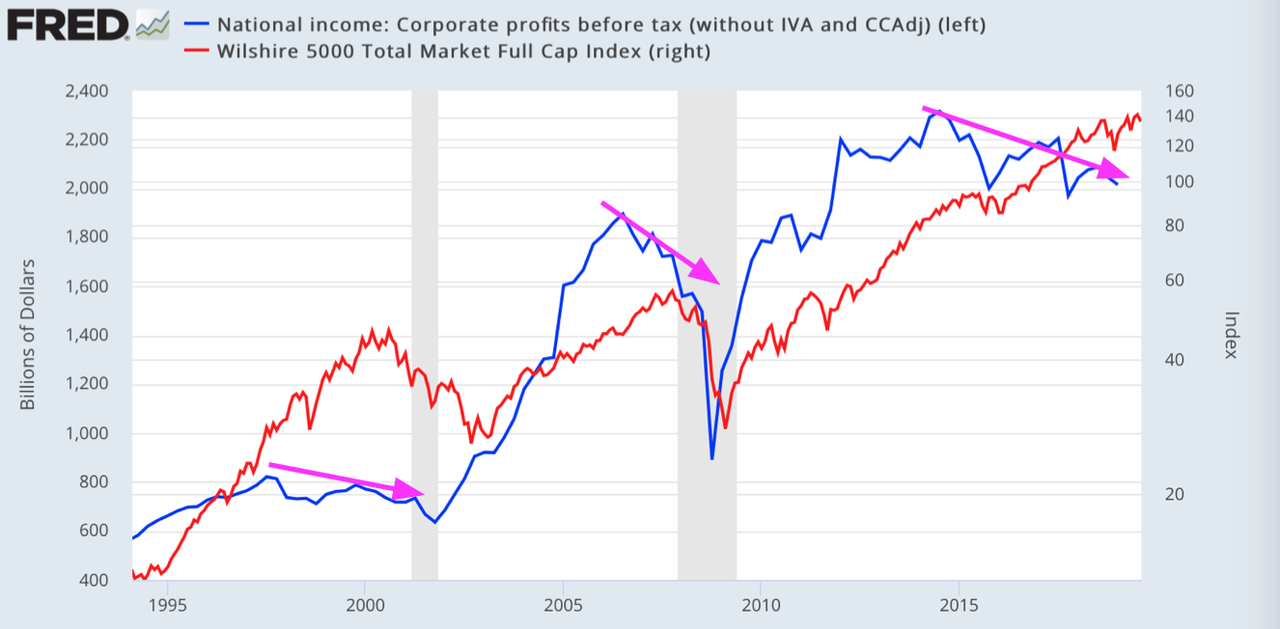

But note, this decline in corporate profits presages the end of a business cycle, i.e. an upcoming recession, but markets tend to keep rising until that happens:

Why don’t markets react to this decline in corporate profits? The last cycle and this cycle in particular give a clear answer: Buybacks.

Even more so now than in 2006-2007 we are still in a very aggressive buyback cycle and this form of financial engineering masks a lot of things.

Here’s how I explained it on twitter the other day in reference to a chart about how earnings growth has come to a halt:

How this works:

Say you earn $1 in year 1 and $1 in year 2.

Earnings are flat.

But because you shrank your float via buybacks you can claim earnings growth.

$1 over 1 share = EPS of 1

$1 over 0.9 shares = EPS of 1.11

Look: 11% earnings growth. Magic.

Now pay me a bonus. twitter.com/dlacalle_IA/st…

235 people are talking about this

And here is how this translates into risk to investors. Take $APPL.

The company is trading around $200 these days, nearly double the level it was trading at in 2015. Why is 2015 relevant? Because $AAPL’s earnings were exactly the same as they are now: Around $53B.

But what did they do? They bought back shares since 2015. Lots of them. 1.2 billion shares to be precise. The net effect:

“With flat net income, the purchase of a net 1.2 billion Apple shares means that per-share earnings are slated to rise from $9.22 in fiscal 2015 to $11.51 this year”.

What’s that mean for investors? Well, you’re paying a near double premium in share price for a company that hasn’t grown earnings in 4 years. That’s called multiple expansion. $AAPL’s forward earnings multiple in 2015 was 11-2, now it’s near 17. That means you’re taking on a lot more risk than in 2015. In fact the multiple expansion is between 45%-55%.

Who says there’s no inflation?

And it’s not only with $AAPL, it’s common across the board. So investors be aware: You’re taking on a lot more risk in paying for shares either directly or in ETFs and index funds, especially at a time when market valuations to GDP have exceeded 140%. Buyer beware.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

No comments:

Post a Comment