https://www.zerohedge.com/markets/corona-crash-sparks-worst-month-stocks-financial-crisis-fastest-correction-history

Corona-Crash Sparks Fastest 'Correction' In History On Record-Breaking Volume

It was a historic week...

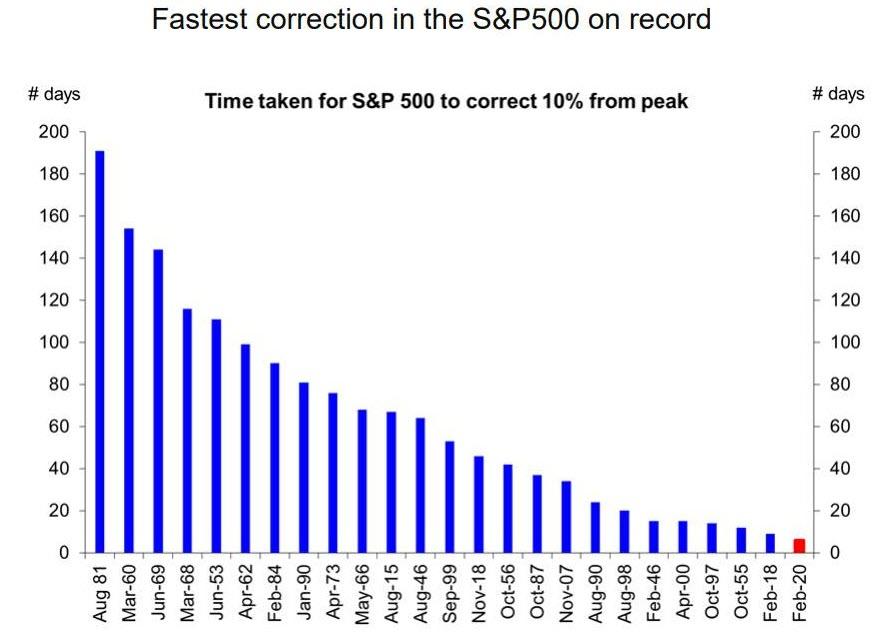

S&P crashed from peak to correction at the fastest pace in history...

Dow crashed from peak to correction at its fastest pace since 1928 - right before The Great Depression

Source: Bloomberg

Right on time...we're gonna need more liquidity...

Source: Bloomberg

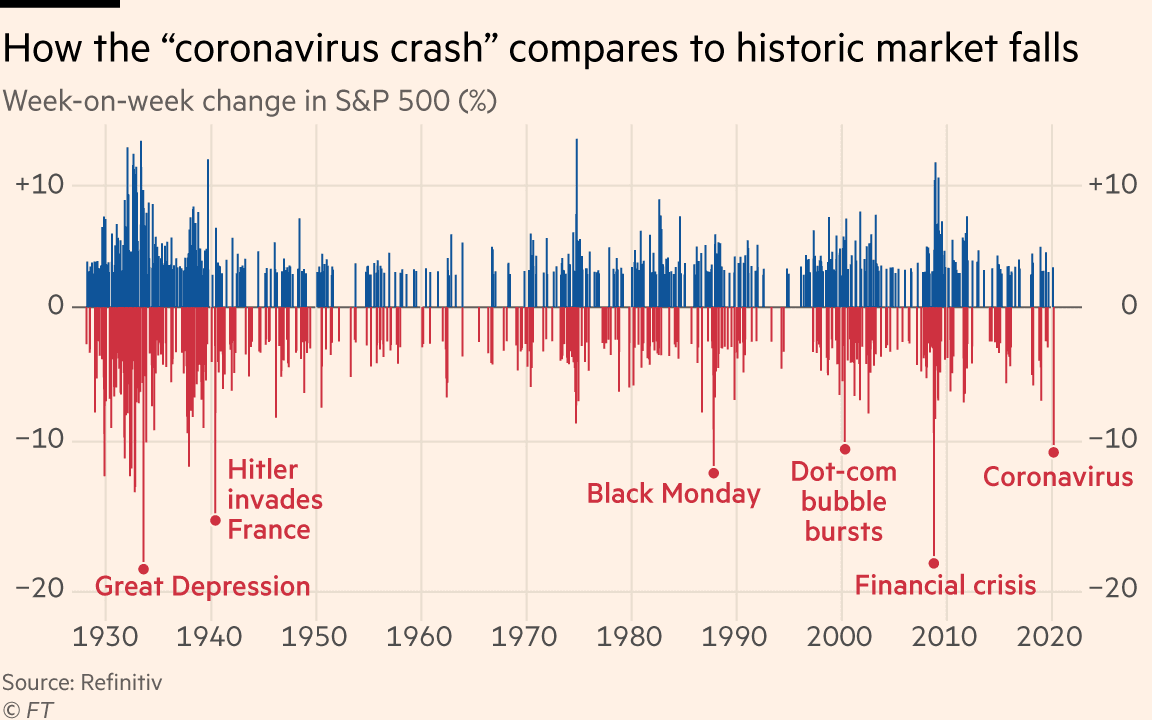

Some more historical context...

The last 7 days has been carnage...

As SunTrust’s chief market strategist Keith Lerner wrote:

"Investors are selling stocks first and asking questions later."“We are seeing signs of pure liquidation. ‘Get me out at any cost’ seems to be the prevailing mood. There is little doubt the coronavirus will continue to weigh on the global economy, and the U.S. will not be immune. There is much we do not know. However, it is also premature to suggest the base case for the U.S. economy is recession.”

But, James McCormick, global head of desk strategy at NatWest Markets noted:

“Asset prices diverged significantly from growth in the past year, in part because of central bank policy, but also because passive investment’s main signal is price action.“The COVID-19 escalation runs a real risk of virtuous cycle turning to a vicious one. Either way, given where growth estimates are heading for the next few months, I’d expect more downside.”

Some of the week/month/year's high- and low-lights...

- S&P is down 7 days in a row - longest losing streak since Nov 2016 (worst month since Feb 2009 - equal to Dec 2018's drop, worst week since Lehman - Oct 2008)

- Dow is down 7 days in a row - longest losing streak since June 2018 (worst month since Feb 2009, worst week since Lehman - Oct 2008)

- Dow volume today hit an all-time record high.

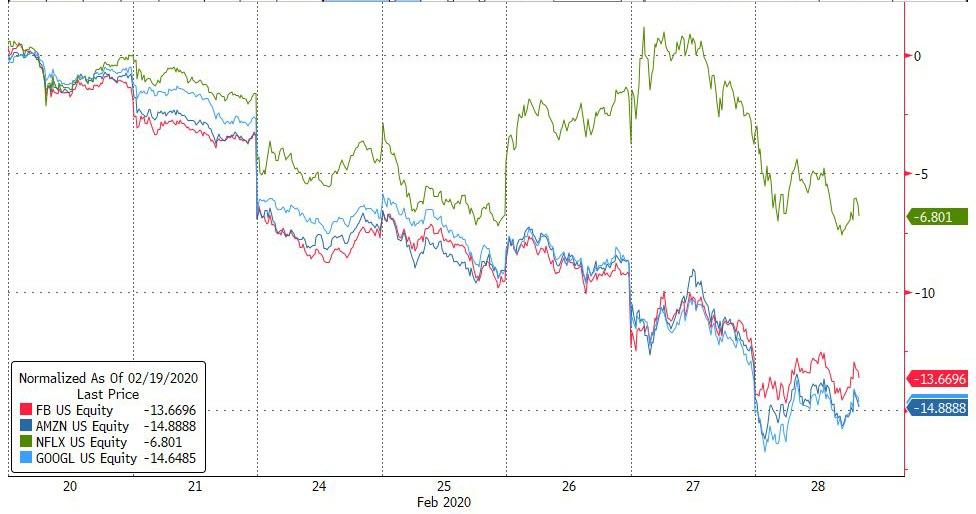

- MAGA stocks lost $780 Billion in market cap in the last 7 days.

- World stocks lost $5 trillion in market cap in the last 7 days

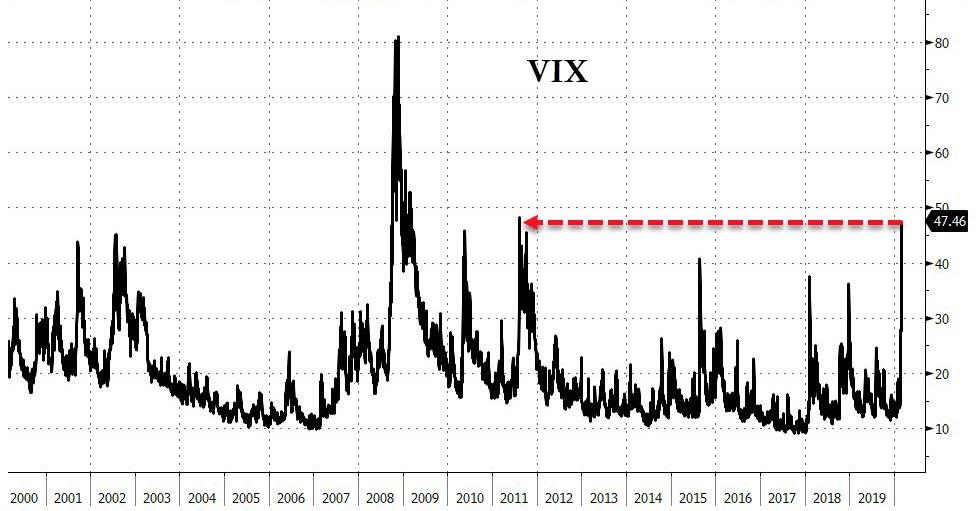

- VIX exploded 30 points higher in Feb - its biggest monthly spike in vols ever

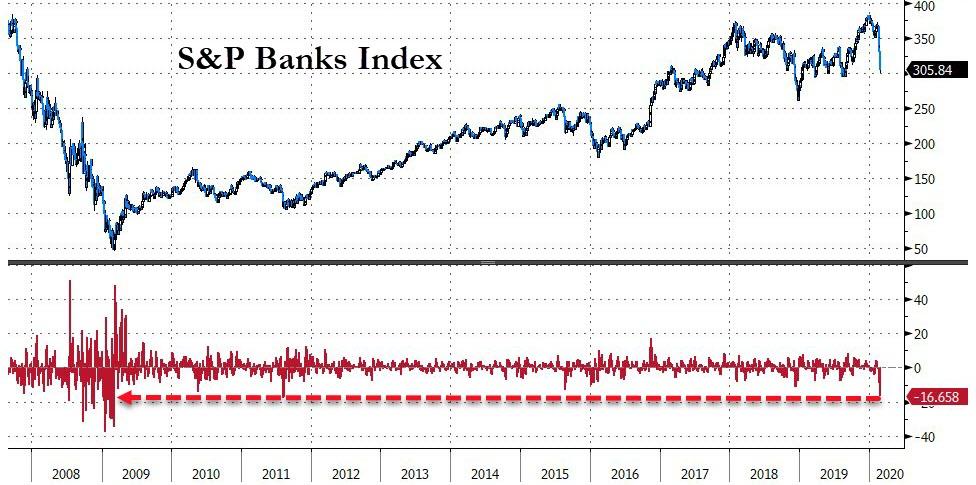

- Bank stocks suffered their biggest weekly drop since March 2009 (worst month since Feb 2009)

- Airline stocks suffered their biggest weekly drop since March 2009 (worst month since Nov 2008)

- 2Y yields fell 39bps in Feb - the biggest yield drop since Nov 2008

- 30Y yields fell 33bps in Feb - the biggest yield drop since Aug 2019

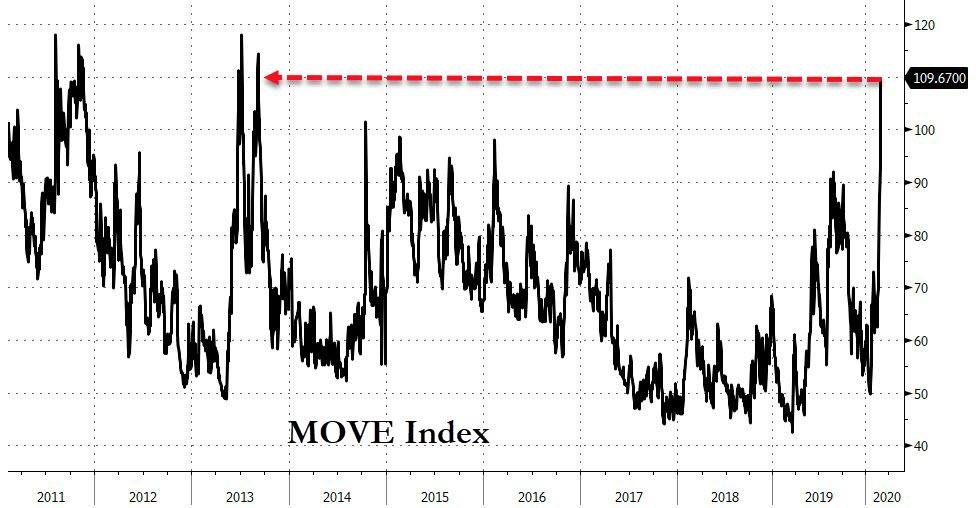

- Treasury Vol highest since Sept 2013

- HY Credit Spreads widened by the most since the financial crisis in Feb

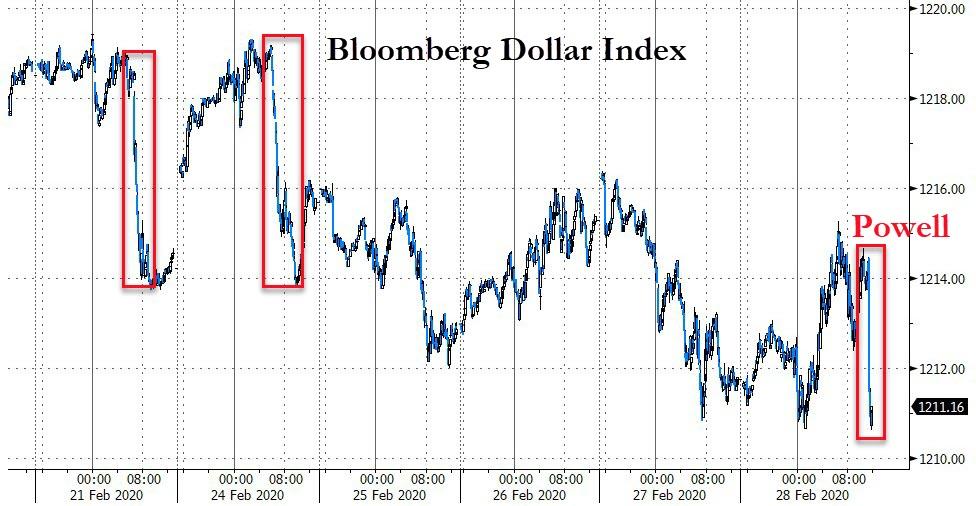

- The USDollar rose by the most since July 2019 in Feb (but the worst week since 2019)

- Silver suffered its worst monthly drop since May 2016

- Gold's worst day today since June 2013

- Oil collapsed again in February for its worst start to a year since 1991

At its low today, the Dow wiped out almost all of last year's 22% gain...

Source: Bloomberg

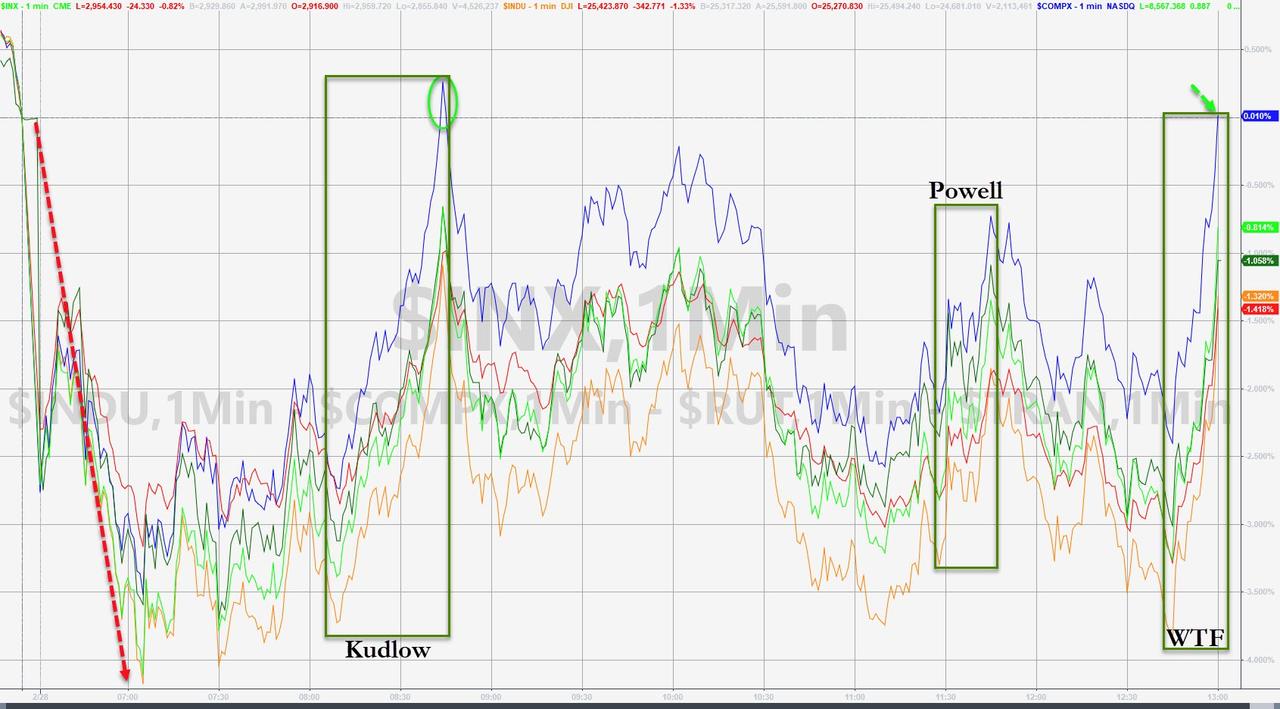

Stocks rebounded a little today on hopes of an emergency cut this weekend... but that failed... and then sheer panic-buying (PPT?) which pushed Nasdaq just into the green!!!

Just look at the closing ramp - End of month flows? Algos gone wild...

Even when Jay Powell issued a statement which definitely didn't suggest that a Sunday night rescue was planned (despite Kevin Warsh's urging)...

0830ET Kaplan: "I'll be prepared to make a judgement as we go into the March meeting, I am trying to keep my attention on what's going on in the underlying economy."0905ET Bullard: "Further policy rate cuts are a possibility if a global pandemic actually develops with health effects approaching the scale of ordinary influenza, but this is not the baseline case at this time... Longer-term U.S. interest rates have been driven lower by a global flight to safety, likely benefiting the U.S. economy." Bullard added that "even with the current stock market price drop, equities have been on a long upswing."1030ET Bullard spoke again reaffirming that US GDP Forecasts "don't look very severe" and The Fed is "willing to react if virus has major impact but will want to wait and monitor events until the next meeting."1430ET Powell: "The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy."

Powell's pumping plan failed...

CNBC's Steve Liesman also summed things up well:

"At what level of interest rates would I be willing to go to a rock concert and risk infection?"

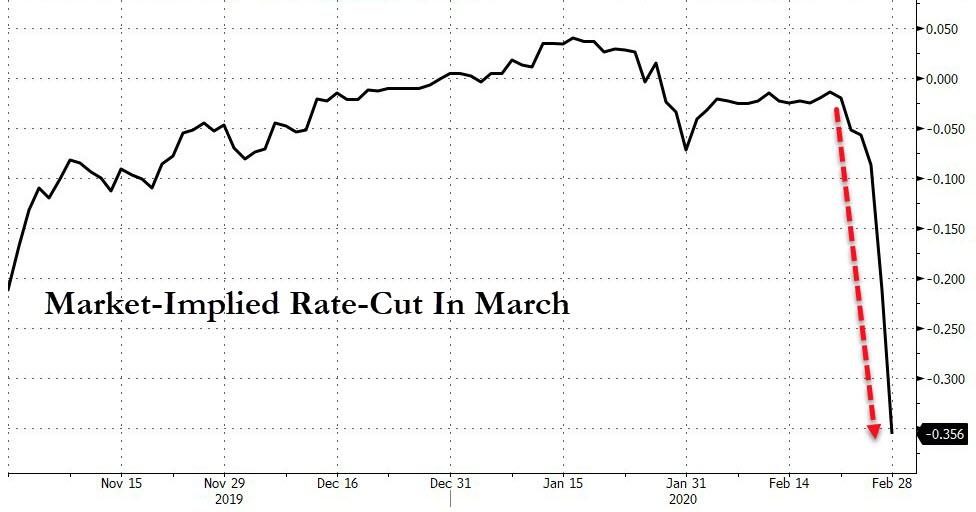

Nevertheless, the market is now demanding 36bps of cuts in March (so one cut guaranteed and a 50% or so chance of 50bps), additionally market is pricing in 65bps of cuts by June.

Source: Bloomberg

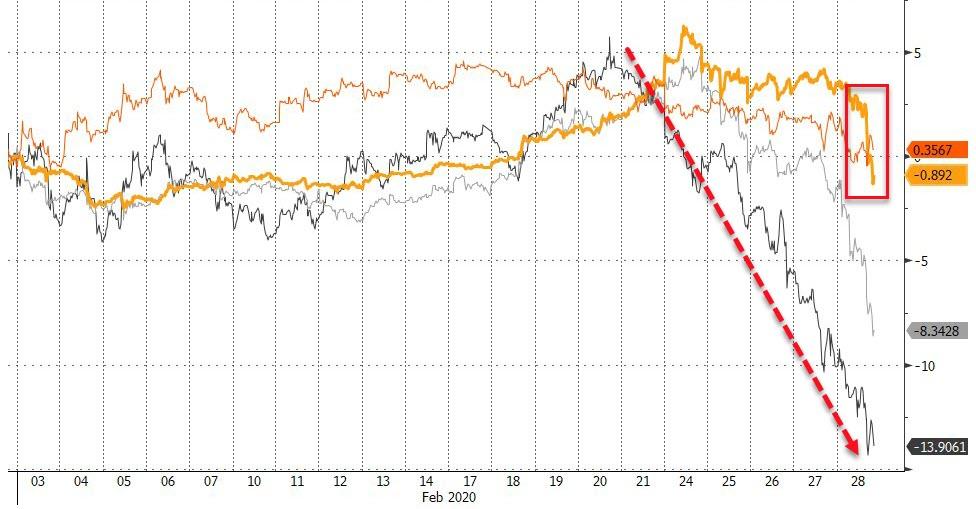

China, finally, was ugly overnight, starting to catch down to EU and US stocks since Covid-19 struck...

Source: Bloomberg

Despite today's desperate attempt to rebound - perhaps on hopes of an emergency rate-cut by The Fed this weekend and Powell's statement - the S&P and Dow are down 7 days in a row...with 4 intraday 1,000 point drops in a row

Source: Bloomberg

The S&P 500 just suffered its fastest crash from peak to correction ever... and US stocks saw their worst week since Lehman (Oct 2008), leaving everything red year-to-date...

Stock market volume has exploded higher as the crash has accelerated - notably higher volumes than during the Dec 2018 crash...

The Dow saw its biggest volume since April 2006...

Source: Bloomberg

FANG stocks were FUBAR...

Source: Bloomberg

MAGA stocks have lost $780 billion in the last week...

Source: Bloomberg

World Stocks lost over $5.1 trillion in market cap in the last 6 days - that is the biggest loss ever...

Source: Bloomberg

Airline stocks collapsed over 21% this week - their worst since March 2009...

Source: Bloomberg

Bank stocks were a bloodbath this week...

Source: Bloomberg

The biggest 6-day collapse in bank stocks since the peak of the financial crisis...

Source: Bloomberg

VIX surged over 30 points in Feb...

Source: Bloomberg

VIX closed at its highest since Aug 2011...

Source: Bloomberg

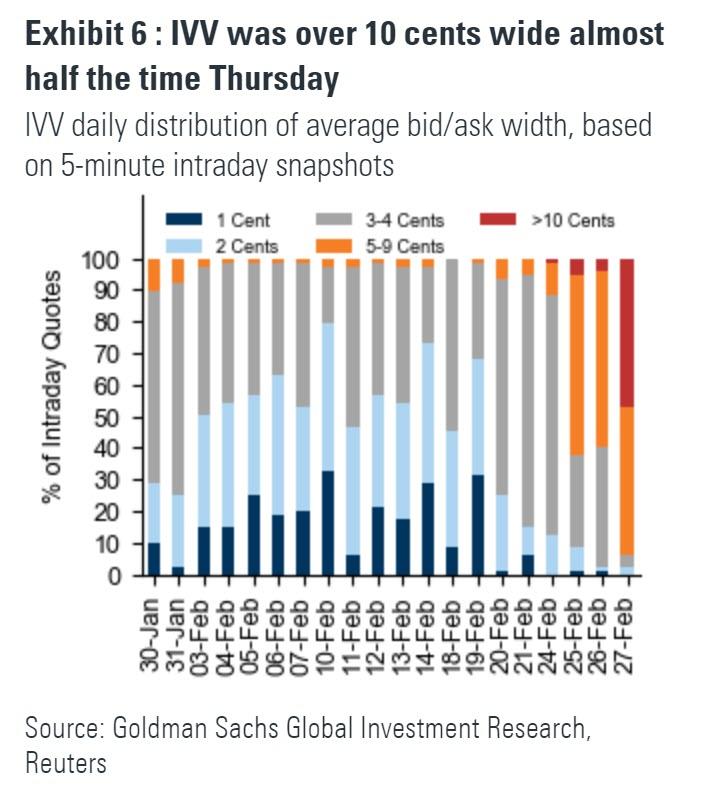

Liquidity has collapsed in the VIX complex as bid-offer spreads have exploded...

Credit markets imploded in the last week, with HY Bond OAS blowing out in Feb by the most

Source: Bloomberg

Treasury yields plunged in February, with the long-end crashing 33bps - the biggest drop since Aug 2019...

Source: Bloomberg

But while all yields were lower, the 2Y saw the biggest drop - down 39bps - the biggest monthly decline since Nov 2008

Source: Bloomberg

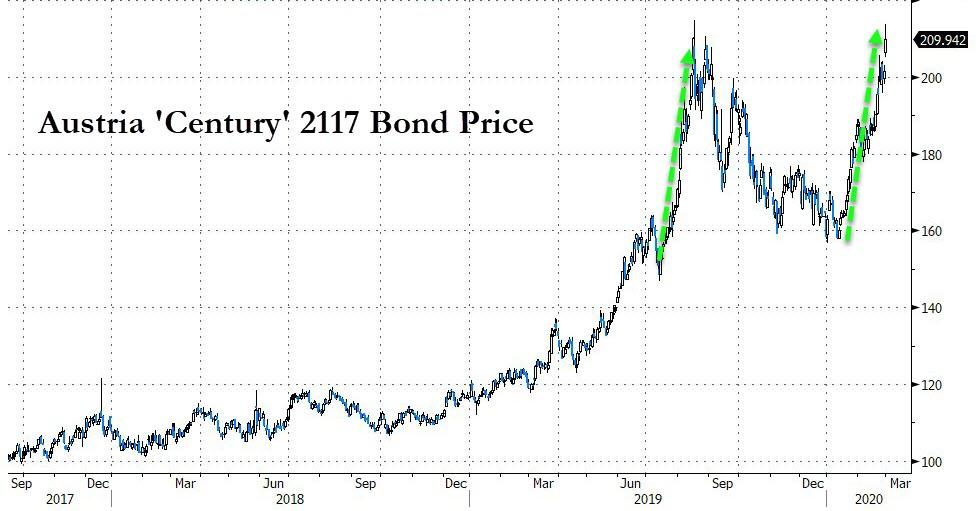

As an aside, the Austria 100-year bond price is back to record highs...

Source: Bloomberg

While equity vol is exploding, Bond vol is also spiking dramatically, to its highest since Sept 2013

Source: Bloomberg

10Y Real Treasury Rates crashed down to -75bps...

Source: Bloomberg

The yield curve (3m10Y) flattened for the second month in a row, closing inverted...

Source: Bloomberg

The entire Treasury curve is now trading below the Fed Funds rate...

Source: Bloomberg

The dollar fell 0.25% on the week, thanks to a last-minute statement from The Fed's Jay Powell. This was the worst week for the dollar since 2019...

Source: Bloomberg

Cryptos had an ugly week (BTC -11%, ETH -15%) erasing the month's gains leaving only Ethereum positive in Feb...

Source: Bloomberg

Thanks to today's carnage in gold, the yellow metal actually ended the month in the red

Source: Bloomberg

The week was also a bloodbath for all commodities... led by oil...

Source: Bloomberg

Silver was clubbed like a baby seal this week to the lowest since Aug 2019...

Gold was also monkey-hammered today on massive volume... its worst day since June 2013

Oil extended its losses from January for the worst start to a year since 1991...

Lots of questions about the crash in gold today - we point to one key chart for the culprit - BoJ!!

Source: Bloomberg

Finally, as @QTRResearch noted:

MON - People on CNBC said buying - WRONG

TUE - People on CNBC said buying - WRONG

WED - People on CNBC said buying - WRONG

THU - People on CNBC said buying - WRONG

FRI - People on CNBC said buying - WRONG

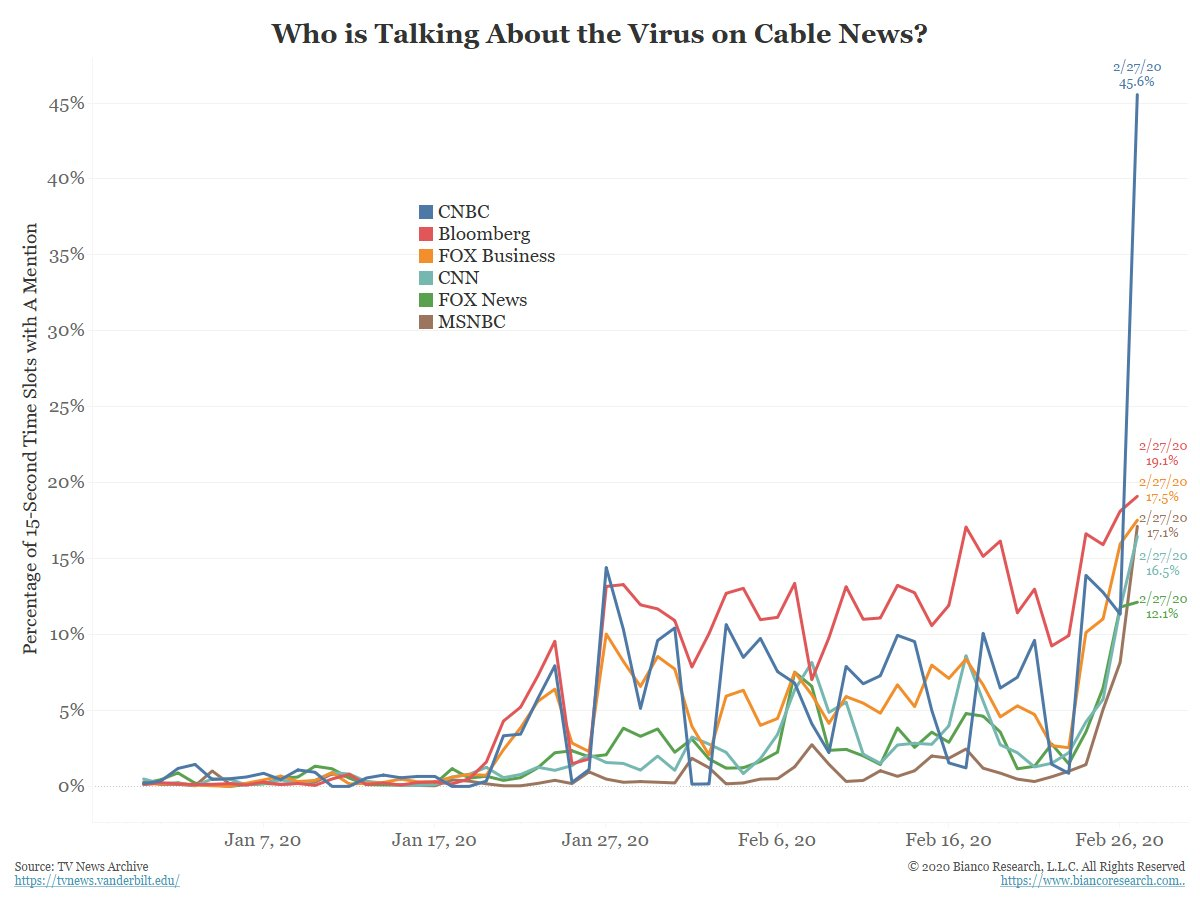

And as Jim Bianco noted, CNBC hit the panic button this week...

Or did the market panic over Bernie?

Source: Bloomberg

From "Extreme Greed" to "Extreme Fear" in 2 months...

Still, we know who will be buying this dip... or telling you to...

White House Economic Adivser Larry Kudlow suggested investors “buy the dip.”

No comments:

Post a Comment