https://www.zerohedge.com/markets/us-treasury-considering-50-year-bond-first-time-it-warns-year-end-repo-fireworks

US Treasury Is Considering A 50-Year Bond For The First Time As It Warns Of Year-End Repo Fireworks

Today's latest quarterly refunding announcement was closely watched for any commentary on how the Treasury may respond to the Fed's recent "Not QE" announcement, which has the central bank buying up $60BN in Bills every month, which according to some strategists could cause a shortage of net Bill issuance, leading to fresh money market turmoil.

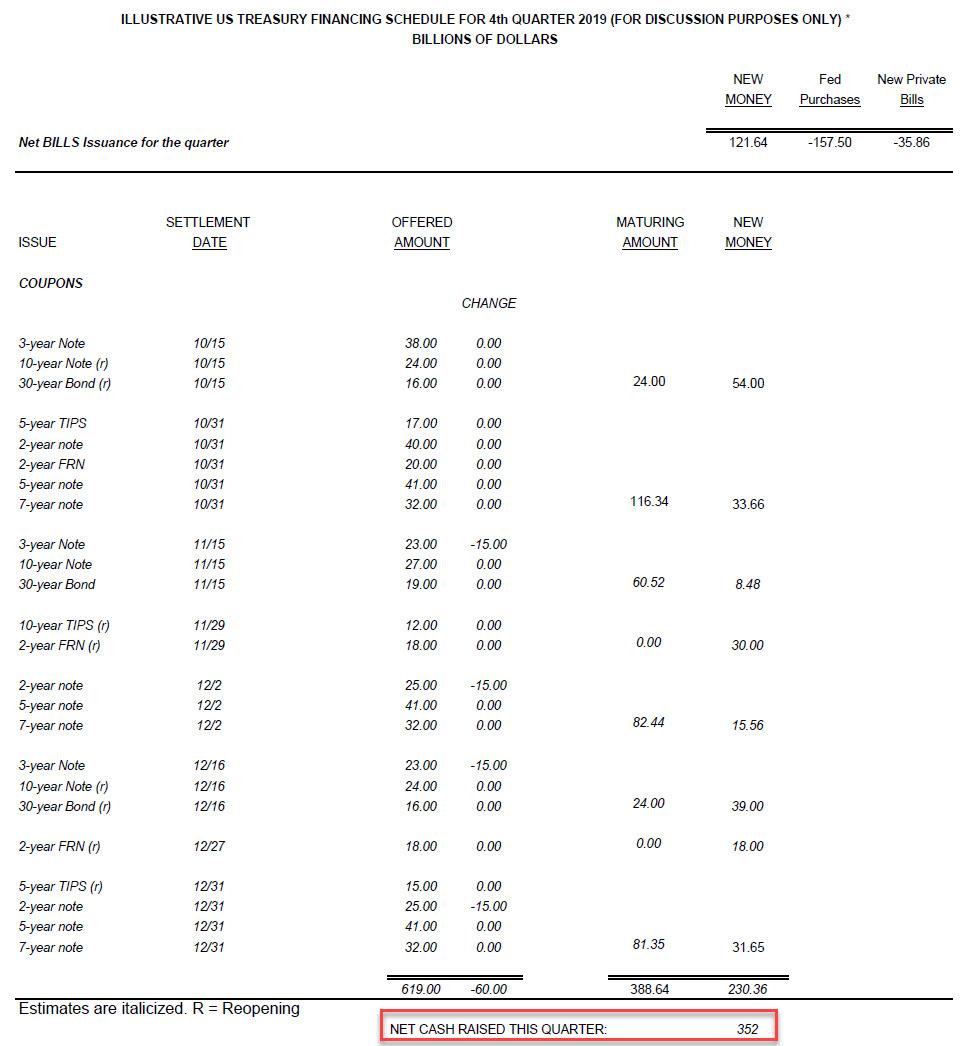

But before we get to that, here is a summary of the bigger picture: the Treasury reported that nominal coupon and floating-rate auction sizes will not change in the November-January quarter, as expected, at a record $84 billion for a fourth straight quarter. Per Bloomberg:

- Government will sell $38 billion in three-year notes on Nov. 5, $27 billion of 10-year notes on Nov. 6, and $19 billion of 30-year bonds on Nov. 7

- Planned sales, in line with guidance from July, will raise new cash of about $23.5 billion

This was in line with projections, as last year’s substantial increase in nominal coupon auction sizes in addition to higher bill issuance continues to provide sufficient funding to cover Treasury’s financing needs roughly until the end of FY2020, at which point auction sizes will need to again rise incrementally. TIPS auction sizes will also be held constant in the upcoming quarter after rising in previous quarters, in line with Treasury’s guidance. As with coupons, TIPS auction sizes will rise modestly in 2020 following the next refunding announcement.

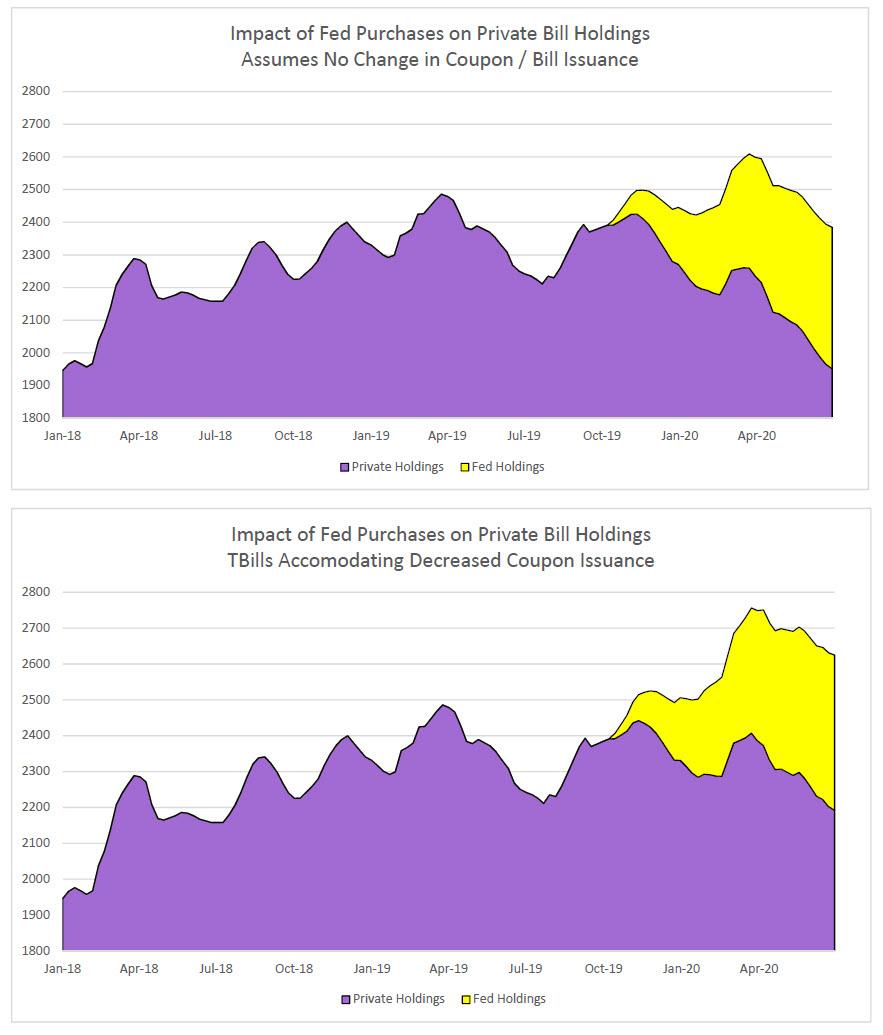

The chart below shows how the TBAC expects the Fed's purchases of Bills to affect the total private holdings of Bills under two scenarios: one in which there is no change in Coupon/Bill issuance, and one accommodates decreased Coupon issuance:

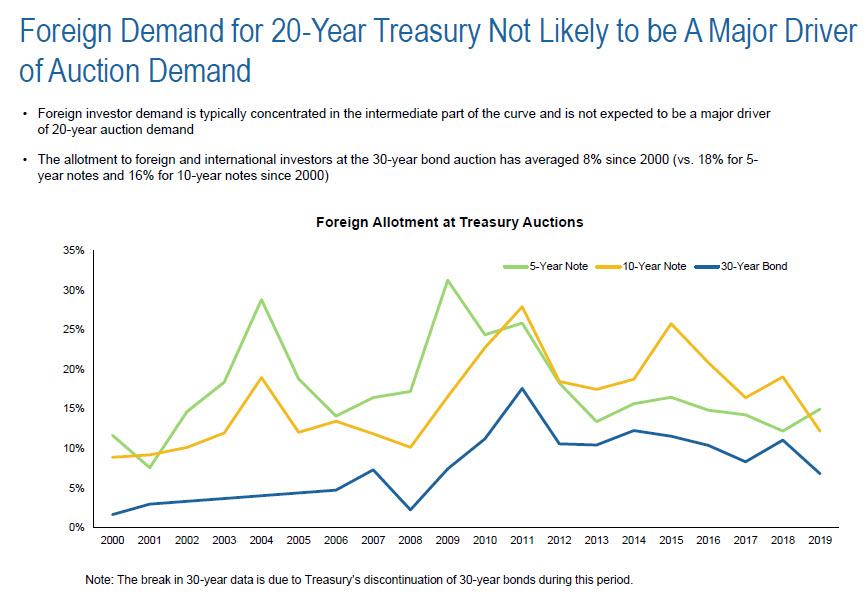

More importantly, the Treasury also announced it is still considering new debt products to meet future financing needs, including a 1-year SOFR-linked FRN as well as 20-year and 50-year nominal coupon bonds. The considerations are in the early stages, as Treasury is conducting analysis and outreach and will “provide market participants with ample notice” of any changes in future quarterly refunding statements. One notable observation from he report: foreign demand is not seen as a major driver of auction demand as the following chart confirms.

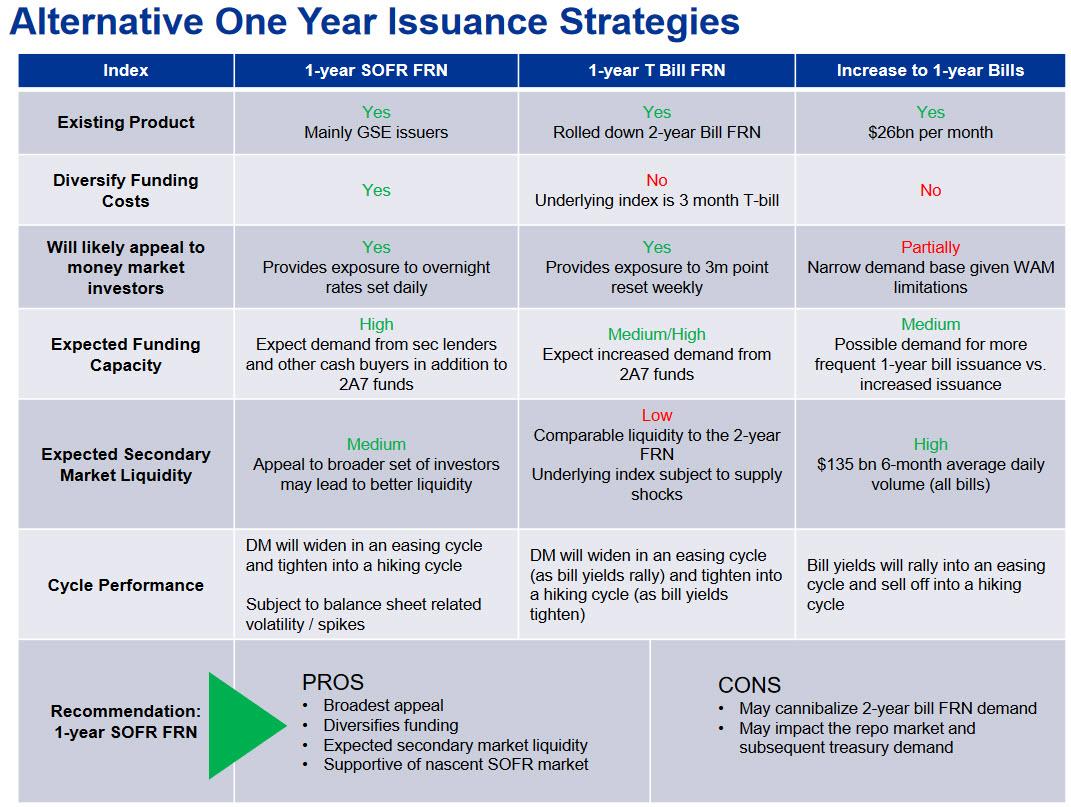

In light of the growing possibility that the Treasury will issue 1-year SOFR-linked FRNs, the TBAC also published the following pros/cons matrix of one-year issuance alternatives:

Back to the main point raised above, the TBAC press release stated that "based on current fiscal projections, and coupled with the Federal Reserve’s recently announced T-Bill purchases, it is possible that scarcity could develop in the T-Bill market if Treasury maintains its current coupon issuance sizes. Barring any change in issuance pattern, the Committee would expect to see a greater divergence in money market rates across T-Bills, CP, Fed Funds, SOFR and term repo rates." Additionally, the TBAC cautioned that "year-end financing rates are expected to be volatile again owing to regulatory capital constraints primarily on the global systemically important banks (GSIBs)."

In other words, another overnight G/C repo spike is all too possible in the last days of the year, just as BofA warned last Friday; and now, the TBAC is echoing that concern.

So what does the TBAC propose to alleviate this potential risk?

The Committee discussed at length the benefits and concerns of altering coupon issuance in light of recent Fed actions, including review of a scenario with 2- and 3-year issue sizes dramatically smaller to maintain the size of privately-held T-Bills. While smooth market functioning and adequate supply of T-Bills are vital, given current fiscal projections of increased borrowing needs in 2021 and 2022, and in keeping with Treasury’s regular and predictable issuance strategy to provide the lowest cost to the taxpayers over time, the Committee recommended keeping coupon issuance sizes unchanged for this quarter. Based on current fiscal projections, and in line with the August recommendations, the Committee expected little or no change to nominal issuance for much of FY 2020, but noted that FY 2021 could require further coupon increases. Finally, the Committee recommended continued close monitoring of developments in Treasury and Treasury funding markets, given expected changes in size and composition of the SOMA portfolio.We discussed the Committee’s prior recommendation that between one quarter and one third of the financing gap be met with T-Bill issuance. While this quarter’s issuance will fall meaningfully below that target, (17%) the group expected Q2 FY2020 to be meaningfully above the target (39%). All agreed that the guidance was intended as a medium term goal to help increase the share of T-Bills outstanding over time, rather than a quarter-by-quarter directive. Given that T-Bills now represent 14.5% of debt outstanding and FRNs a further 2.5%, the Committee suggested future review on the appropriate share of variable rate debt taking into consideration projected interest expense, a potential SOFR FRN, and overall market functioning.

The Treasury indicated it’s still pursuing three prospective issues it’s been seeking feedback on this year. In Wednesday’s statement the department said it’s “taking a proactive approach to prepare for prospective future financing needs” by “exploring a range of possible new products.”

Those include a 1-year floating-rate note linked to SOFR, which is intended to replace the Libor benchmark; a rebooted 20-year bond; and a brand new, ultra long maturity 50-year bond. As a reminder, a SOFR-linked issue and a 20-year security topped the list of ideas the Treasury solicited from the Treasury Borrowing Advisory Committee early this year to help expand and diversify the investor base for its expanding pile of debt, but as several years ago, dealers were skeptical about the Treasury’s proposal for a 50- or 100-year bond when the department revisited the proposal earlier this year.

Separately, the Treasury’s latest quarterly estimates put 2019 total borrowing at $1.2 trillion, though it plans to issue less debt in the final months of the year than previously anticipated.

On Monday, the Treasury revealed that it expects to raise $352 billion in net marketable debt from October through December, $29 billion less than it estimated in July. The revision owed in part to a higher than expected cash balance at the start of the quarter, thanks to the Fed halting its balance sheet run-off sooner than expected.

Looking ahead, issuance is seen again picking up in January through March, to $389 billion, based on an end-of-March cash balance of $400 billion.

No comments:

Post a Comment