https://www.zerohedge.com/markets/qe4-officially-begins-feds-first-t-bill-purchase-4x-oversubscribed-amid-massive-liquidity

QE4 Officially Begins: Fed's First T-Bill Purchase Is 4x Oversubscribed Amid Massive Liquidity Demand

QE4 has officially arrived.

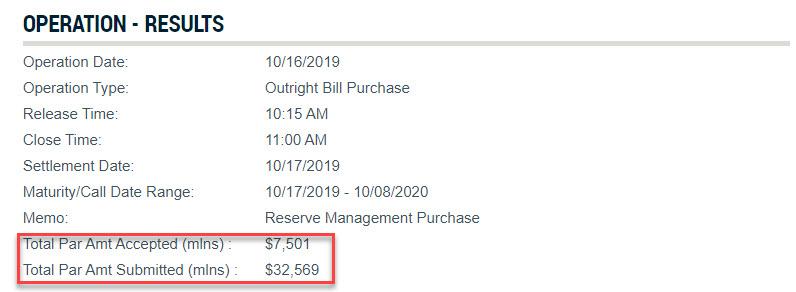

As previewed yesterday, moments ago the Fed concluded the first POMO - as in Permanent Open Market Operation, not to be confused with Temporary - from previously announced T-Bill purchases ($60 billion per month, $7.5 billion per operation), and what it showed is a confirmation of message sent by today's repo operation: there is an unprecedented demand for liquidity.

Specifically, the Fed purchased $7.501 billion in Treasury Bills out of $32.569 billion in T-Bills submitted. In other words, the operation was 4.3x oversubscribed, and when combined with the oversubscribed repo operation announced earlier today, confirms that there is a dramatic need for liquidity among the Primary Dealer community.

Also worth noting, the scramble to sell Bills to the Fed directly refutes what the FT reported earlier today that "money market funds that are among the largest holders of U.S. Treasury bills say they are reluctant to sell them to the Federal Reserve."

“We are not going to sell them,” said Pia McCusker, global head of cash management at State Street Global Advisors, which holds more than $22bn of T-bills in its $350bn of money market funds. “It’s a short-term gain and then I would have to replace it with something else at a much lower rate.”

Clearly someone was more than happy to sell them today in a furious scramble to convert Bills to cold, hard cash.

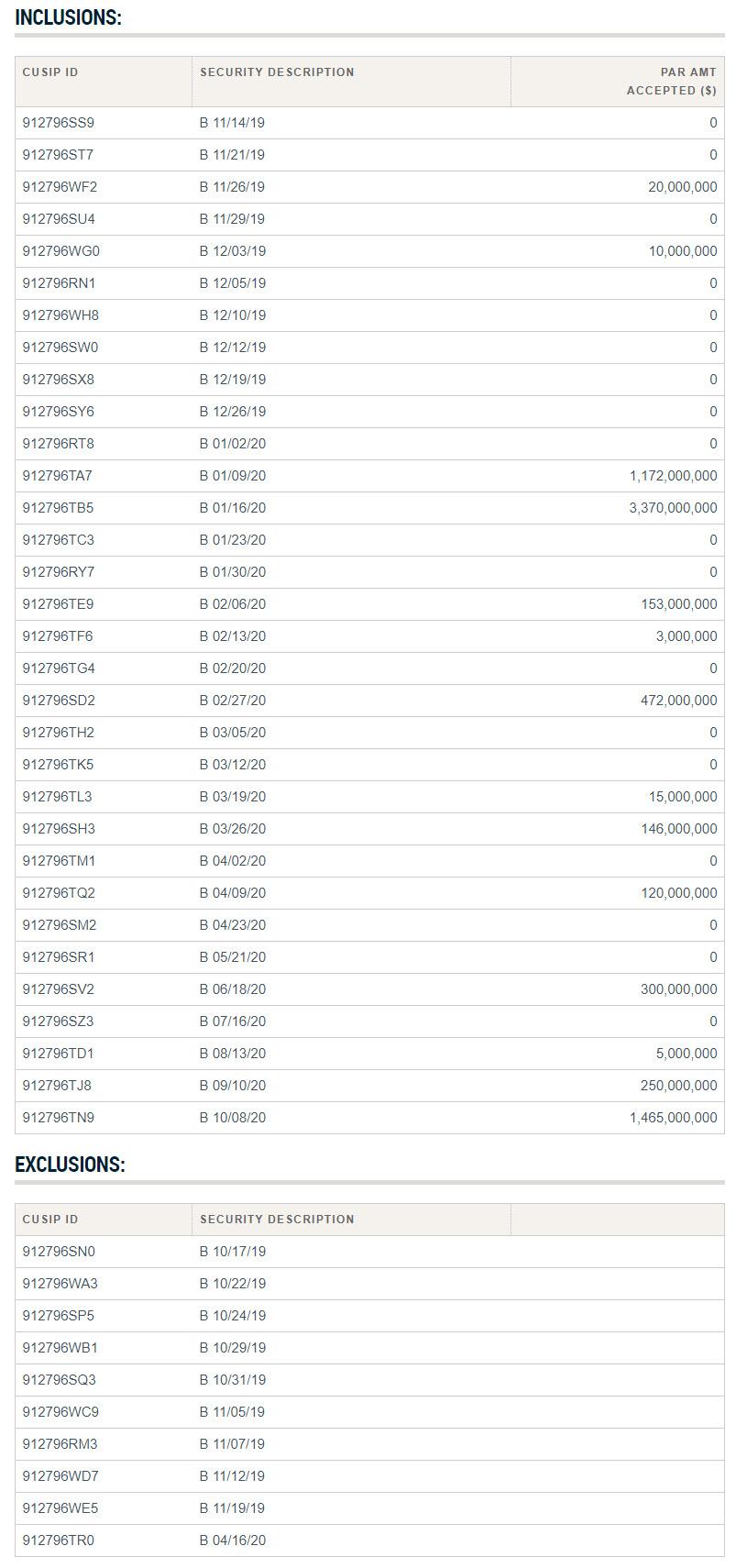

Separately, as previewed yesterday, the Fed did not purchase securities with less than 4 weeks to maturity or cash management bills, and sure enough, the "nearest" maturity purchased today was Bills maturing on Nov 26, for some $20 million. The most aggressive purchases were for CUSIPs TB5 and TN9, for the amount $3.37BN and $1.465BN, respectively, and which mature on Jan 16, 2020 and Oct 8, 2020. The sub-1 month Bills were all excluded from today's operation.

And with that, QE 4, pardon, "Not A QE" has begun, and will continue "at least into the second quarter" of 2020, by which point the Fed will have purchased over $300 billion in Bills, and will at some point find itself compelled to shift to buying short-maturity coupons as well as the "Not A QE" gradually morphs into a full-blown QE.

No comments:

Post a Comment