https://www.zerohedge.com/personal-finance/youve-got-be-kidding-me-outraged-wework-employees-furious-neumanns-12bn-platinum

"You've Got To Be Kidding Me": 4,000 WeWork Employees Face The Ax As Neumann Walks Away With $1.2 Billion

Update (1330ET): Just hours after employee fury is soaring at Neumann's payout (and the reported millions in severance now agreed for the current co-CEOs), The FT reports that WeWork is planning to cut as many as 4,000 jobs as part of an aggressive turnaround plan put in place by Japan’s SoftBank after it took control of the co-working business this week.

According to people with direct knowledge of its plans, the job cuts will amount to just under a third of WeWork’s global workforce of around 14,000 people. About 1,000 of the cuts will hit employees such as janitorial staff, which WeWork is looking to move to an outsourcing company.

“Yes, there will be lay-offs - I don’t know how many - and yes, we have to right-size the business to achieve positive free cash flow and profitability,” he wrote in a memo reviewed by the Financial Times. Mr Claure added:“But I will promise you that those that leave us will be treated with respect, dignity and fairness. And for those that stay, we will ensure everyone is aligned and shares in future value creation.”

* * *

As we detailed earlier, in the aftermath of the stunning news that after extracting $700 million from WeWork, which was effectively insolvent before SoftBank doubled down on its money-losing investment to breathe some life in the imploding office subletter, the company's ex-CEO Adam Neumann was set to reap another $1.2 billion payday, outspoken critic Scott Galloway said that "This is a disaster we'll be teaching for decades in b-school" adding that while the CEO gets a platinum parachute, "thousands of employees are scrambling to clean up the mess, knowing they have a 1 in 2 chance of being fired."

This is a disaster we'll be teaching for decades in b-school. The idolatry of innovators leads to billion-dollar payouts while thousands of employees are scrambling to clean up the mess, knowing they have a 1 in 2 chance of being fired. wsj.com/articles/softb…

915 people are talking about this

Yet while Galloway may be correct in his business school case study forecast, he may have underestimated the anger bubbling among the company's employees, because as Bloomberg notes, the reaction from his ex-colleagues, who are facing the prospect of mass job cuts and a corporate crisis: "You’ve got to be kidding me."

As WeWork's disheartened employees walked in on Tuesday to learn that their recently departed messiah CEO was set to wave farewell to his noble pursuit of "elevating the world's consciousness" and quit as WeWork's Chairman in exchange for over $1 billion even as most of them faced near-certain termination, they took to the company's system-wide communication system and that was one of the comments posted, reflecting the mood of anger and betrayal throughout its headquarters in New York. And, as Bloomberg adds, "dozens of employees expressed indignation in interviews and messages to colleagues on company Slack channels." Predictably, those speaking out against an epic injustice that will be used by politicians for years to show the wealth chasm that has developed between the rich and everyone else, requested anonymity in a bid to protect their jobs, especially with management weighing the dismissal of thousands of employees.

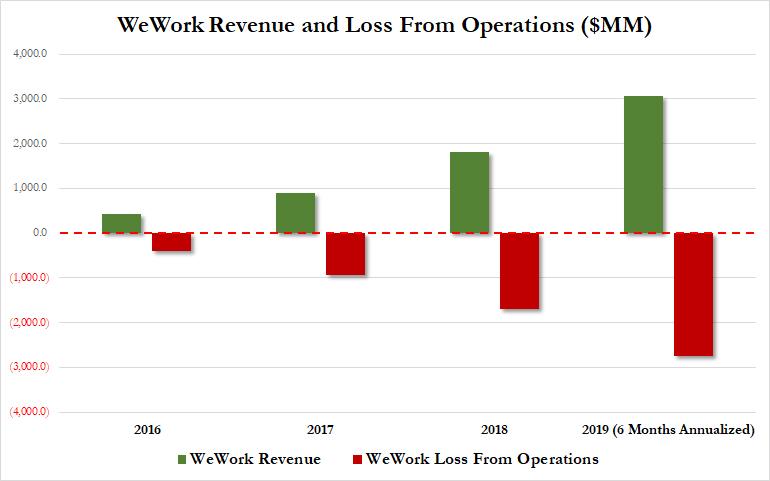

To his credit, Neumann did build WeWork into a global real estate company fueled by relentless optimism and billions of dollars in investment capital and debt. In retrospect, however, virtually anyone could have done with Neumann did: after all, he was essentially selling a dollar for less than 50 cents, with the company set to burn through almost as much cash this year as it makes in revenue.

As such, it was only the generous investments by SoftBank, Benchmark and other VC who fell for Neumann's spell that made WeWork "success" possible in the first place. In the end, however, the company sports a mere $8 billion valuation after investors already put down more than $17 billion into the venture: so far they are losing more than 50 cents for every dollar invested.

Which means that the only winner here is Adam Neumann who somehow will walk away with nearly $2 billion.

Ironically, it was his fake, virtue signaling sermons about community and mission that engendered a fierce loyalty among his gullible staff and investors for years. But it took just a few weeks for his aura to vanish over once public investors were given a closer look at the business ahead of an initial public offering: as a result of the wholesale revolt at what Neumann was peddling, WeWork's valuation imploded from $47 billion to $8 billion as it abandoned its IPO. More importantly, absent a last minute bailout from SoftBank - which had already sunk $9 billion into WeWork - it would have been bankrupt in November.

Meanwhile, the company's thousands of employees were forgotten by everyone, including their former messiah who it turned out, cared only about his exit package than his co-workers, whose consciousness would no longer be elevated.

To be sure, in recent weeks, an executive exodus and cost-saving measures had already dampened morale. Especially in satellite offices, many workers had stopped coming into work. But it was the news of Neumann’s “platinum parachute,” as one former employee described it, made things a lot worse this week.

A link to a news article about the deal on WeWork’s Slack network Tuesday drew more than 100 “thumbs down” emoji from employees. Several workers noted the irony that WeWork could not afford payroll costs associated with the planned job cuts but that its largest shareholder agreed to pay a hefty fee to Neumann. One post read: “So we’re too broke to pay employees severance, but Adam gets $200m?”

Another employee posted a photo of the orphan from “Oliver Twist” with the caption: "Please, Masayoshi Son, can I have some severance?" To that employee we have some soothing words: when this insane liquidity bubble finally bursts, Masayoshi Son will be in urgent need of severance himself.

As Bloomberg concludes, whereas Neumann was the main subject of staff fury, some complaints were also pointed at the pair of men who replaced him as CEO last month: “Seriously, where’s the email from our co-CEOs or whoever’s running the company now?”

No comments:

Post a Comment