https://www.zerohedge.com/markets/softbank-hiring-valuations-expert

SoftBank Is Hiring A... Valuations Expert

SoftBank Is Hiring A... Valuations Expert

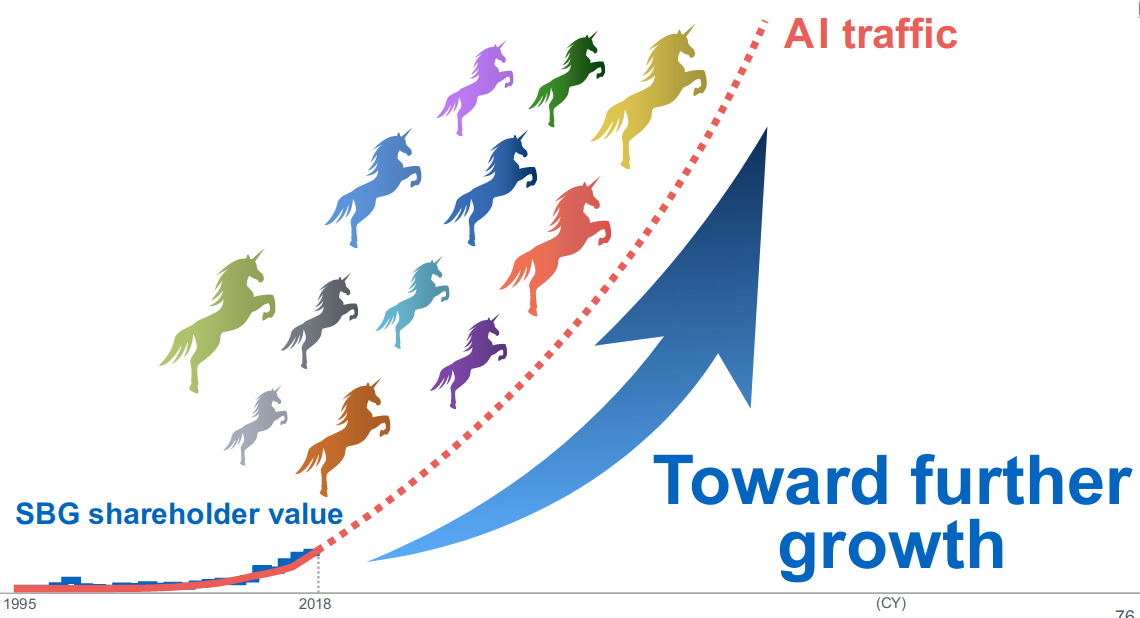

With its marquee investments, Uber and WeWork foundering now that the IPO investing public has been dragged out of its idiotic zombified trance following the realization that insiders exiting their stake to naive retail investors at all time highs is not a recipe for success (Theranos investor Larry Elison piling on is certainly not helping), and with some even speculating that SoftBank's entire investing style is nothing but one giant, self-perpetuating ponzi scheme (with the twist that SoftBank is the only investors who keeps dumping money at higher and higher valuations) based on cheap money, hype, hyperventilatio and slide charts such as this one...

... it appears that Japan's VC behemoth is starting to sweat.

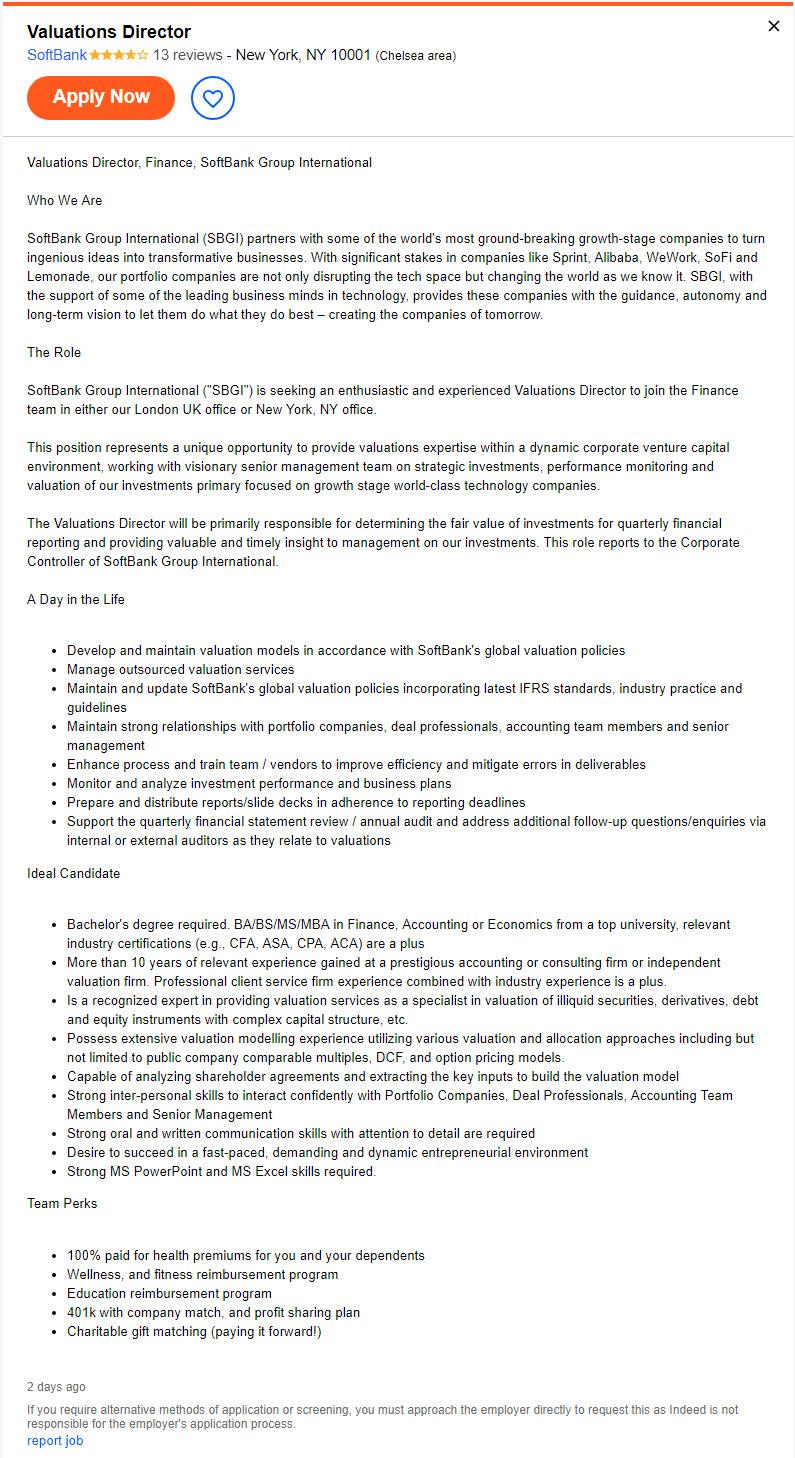

Proof: the company with the now infamous $100 billion SoftBank Vision Fund is seeking to hire a, drumroll, Valuations Director.

Here is what the new hire will be expected to do:

This position represents a unique opportunity to provide valuations expertise within a dynamic corporate venture capital environment, working with visionary senior management team on strategic investments, performance monitoring and valuation of our investments primary focused on growth stage world-class technology companies.The Valuations Director will be primarily responsible for determining the fair value of investments for quarterly financial reporting and providing valuable and timely insight to management on our investments.

No, this is not a joke: it's real.

As for Masayoshi, here is some free, if valuable and timely insight: this is a hire you probably should have considered a few years ago.

Meanwhile, for those who hope to become as rich as SoftBank's head - and Japan's richest man - Masayoshi Son, who lost a $70 billion fortune when the dot com bubble burst, only to rebuild it from scratch thanks to the latest, and biggest ever, asset price bubble courtesy of central banks, only to lose it all again very soon, here's a suggestion: find a way to, ahem, secure funding to short every single one of SoftBank's current portfolio companies with leverage.

Then sit back and wait five or so years to find out who will play you in the sequel to the Big Short.

h/t ThreeCommaKid

No comments:

Post a Comment