https://www.zerohedge.com/markets/insider-selling-hits-20-year-high-stock-buybacks-soar

Insider Selling Hits 20 Year High As Stock Buybacks Soar

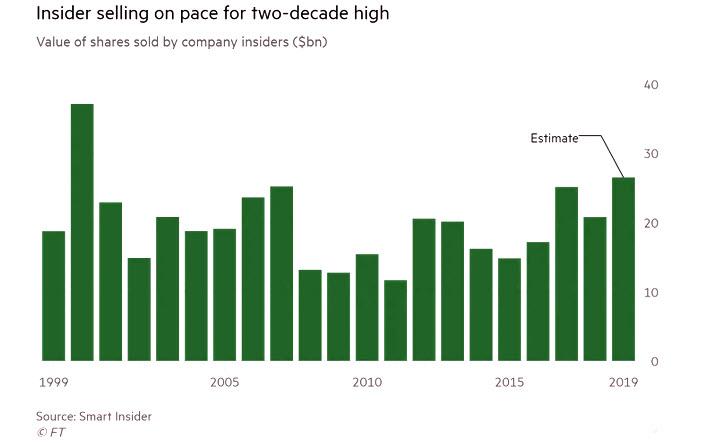

When it comes to the "fair value" of stocks, nobody knows it better than insiders, who tend to aggressively offload shares any time they see the price of their equity holdings as generously high. This, however, may be a problem for the broader market because according to research from Smart Insider, the market is now the most overbought since the first dotcom bubble, as "executives across the US are shedding stock in their own companies at the fastest pace in two decades, amid concerns that the long bull market in equities is reaching its final stages."

As the FT reports, corporate insiders - typically CEOs, CFOs, and board members, but also venture capital and other early state investors - sold a combined $19BN of stock in their companies through to mid-September. Annualized, this puts them on track to hit $26BN for the year, which would mark the most active year since 2000, when executives sold $37bn of stock amid the giddy highs of the dotcom bubble. That 2019 total would also set a post-crisis high, eclipsing the $25bn of stock sold in 2017.

For those wondering which insiders are scrambling to part with their equity holdings, the answer is simple: virtually everyone - from the VCs behind bungled, rushed IPOs of companies such as WeWork, Uber and Lyft, to iconic stakeholders including members of the Walton family, who have sold a combined $2.2BN of shares in the Walmart retail empire. Executives at Estée Lauder, the cosmetics giant, and clothing group Lululemon Athletica also appear among the most active sellers, according to Smart Insider.

The reason investors care about insider stock sales is that it has traditionally been a handy marker for the confidence of executives in their own companies’ prospects, and the broader valuation of the market. Spikes in selling indicate that top figures in boardrooms around the country are taking advantage of high valuations in the US stock market.

Troy Gayeski, co-chief investment officer for SkyBridge Capital, said that recent moves by central banks to ease monetary policy, in response to deteriorating economic data, are a sign that companies can expect profits to fade.“In management, you know the boom times are over in terms of record profitability. Why wouldn’t you take money off the table?” Mr Gayeski said.

For those countering that insiders tend to always sell, the truth is that insiders not only paused stock sales late last year when the worst December for US stocks since 1931 sent the market to a brief -20% drop, which ended the year down about 6 per cent, at which point insiders turned buyers. However, since then, the S&P 500 has come roaring back, rising by almost 20% as central banks around the world turned dovish, cut rates and have expanded their direct liquidity injection; and the insider selling has exploded.

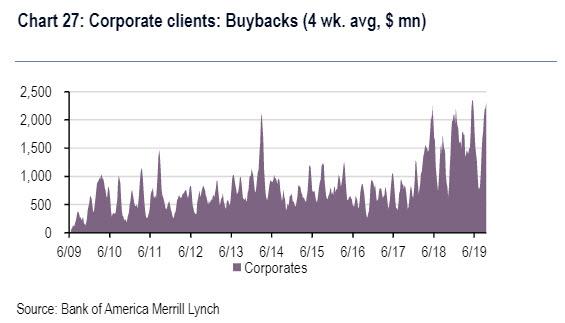

But if the insiders are selling who is buying? The answer will come as a surprise to exactly no one. As Bank of America explains, "despite what is usually a seasonally weak time for buybacks, corporate buybacks remained strong last week, driven by Tech for the fourth week in a row." As a result, cumulative buybacks YTD are already up +20% YoY compared to 2018 which was already a record year for stock buybacks, meaning 2019 will be another record, while rolling 4-wk avg. buybacks are +122% YoY, the highest of any point this year.

To summarize:

- Companies issue record amounts of debt

- Companies use the debt to repurchase record amounts of stock

- Insiders sell (near) record amounts of stock to their own company, even as retail investors buy everything with the S&P at all time high

And that's why billionaires - like Jamie Dimon - are richer than you.

No comments:

Post a Comment