https://www.zerohedge.com/news/2019-08-09/albert-edwards-chinese-authorities-lost-control-situation-back-2015

Albert Edwards: "Chinese Authorities Lost Control Of The Situation Back In 2015"

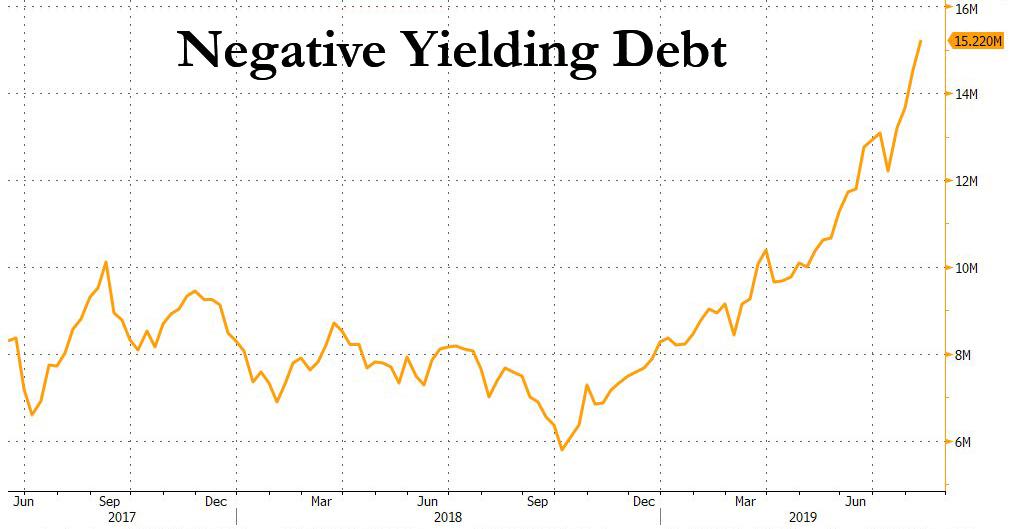

Having repeatedly praised Albert Edwards in the past month for correctly predicting the creeping ice age that has now sent $15.2 trillion in global debt, or almost 30% of total, into negative yield territory...

... we were certainly expecting some much deserved gloating at the expense of all those who said the 30 year bond bull market was over, in his latest letter. However, we were surprised when instead, Edwards - clearly aware what was expected of him - said that he "resisted the obvious temptation to write about the incredible bond market rally that has unfolded before our eyes" although even he couldn't help himself to note "that more high profile names are now seriously contemplating a negative US 10y bond yield, with the folks at PIMCO also now seeing it as a plausible outcome in the next recession."

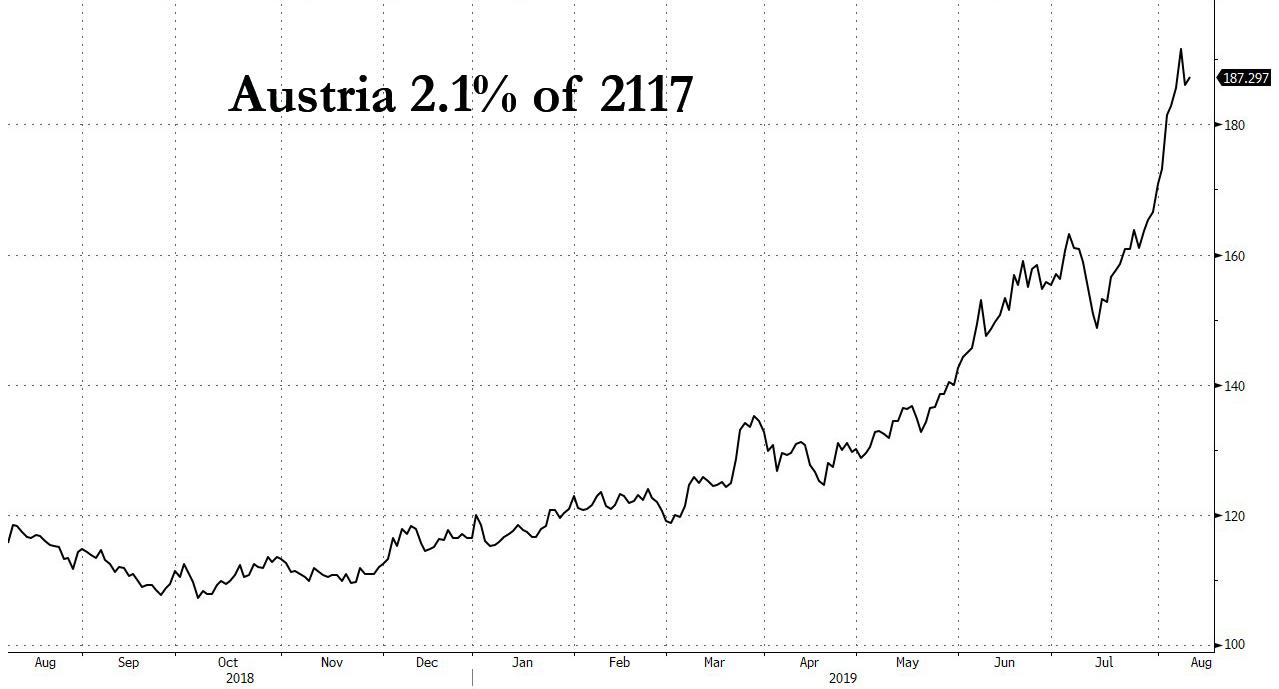

So instead of pointing out charts such as this one, which shows the parabolic price increase in ultra high duration bonds such as Austrian 100Ys...

... what Edwards focused on in his latest periodic report was China in the wake of the intensification of the trade/currency war and the recent historic breach of the 7.00 Yuan floor, and in typical style, Edwards cautioned that "investors may be underestimating the turmoil that is now stirring under the surface in China. All may not be as stable as investors suppose."

One of Edwards' key argument is, as we said earlier today, that contrary to popular opinion, it is not China that is winning the trade war - after all it has the benefit of time, while Trump has to win (or lose) the war ahead of the 2020 presidential election - but rather it is Trump who has the upper hand (today's news of a 3rd major Chinese bank failure/bailout in as months certainly underscores Edwards' claim). In this context, he asks the following rhetorical question:

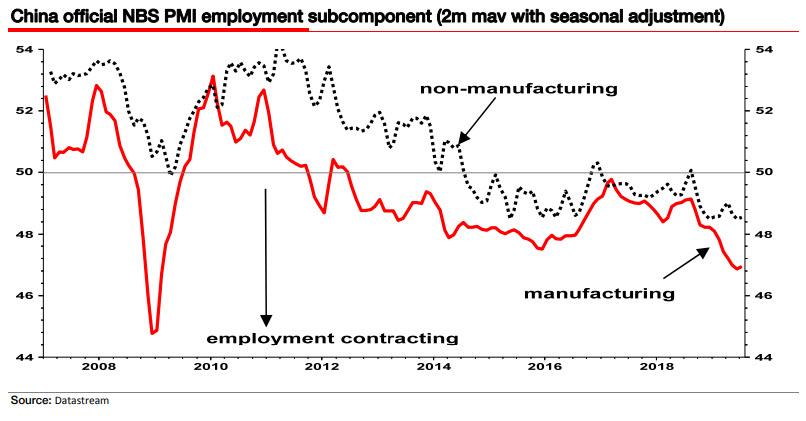

... what happens if this consensus is wrong? What if China is in a far more vulnerable situation than investors realise? US economic data has been poor of late but it hasn’t been great in China either. I think the chart below showing a rapidly contracting jobs market will be a key concern to the Chinese authorities. Indeed, our own China economist, Wei Yao, described the economy being on “shaky ground” in a recent note.

Next, since we already bored readers with our take on the 3rd consecutive bank failure in China earlier this morning, we will only touch on Edwards' next point, which not surprisingly, refers to China's growing bank instability, and which notes that "more concerning are the ructions in the banking sector after the recent bailout of Baoshang Bank. Wei writes “It would not be an overstatement to say that Baoshang’s fallout is a milestone in China’s deleveraging reform and financial liberalisation. The deleveraging process is bound to expose weak institutions along the way, and it is only a matter of time before counter-party risk reaches the interbank market. …When the deleveraging process enters the very core of the financial system, the risk of things going terribly wrong rises [ZH: just as we said earlier today]. We still think China has a chance to pull through without a financial crisis, given the Chinese government’s control over many things…but we will be keeping a close eye on interbank developments, as this may be the source of under-appreciated risk for the global economy. We are not yet convinced of a clear recovery trend. Against a backdrop of continued trade uncertainties and deterioration in the liquidity conditions of small financial institutions after the PBoC’s takeover of Baoshang Bank, the economy remains on shaky ground."

The Baoshang bailout (seizure?) has been followed by yet another banking intervention. This has certainly caused far more tremors in the interbank market than anyone appeared to be expecting, and has led to a credit crunch for Chinese small and medium sized companies which is likely to exacerbate the economic slowdown. To be honest, understanding the mechanics of all these issues is slightly beyond me, but even a generalist like myself can see that all does not seem to be well under China’s financial hood (Zero Hedge is worth reading link).

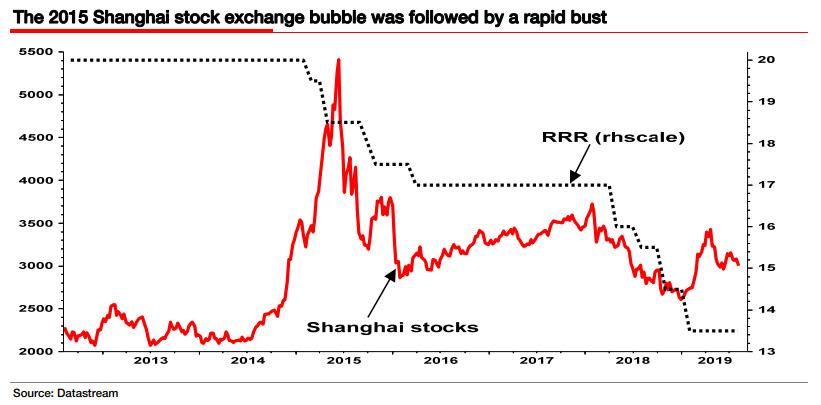

Which brings us to the core of the paper, which is Edwards' rhetorical allegation that "what if - take a deep breath - the Chinese authorities are not as in control of events as investors assume? One reason why Edwards believes that is the case is due to his confidence in their economic management plunging from pretty high levels in the aftermath of the Shanghai Stock exchange bubble bursting in mid-2015, to wit:

It seemed odd back in H1 2015 that the normally cautious Chinese authorities acted as vocal cheer leaders for the equity market's vertiginous rise back then. But it sort of made sense in the context of ravenous foreign appetite for Chinese stocks in expectation that MSCI was about to allow mainland China shares into its Emerging Market Index. One reasonable interpretation of the Chinese authorities allowing (encouraging) that horrendous bubble to develop is that it served the purpose off allowing overleveraged companies to convert excess balance sheet debt into equity that would be bought by over-enthusiastic foreigners who failed to realize a renminbi devaluation was just around the corner (better for Chinese companies to have eliminated their dollar debt and convert it to renminbi equity liabilities)

Everyone knows what happened next: MSCI failed to play ball. On 9 June 2015 it announced against expectations that it would not include Chinese stocks in its EM index. Somewhat unsurprisingly, the Chinese equity market peaked that week at 5410 and then collapsed 45% in less than two months despite aggressive rate cuts (see chart below) and despite the controversial suspension of trading in 1,300 stocks.

So what is the point Edwards is trying to make? Simple: "the Chinese authorities absolutely lost control of the situation back in 2015."

Indeed, I would contend that they contributed to inflating the bubble in an irresponsible, almost Western, way. At the time that really shook my confidence that the Chinese authorities were better economic managers than their western counterparts, the latter having demonstrated their gross incompetence in the run-up to the 2008 Global Financial crisis.

So where does that leave us now? As the SocGen strategist summarizes, we are left in "the chaos in the Chinese interbank market in the wake of the Baoshang Bank seizure appears to have surprised investors as much as it appears to have surprised the authorities. And with more banking interventions to come, the situation remains 'volatile'."

* * *

But it's not just China's capital markets and financial system that is on the brink: the macro data is deteriorating rapidly too, and ongoing weak Chinese economic data and ructions in the financial sector beg two questions:

- How robust are China’s economy and financial system really?

- And to what extent is Trump’s tariff war putting the Chinese economy in a far more difficult situation than most commentators assume?

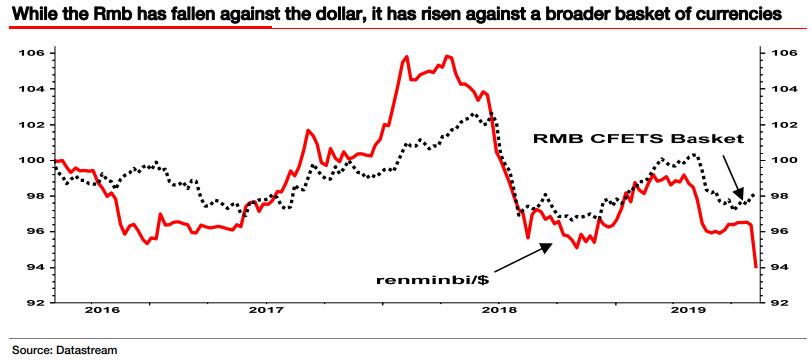

Is this one reason why, Edwards asks, in the face of rapidly contracting employment - as evidenced by PMI employment series shown on page 1 - that the renminbi was allowed to slide below the critical Rmb7.00 level? An interesting, if tangential observation made here by the SocGen strategist is that "the fall in the renminbi against the dollar has not been mirrored by the performance of the official CFETS trade weighted renminbi basket that the authorities now supposedly target. Indeed, the trade weighted index has actually risen recently (see chart)! "

And another notable observation: in addition to devaluing against the USD, China is now seeking to keep pace with other Asian devaluations.

Take the Korean Won, which has fallen sharply this year as the economy has been caught in the crossfire of the US/China trade war as well as a separate trade dispute with Japan. Korean exports have slumped for eight consecutive months and interest rates have been slashed as the economy struggles, with core CPI sliding to below 1%. In this context, back in January 2017 the Korean won entered the CFETS trade weighted basket and now has a hefty 10.8% weight, up from zero in the original 2015 basket while US$, yen and euro weightings have been reduced to make space.

To Edwards, the reason for the (shock) addition of the won with such a large weight was clear; "China did not want to lag other competitive Asian devaluations as it did in the run-up to its August 2015 devaluation."

I wrote at the time that what was playing out was very similar to the run-up to the 1997 Asian currency crisis. The chart below shows how in 2014-15 the weak yen had pulled the won sharply lower (and other competing Asian currencies), leaving the renminbi appreciating rapidly against its competitors due to its dollar link. That is why the won was added to the basket in such massive size. And so now what you are seeing is China reacting to won weakness even with a stronger yen (see chart below). And China is likely to continue to respond to further won weakness by further weakening the renminbi pari passu.

Finally, Edwards leaves us with some observations on the recent devaluation of the yuan by the PBOC below the historic 7 level against the dollar, by George Magnus, former chief economist at UBS and the current associate at the China Centre at Oxford University and London University School of Oriental and African Studies. In a Bloomberg opinion article Magnus, long a China skeptic, says:

“China allowing the yuan to slide below 7 to the dollar is a watershed moment for currency markets that's symbolically equivalent to the U.S. and other countries abandoning the gold standard in the interwar period, or the collapse of the postwar Bretton Woods system of fixed exchange rates four decades ago. The implications for the global economy are equally significant.”Focusing on other key sections in the article George goes on: “It may be too early to assert that China is “weaponising” the yuan in the deepening trade war with the US, especially because the central bank’s actions still appear measured and moderate. Nevertheless, the assumption that keeping the yuan rate stable against the dollar was part of the complex politics surrounding the trade negotiations no longer holds.As far as economic activity is concerned, the yuan’s move through 7 almost certainly reflects concern over the weaker trajectory of the economy, in which trade plays a relatively small direct role, though a cumulatively more important one. It’s not only the effect of tariffs that filters through China’s economy, but the loss of productive capacity as a rising number of firms move supply chain operations, and jobs, outside the country. A major Chinese investment bank recently suggested the industrial sector has lost about 5 million jobs in the last year, almost half of which are attributable to the trade war.” (note – no wonder the PMIs are weak).“The yuan’s move appears to reflect frustration at the lack of progress in trade talks, and specifically the refusal of the U.S. side to remove tariffs as a condition for any Chinese concessions. The depreciation will be managed for the time being, but it’s unlikely to stop. With time, the rapid expansion of financial assets in China, combined with political pressures, will probably lead to a much greater decline.By then, it won’t be only financial markets that are paying attention. The yuan’s path may help shape the future of geopolitical and economic arrangements around the world.”

So where does all of that leave us? As Edwards concludes, "the market is currently almost solely focused on the Fed and the pressure the intensifying trade war puts it under to slash interest rates. And while the mainstream dismisses Trump as shooting himself in the foot by trying to face down a far more resilient opponent, maybe the situation in China is far graver than anyone seems to consider possible."

Why? Because Edwards believes that "the risk that Chinese policy makers lose control is very high indeed, not just in relation to the risk of capital flight such as we saw in 2016, but also the clear and present vulnerability of the banking sector that we have witnessed in recent weeks."

Or, as we said last night after the latest dismal Chinese inflation data, "who knows: a few more downward nudges to the Chinese economy, and Trump may win the trade war against Beijing well before the 2020 presidential election."

No comments:

Post a Comment