https://www.zerohedge.com/news/2019-02-21/shocking-philly-fed-collapse-biggest-drop-2011-us-rating-downgrade

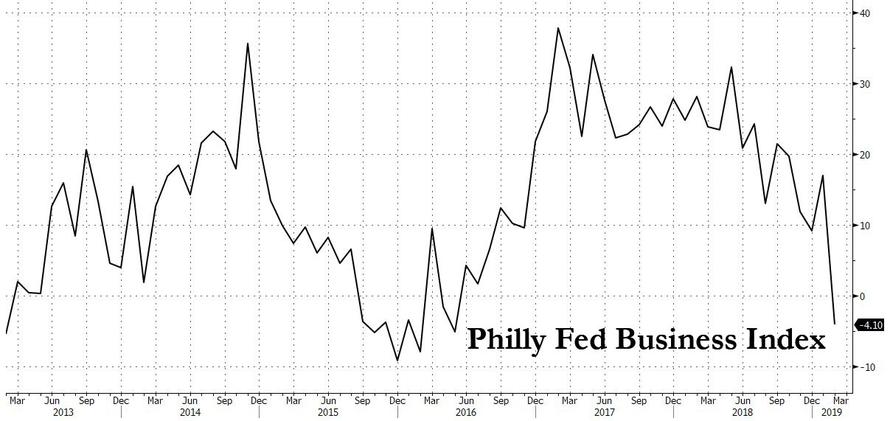

Shocking Philly Fed Collapse: Biggest Drop Since 2011 US Rating Downgrade

Just in case US stocks needed some more shitty data to surge on, they got it this morning when first the Durable Goods report disappointed, printing below expectations while core CapEx declined for the 3rd consecutive month - its longest stretch below zero since late 2015 - and then the latest Philly Fed print was an absolute shocker, as the regional manufacturing Business Idnex collapsed from 17.0 to -4.1, the first negative and the lowest print since May 2016...

... and the biggest drop in point terms since the US downgrade in August 2011.

Both the new orders and shipments indexes also fell this month. The current new orders index decreased nearly 24 points to -2.4, and the current shipments index decreased 17 points to -5.3; these were offset by the employment index which remained positive. Input prices also moderated notably this month.

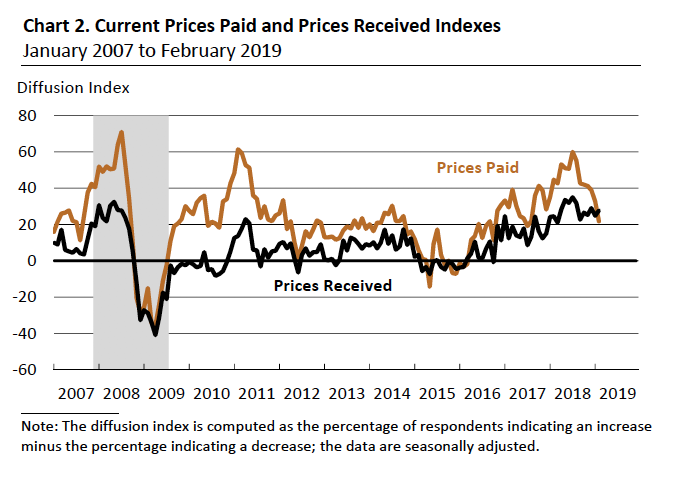

In the latest sign that peak inflationary pressures have passed, price pressures originating from purchased inputs continued to abate the Philly Fed reported. The prices paid index tumbled 11 points to 21.8, and has been trending down since last July and is now at its lowest reading since July 2017. Over 28 percent of the firms reported higher input prices this month, down from 40 percent last month. With respect to prices received for firms’ own manufactured goods, almost 33 percent of the firms reported higher prices, and 5 percent reported lower prices. The prices received index increased 3 points to 27.7, which is good news for profit margins as the smaller the delta between prices paid and received, the more the company gets to pocket.

In employment news, firms continued to add to their payrolls this month, with the current employment index improved from a reading of 9.6 in January to 14.5 this month. Nearly 24 percent of the responding firms reported increases in employment, while 9 percent of the firms reported decreases in employment. The current workweek index also remained positive but decreased 1 point to a reading of 4.7. This bizarre divergence between economic sentiment and a very strong labor market continues to surprise and puzzle economists.

Finally, while the current reading collapsed, the outlook remained buoyant, and the survey’s indexes for future conditions were mostly steady, with firms remaining generally optimistic about growth over the next six months.

No comments:

Post a Comment