https://www.zerohedge.com/news/2019-02-01/no-need-be-pessimistic-worlds-biggest-pension-fund-suffers-record-collapse-q4

"No Need To Be Pessimistic" - World's Biggest Pension Fund Suffers Record Collapse In Q4

"fleshwound"?

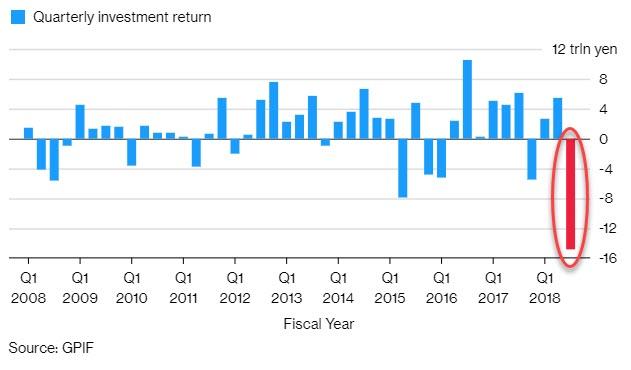

The world's largest pension fund - in the world's most demographically-challenged nation - suffered a stunning record loss in the last quarter as its Abe-supporting domestic-stock-buying-spree crushed Japan's Government Pension Investment Fund (GPIF).

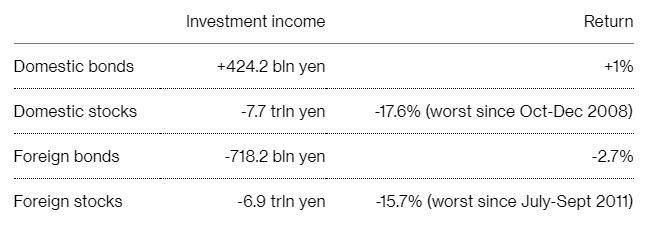

Bloomberg reports that GPIF lost 9.1 percent, or 14.8 trillion yen ($136 billion), in the three months ended Dec. 31, it said in Tokyo on Friday. The decline in value and the rate of loss were the steepest based on comparable data back to April 2008. Domestic stocks were the fund’s worst performing investment, followed by foreign equities. Assets fell to 150.7 trillion yen at the end of December from a record 165.6 trillion yen in September.

While global central-bank-liquidity driven gains in global stocks helped the GPIF generate returns for the previous two fiscal years, December’s global rout underscored the risks facing the fund since it revamped strategy in 2014 to accumulate stocks and pare domestic bonds - something they vehemently deny is anything but prudent independent risk-managed behavior.

Bloomberg notes that the GPIF may have little choice but to invest in equities as fixed-income yields, especially those of Japanese government debt, are too low, said Naoki Fujiwara, chief fund manager at Shinkin Asset Management Co. in Tokyo.

“It makes sense for the GPIF to hold some risk assets in this environment because yields are low globally and bond investments don’t give good returns,” Fujiwara said.“Yet from a pensioner’s point of view, it takes too much risk on its investments.”

But that won't stop Abe (and Kuroda) from pushing their nation's "independent" pension fund administrators to keep buying the dip in domestic stocks... or else.

Analysts are mixed on what to make of this collapse... some are blindly toeing the government line that any quarter now, everything will be awesome.

Shingo Ide, the chief equity strategist at NLI Research Institute in Tokyo, points out that the GPIF’s long-term performance is more important than quarterly moves. GPIF’s cumulative investment return since fiscal 2001 was 56.7 trillion yen for an annualized 2.7 percent gain.“There’s no need to be pessimistic just because GPIF would incur loss on its investment on a quarterly basis,” Ide said.“For pension funds, it’s more important to focus on how they secure long-term returns rather than their quarterly performance.”

But some worry about just how much risk GPIF carries...

Still, with about half of its assets in domestic and foreign equities, the GPIF’s performance may be in danger of declining as concerns about the U.S.-China trade war and the U.K.’s departure from the European Union increase the risk of a global economic slowdown, according to Hidenori Suezawa, an analyst at SMBC Nikko Securities Inc. in Tokyo.“Trade frictions between the U.S. and China haven’t been fully solved yet and there’s a possibility that the Brexit problem may be prolonged,” Suezawa said.“We can’t be optimistic about the investment performance toward March.”

And yet, as we noted previously, it may be about to get even worse. As Sumitomo Mitsui strategist Ayako Sera said, the GPIF has little choice but to diversify into alternative assets and high-yield bonds if it wants higher returns because Japan’s bonds, which make up about 27% of the GPIF’s assets, have virtually zero returns (well, the may rise as high as 0.2% as per the BOJ's latest announcement) as the Bank of Japan maintains its unprecedented monetary easing.

“The GPIF’s biggest problem is it can’t keep taking in domestic bonds - especially government bonds - as a staple with Japanese interest rates so low,” Sera said.“The fund needs to sample a wider variety of dishes.”

Apparently that's prudent banker talk for "we need to put more pensions into, well, junk." What it really is, is the famous yield creep to justify buying ever riskier securities, which of course, are "not risky" because the GPIF can hold in perpetuity, which somehow means the laws of the business cycle no longer matter.

No comments:

Post a Comment