https://www.zerohedge.com/markets/hedge-fund-trader-who-called-2008-crash-lists-3-biggest-threats-us-stocks

Hedge Fund Trader Who Called 2008 Crash Lists 3 Biggest Threats To US Stocks

Goldman Sachs alum and former hedge fund manager Raoul Pal is one of a handful of traders/fund managers/analysts who achieved fame and notoriety in the financial press after "predicting" the financial crisis of 2008.

And during a brief phone interview with MarketWatch on Thursday, it appears Pal, the author of the Global Macro Investor newsletter - a newsletter that is purportedly closely followed by macro traders (at least those remaining macro traders who still have a pulse and are composed mostly of flesh and blood) - has a few thoughts about what will bring about the next sustained downturn in global markets.

As Pal sees it, there are three major risk factors facing US markets in particular that could trigger a selloff the magnitude of which we haven't seen since the crisis (thanks, in large part, to the Federal Reserve and PPT). And the increasingly fraught trade talks were not among them.

Raoul Pal

The first is a perennial source of concern among sell-side analysts across Wall Street (warnings we have echoed in the past): The blackout period for corporate share buybacks, which hits around the release of quarterly earnings.

Even Pal's former employer has warned about what might happen to the broader market if Democrats succeed in banning corporate share buybacks, or pass new restrictions to restrict them.

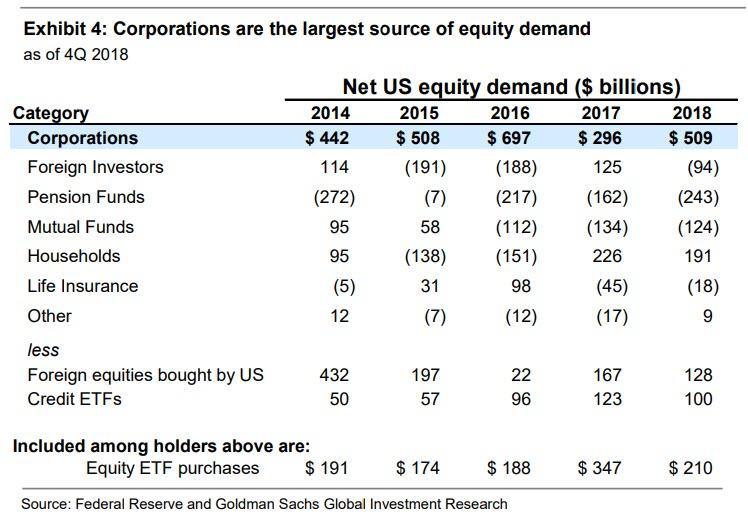

After all, corporations are, and have long been, the largest source of equity demand.

"We’re coming into a period of illiquidity for equities," Pal told MarketWatch.

Secondly, Pal brought up an issue that has captivated investors over the past month: The complications in the repo market. Now, Jerome Powell appeared to announce 'Not-QE-4' the other day to try and reassure investors that institutions in need of some quick cash for collateral will be able to access those dollars without being forced to pay exorbitant interest rates.

But according to Pal, dealers' unwillingness to take more collateral onto their books in exchange for providing an essential source of liquidity for markets is certainly concerning.

Finally, Pal said the third biggest issue facing stocks is Baby Boomers cashing in their chips as they prepare for retirement. According to Pal, many seniors who are tapping their retirement accounts have been advised to liquidate about 5% of their individual retirement accounts (which have been loaded up with equities) every year after they turn 70.

"The problem is the gap between this year and last year is huge. It’s like 50% increase in the amount of selling that has to be done," Pal said. "They have to start selling by year-end. If you take out the Christmas week and you’re a financial adviser, and you want to get this done early, you will start in October."

No comments:

Post a Comment