https://www.zerohedge.com/news/2019-08-09/fed-trapped-rate-cutting-box-its-debt-stupid

The Fed Is Trapped In A Rate-Cutting Box: It's The Debt, Stupid!

The Fed desperately needs to keep credit expanding or the economy will collapse. However, it's an unsustainable scheme.

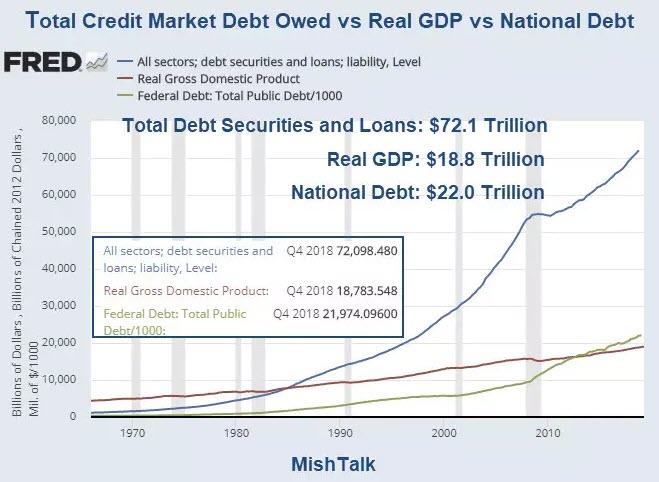

Key Debt Points

- In 1984 it took $1 of additional debt to create an additional $1 of Real GDP.

- As of the fourth quarter of 2018, it took $3.8 dollars to create $1 of real GDP.

- As of 2013, it took more than a dollar of public debt to create a dollar of GDP.

- If interest rates were 3.0%, interest on total credit market debt would be a whopping $2.16 trillion per year. That approximately 11.5% of real GDP year in and year out.

Total Credit Market Debt Detail

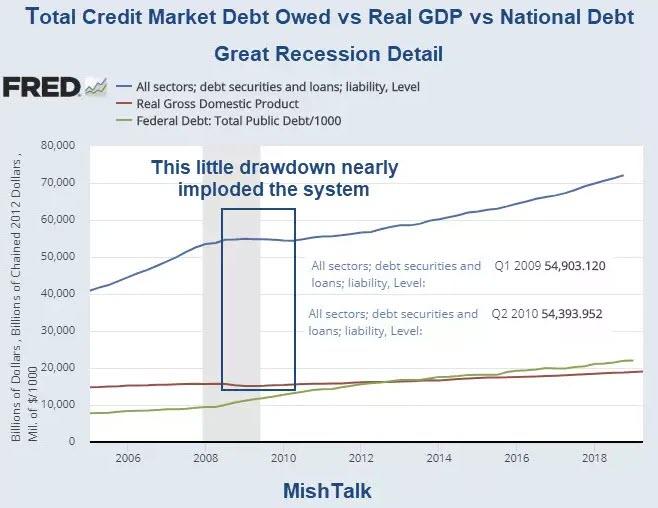

Tiny Credit Drawdown, Massive Economic Damage

Note the massive amount of economic damage caused by a tiny drawdown in credit during the Great Recession

Q. Why?

A. Leverage.

The Fed halted the Great Recession implosion by suspending mark-to-market accounting.

What will it do for an encore?

Choking on Debt

The Fed desperately needs to force more debt into the system, but the system is choking on debt.

That's the message from the bond market.

One look at the above charts should be enough to convince nearly everyone the current model is not close to sustainable.

Here's another.

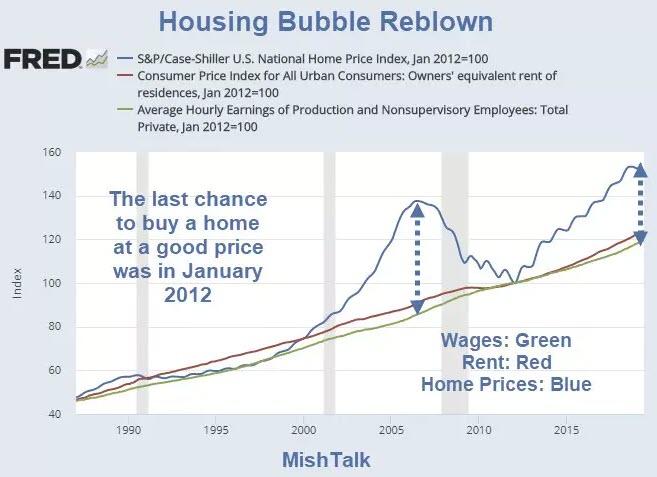

Housing Bubble Reblown

How the heck are millennials (or anyone who doesn't have a home) supposed to afford a home?

Despite the fact that Existing Homes Prices Up 88th Month, the NAR Can't Figure Out Why Sales Are Down.

Negative Yield Ponzi Scheme

So far, all of this negative-yielding debt is outside the US.

Why?

- The ECB made a huge fundamental mistake. Whereas the the Fed bailed out US banks by paying interest on excess reserves, the ECB contributed to the demise of European banks, especially Italian banks and Deutsche by charging them interest on excess reserves that it forced into the system.

- The demographics in Europe and Japan are worse than the US.

Tipping Point

We are very close to the tipping point where the Fed can no longer force any more debt into the system. That's the clear message from the bond market.

Currency Wars

Meanwhile, major currency wars are in play.

Under orders from Trump, US Treasury Declares China a Currency Manipulator.

Hello Treasury Bears

For decades, bond bears have been predicting massive inflation.

Once again, I caution Hello Treasury Bears: 10-Year Bond Yield Approaching Record Low Yield.

Fed Misunderstands Inflation

The Fed remains on a foolish mission to achieve 2% inflation.

In reality, the Fed produced massive inflation but does not know how to measure it.

Inflation is readily see in junk bond prices, home prices, equity prices, and credit expansion.

Note that small credit contraction in 2008-2010. Recall the 'Great Recession" damage that accompanied it.

I do not expect a repeat on that scale, all at once. But I do expect a prolonged period of credit stagnation as retiring boomers start to worry about their retirement. All it will take to set the wheels in motion is a prolonged downturn in the equity markets.

Economic Challenge to Keynesians

Of all the widely believed but patently false economic beliefs is the absurd notion that falling consumer prices are bad for the economy and something must be done about them.

My Challenge to Keynesians “Prove Rising Prices Provide an Overall Economic Benefit” has gone unanswered.

BIS Deflation Study

The BIS did a historical study and found routine deflation was not any problem at all.

“Deflation may actually boost output. Lower prices increase real incomes and wealth. And they may also make export goods more competitive,” stated the BIS study.

It’s asset bubble deflation that is damaging. When asset bubbles burst, debt deflation results.

Deflationary Outcome

The existing bubbles ensure another deflationary outcome.

So prepare for another round of debt deflation, possibly accompanied by a lower CPI especially if one accurately includes home prices instead of rents in the CPI calculation.

Central banks’ seriously misguided attempts to defeat routine consumer price deflation is what fuels the destructive asset bubbles that eventually collapse.

For a discussion of the BIS study, please see Historical Perspective on CPI Deflations: How Damaging are They?

Message from Gold

Please pay attention to gold. As Gold Blasts Through $1500, the Message is Central Banks Out of Control, Not Inflation

Inflation is, or will soon be, in the rear-view mirror. Another deflationary credit bubble bust is at hand.

No comments:

Post a Comment