https://www.zerohedge.com/news/2019-08-29/first-time-ever-fed-stands-alone

For The First Time Ever, The Fed Stands Alone

Summary

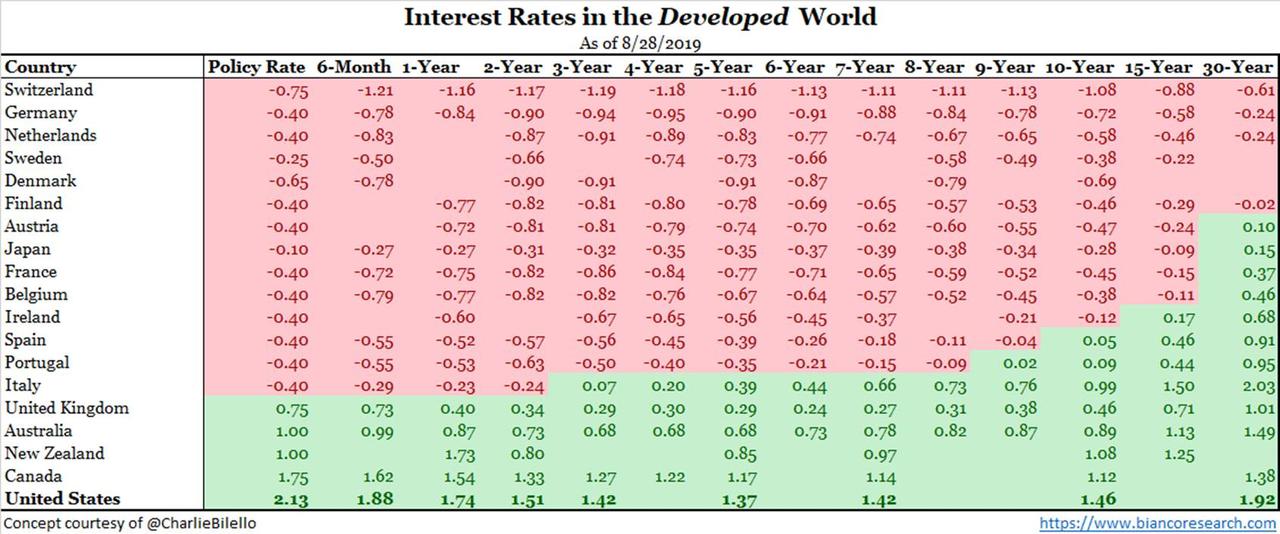

For the first time ever, the fed funds rate is the highest rate in the developed world. The Fed has some explaining to do.

Comment

This morning the yield of 30-year Italian bonds fell below the fed funds rate. This means the Fed is now in charge of the single highest interest rate in the developed world.

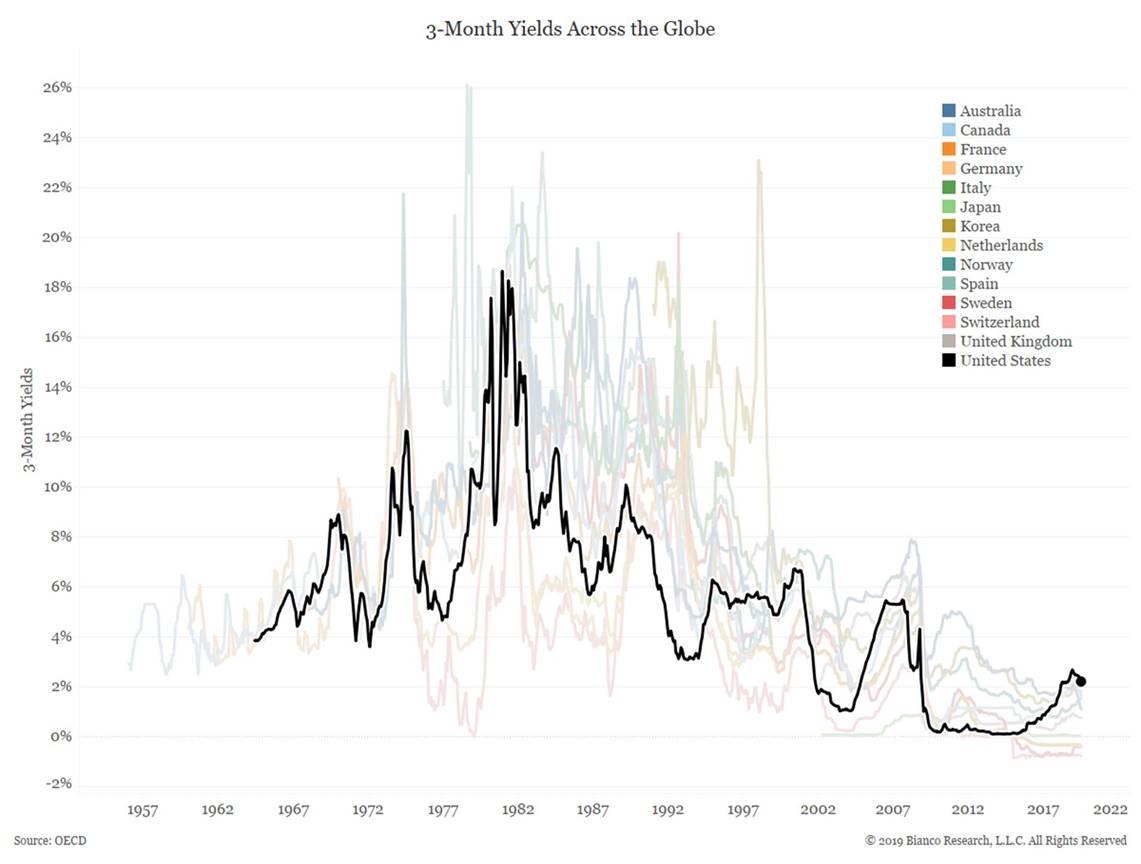

The next chart shows 3-month rates for developed countries back to the 1950s. For the first time in over 50 years, the U.S. 3-month rate (a proxy for the policy rate) is the highest in the developed world.

Restated, this is the first time in modern history that the federal funds rates is the highest short-term rate in the developed world.

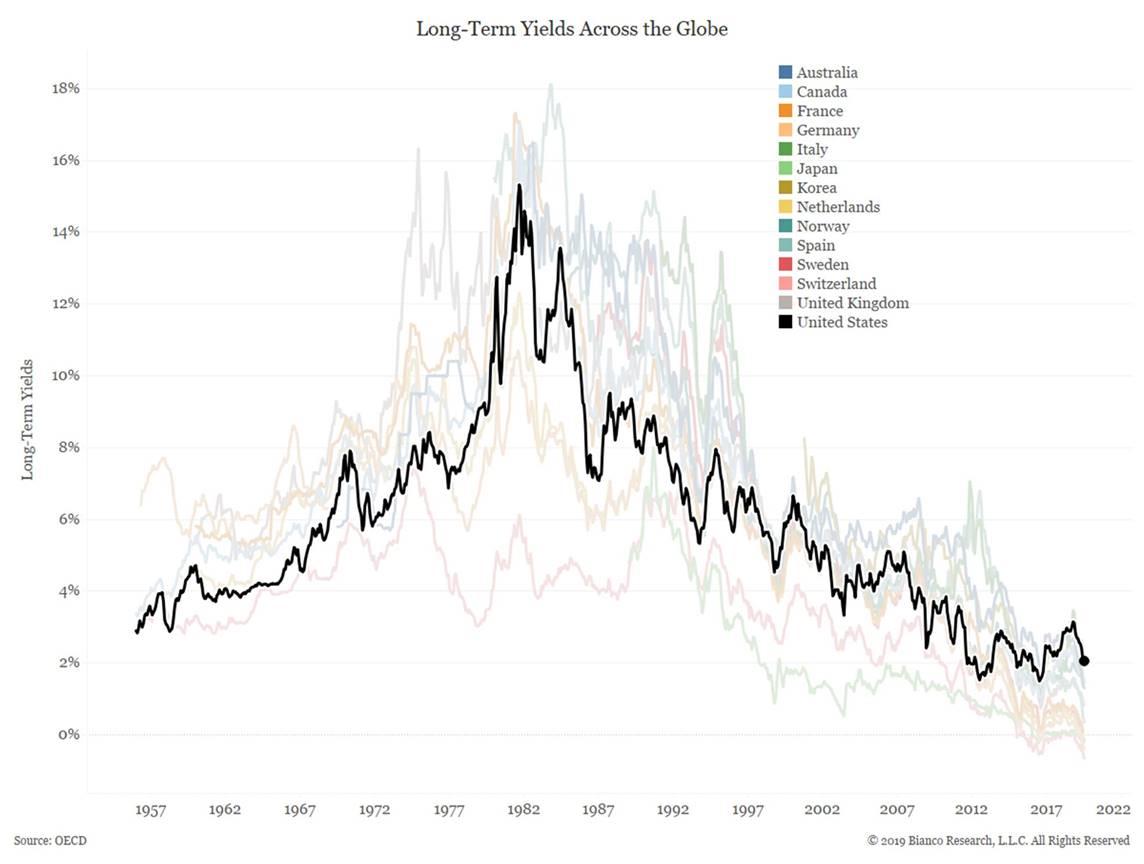

U.S. long rates are at a similarly extreme level relative to other developed nations. The next chart shows 62 years of data and, for the first time, U.S. long-rates are the highest in the developed world (this trend began in 2018).

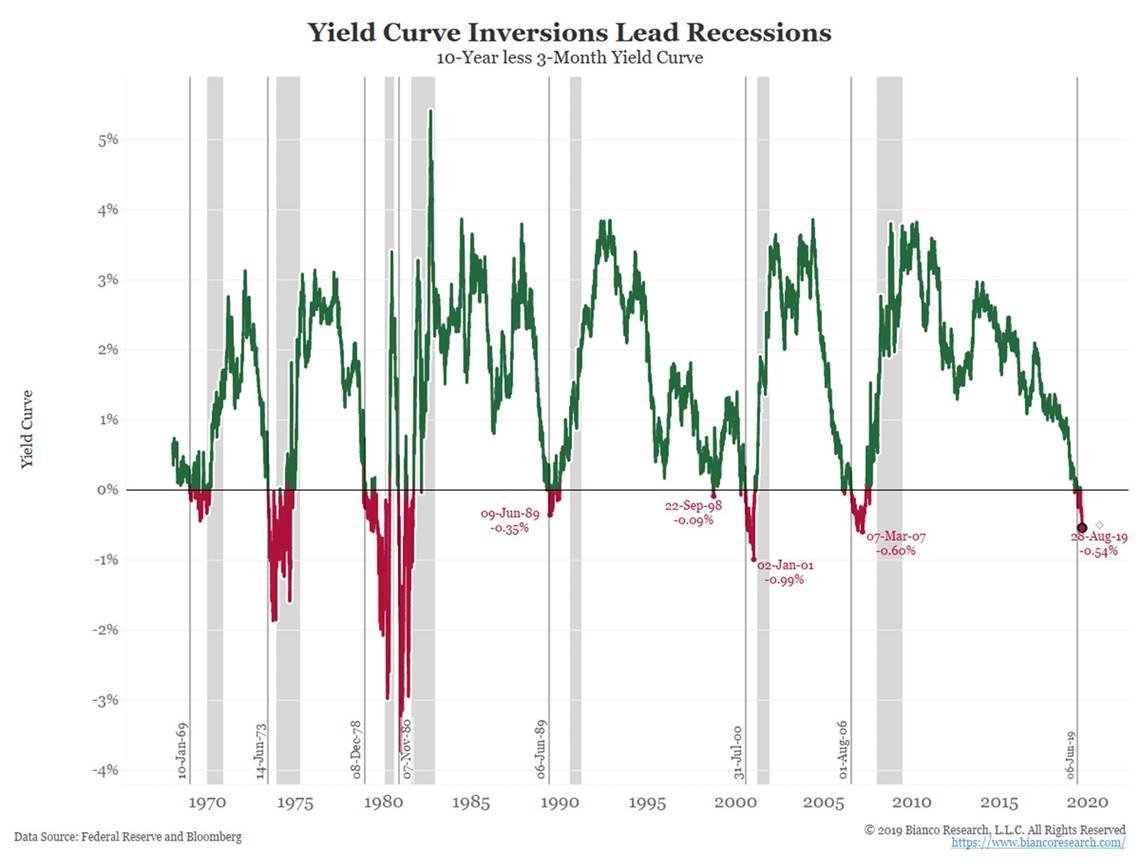

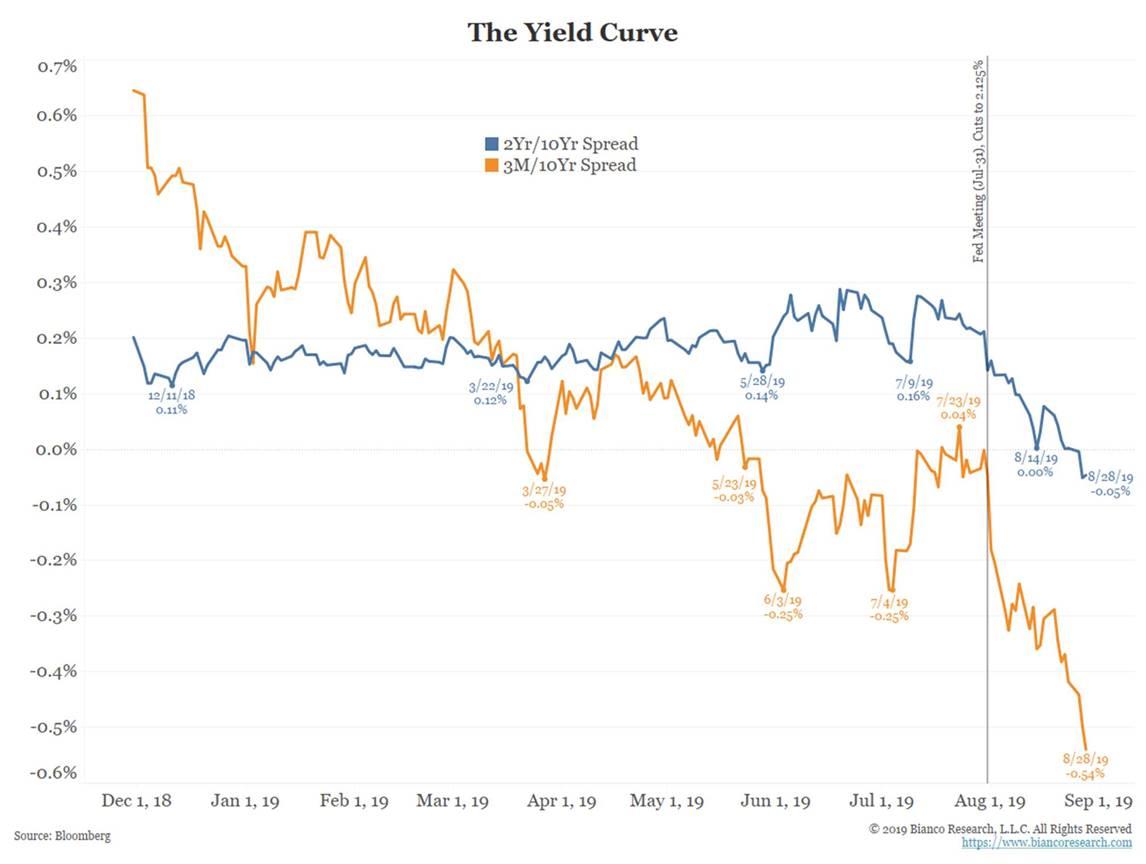

The market has made its opinion known about this situation via the yield curve.

The 3m/10y curve continues to sink further into inversion, approaching its most extreme level in 19 years.

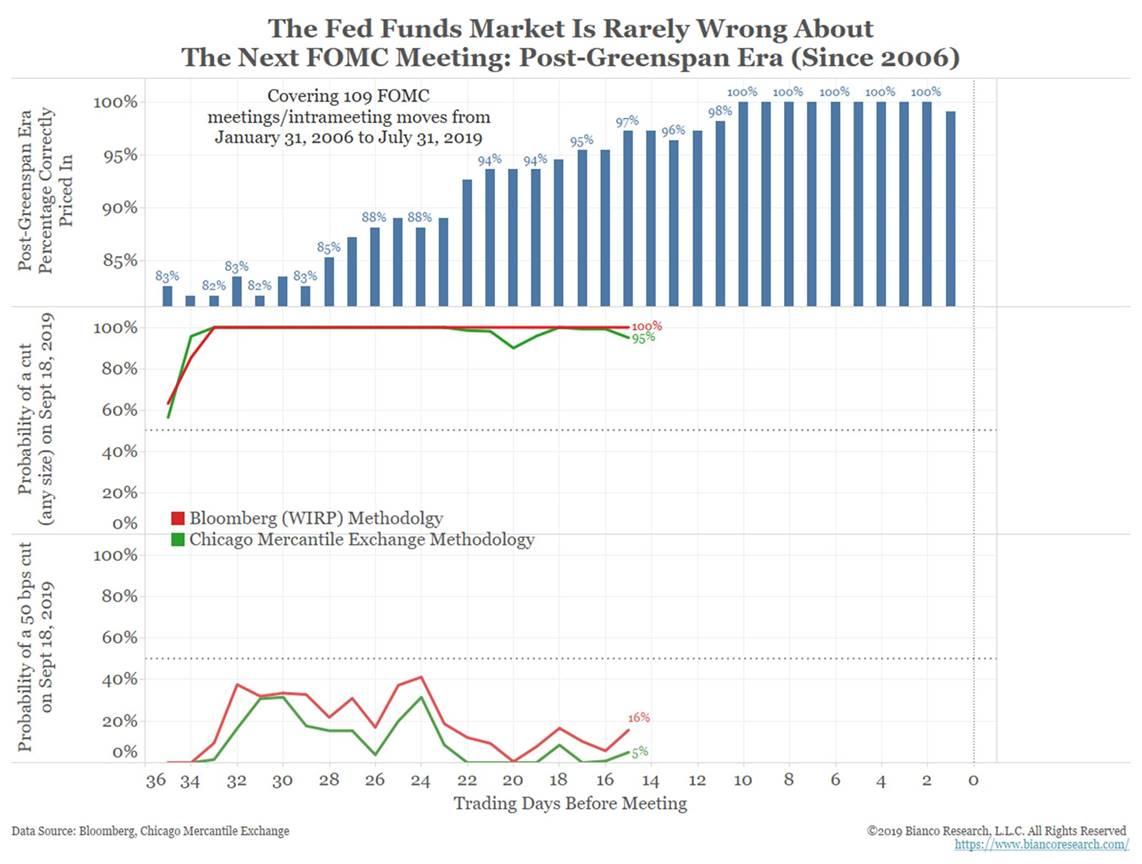

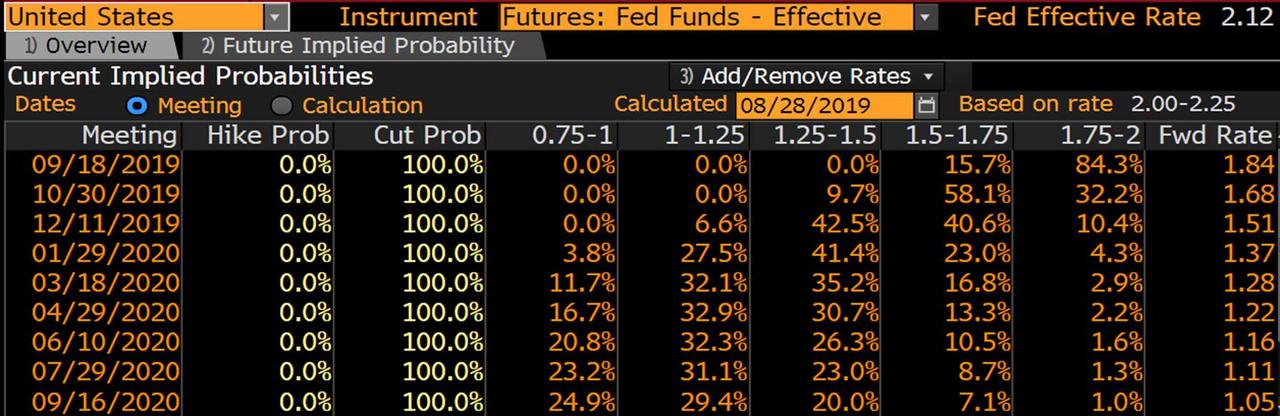

While the yield curve is screaming for a 50 basis point cut, the market is not yet pricing in such a move. As the chart below shows, the probability of a 50 basis point cut is between 5% and 16%.

So why is in the fed funds market not pricing in as aggressive a stance as the yield curve?

As we noted yesterday:

Fed fund futures (and OIS) are not pricing in a 50bps cut because Powell and Fed officials are hinting they are not willing to cut 50. The inverted curve says this is a mistake.

So what gets the market to price in a 50 basis point cut? As we also pointed out yesterday:

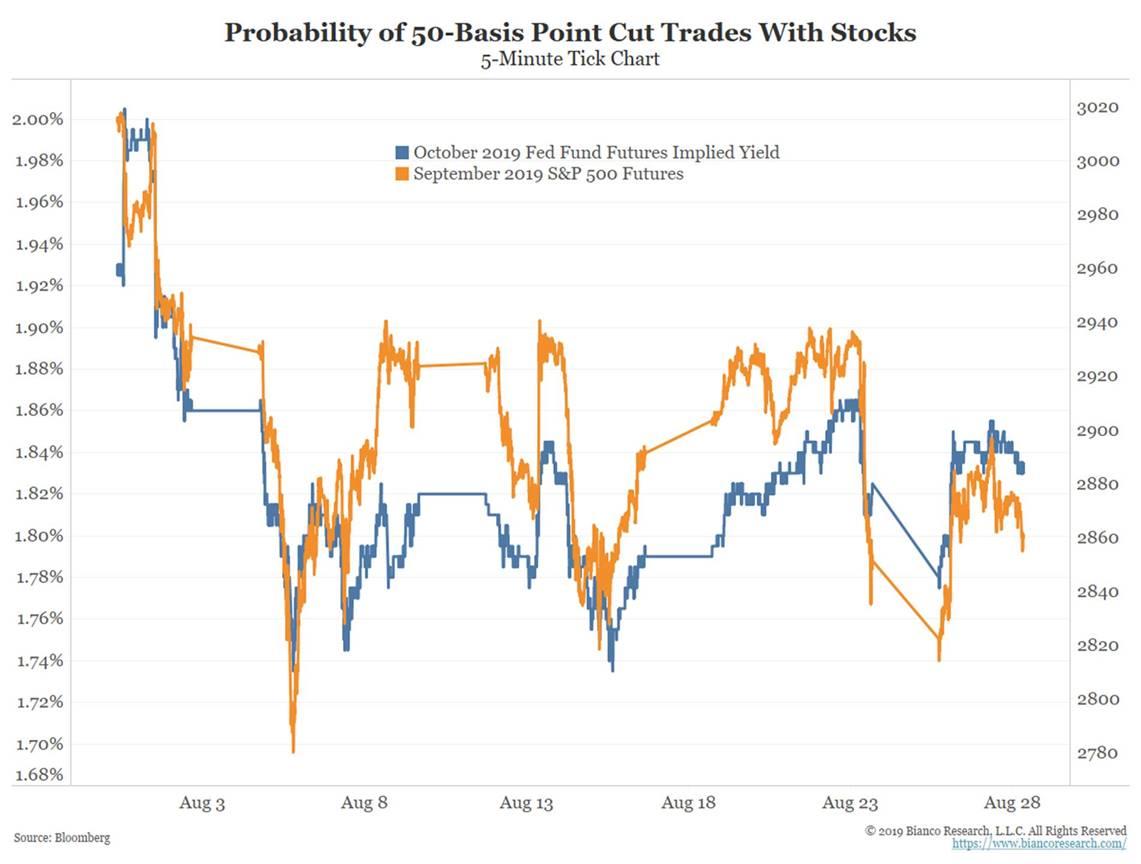

Currently, the S&P 500 is trading around 2890. Given a drop to 2822 pushed the implied odds of a 50 bps cut to 36%, it is looking like a trade under 2800 (about an 8% correction from the all-time high) would push fed funds futures to price in a 50% chance of a 50 bps cut.

The next chart illustrates how the odds of a 50 basis point cut (as measured by the October fed funds futures in orange) closely follow the stock market (blue).

Conclusion

When the Fed meets on September 18, officials should ask themselves the following:

The federal funds rate, the rate we administer, is now the single highest interest rate in the developed world. Market measures, like the yield curve, are saying this is wrong.

Are we sure we have the correct policy? What set of economic indicators suggest this is the first time in 60 years that the U.S. should stand alone with the highest rate in the world, led by our administered rate as the highest point of all?

We have argued that an inverted curve damages the economy. Accumulate enough damage and the economy sinks into recession. So, the curve does not predict a recession, it causes it. What is not known is how much damage the economy can withstand.

If the Fed does not get aggressive and cut rates, we are going to find out how much the economy can withstand. And until they do cut aggressively, long-term rates will continue to sink and the inversion will get deeper.

No comments:

Post a Comment