https://www.zerohedge.com/news/2019-08-09/farmageddon-farm-loan-delinquencies-and-bankruptcies-soar-incomes-plunge

Farmageddon: Farm Loan Delinquencies And Bankruptcies Soar, Incomes Plunge

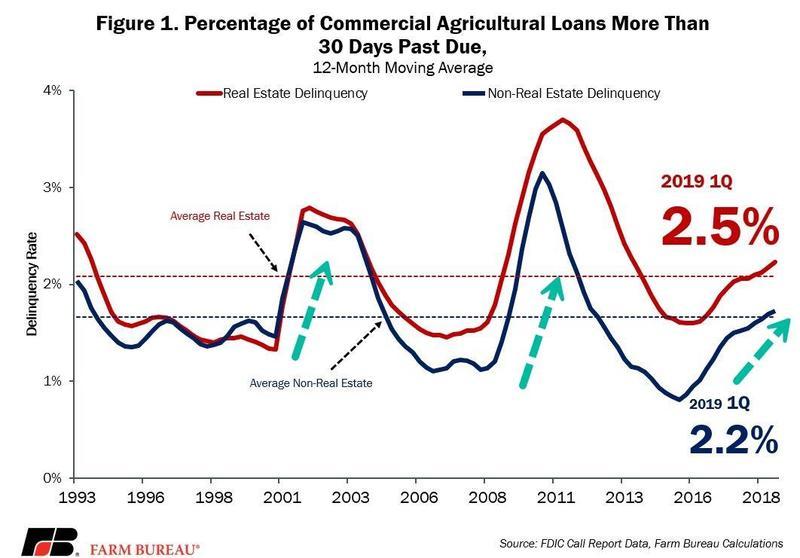

Following years of depressed farm income and rising debt levels, a review of the Federal Deposit Insurance Corporation (FDIC) quarterly report by Tri-State Livestock News reveals that "delinquency rates for commercial agricultural loans in both the real estate and non-real estate lending sectors are at a six-year high."

About 2.5% of commercial real estate loans in agriculture were 30 days past due in 1Q19, up from 2.1% in the prior quarter and above the historical average of 2.1%. 2.3% of non-real estate loans in agriculture held by commercial lenders were 30 days past due, up from 1.5% in the previous quarter and above the historical average of 1.7%. Delinquency rates for commercial lenders haven't been this high since 2013.

Delinquency rates of agriculture loans aren't at crisis levels yet but have trended above historical averages in the last several years as farm incomes in the Midwest and Mid-Southern states have collapsed over the previous six years.

Net farm income, a broad measure of profits, has fallen 45% since a high of $123.4 billion in 2013 to about $63 billion last year, according to the US Department of Agriculture (USDA).

Farm incomes are expected to be significantly lower in 2019 as record floods devastated large parts of the Farm Belt this year.

About two-thirds of agriculture banks surveyed by the St. Louis Fed said their farm clients were severely affected by the flooding and other adverse weather conditions through summer.

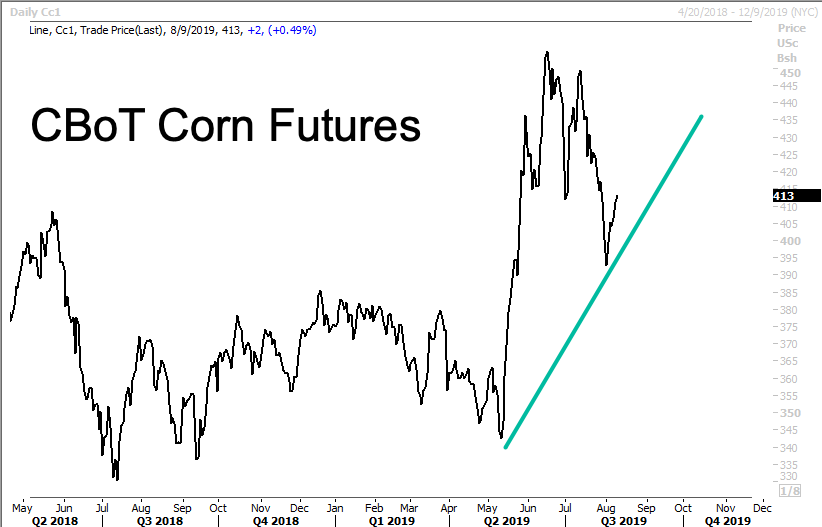

Farm incomes in several regions of the Midwest have become stable this year thanks to President Trump's farm bailout(s) and elevated corn prices that started in May due to yield concerns following wet weather, according to bankers surveyed by the Kansas City Fed.

Record rain in the Midwest added more pain for the heavily indebted farmer dealing with low commodity prices, and now, all agriculture export channels into China have been completely halted thanks to President Trump's latest escalation of the trade war.

The wet weather earnings for global grain traders Cargill Inc and Archer Daniels Midland Co, as heavy rains halted barge transport on the Mississippi River, disrupted livestock shipments, and forced some facilities to close.

The St. Louis Fed said, 2Q19 recorded the 22nd consecutive quarter for farm income declines in the Eighth Federal Reserve District (Arkansas, Illinois, Indiana, Kentucky, Mississippi, Missouri, and Tennessee).

Depressed incomes are expected to continue through 2H19, pulled down by an escalating trade war between the US and China, crop production issues with the possibility of lower yields thanks to adverse weather conditions, and overall agriculture prices remaining in deflation, the Eighth District said.

The Trump administration is preparing for steeper declines in farm income and an overall bust in the Midwest in the next several years.

President Trump on Tuesday morning hinted at what appears to be yet another farm bailout.

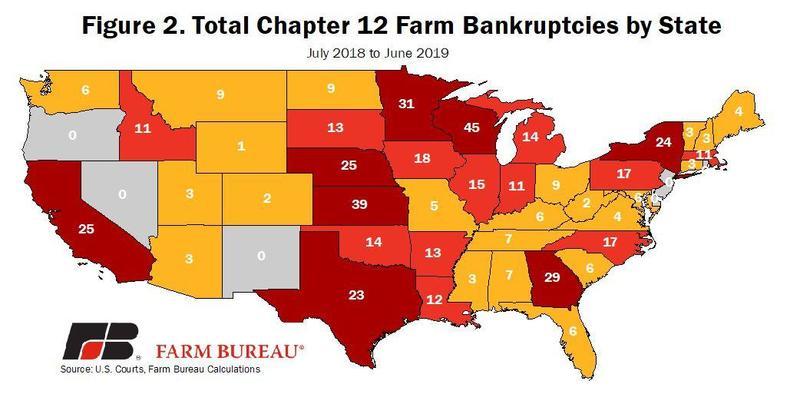

There has also been a bipartisan bill, called the Family Farmer Relief Act of 2019, that increases the total debt load of how much a farmer can have to meet the qualifications to file Chapter 12 bankruptcy, to $10 million from the prior $4 million ceiling. This makes it easier for mom-and-pop farmers to file Chapter 12, instead of Chapter 11 bankruptcy protection, which is expensive and chaotic.

The bill was passed last Thursday and earlier by the US House of Representatives, is headed for President Trump's desk to sign. Judging by the president's comments on Tuesday morning about the potential of a third farm bailout, it seems that this bill will most likely get passed.

Through June 2019, and over the last year, there were 535 Chapter 12 bankruptcy filings, up 13%. The level of Chapter 12 bankruptcy filings is at the highest level since 2012.

Republicans and the Trump administration are preparing for Farmageddon with new interventionist measures [bailouts and changes to bankruptcy law) that will hopefully cushion farmers from retaliatory tariffs by China.

A Reuters investigation of the FDIC showed that major Wall Street banks are now winding down risky lending to farmers because their incomes continue to drop.

With farm incomes plunging and bankruptcies soaring, it seems that the government is preparing for a farm crash, could be worse than the early 1980s.

No comments:

Post a Comment