https://www.zerohedge.com/news/2019-08-21/germany-sells-worlds-first-30-year-negative-yielding-bond-and-its-failure

Germany Sells World's First 30-Year Negative Yielding Bond... And It's A Failure

Last night, when we previewed Germany's sale this morning of what would be the world's first ultra-long (30 Year) auction with a negative yield, we said that "traders will closely following the oversubscription rate on the sale, which neared a record low in the July after falling for the last three auctions." And sure enough that turned out to be a rather thorny issue as the bond sale was technically a failure.

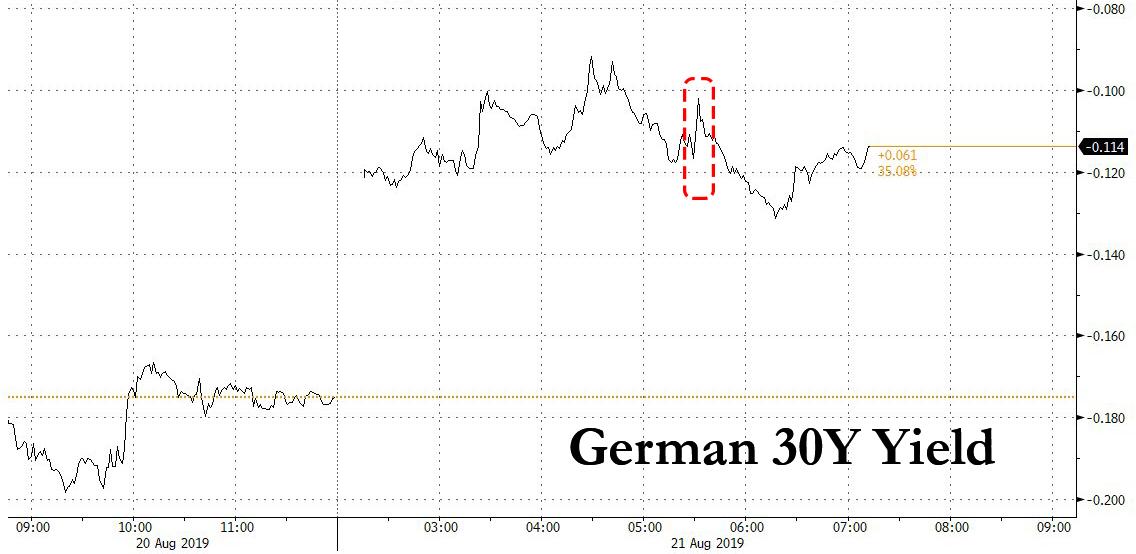

Here's what happened: on Wednesday morning, with its entire yield curve below zero and the yield on the 30Y auction assured to be below zero, a reflection of dwindling expectations for inflation and growth over the coming years and ahead of the ECB's relaunch of QE next month - Germany was hoping to sell some €2 billion in bonds maturing 2050. However, with bond yields rising sharply into the auction, with the yield on the German 30Y rising from -0.18% to as high as -0.10%, demand suddenly slumped.

And so, when the dust settled, it turned out that Germany had managed to sell just €824 million of the total €2 billion target at a record low yield of -0.11%, with the Bundesbank forced to retain almost two-thirds of the entire issue as demand plunged. In other words, this was basically a failed auction.

Thanks to the central bank's intervention, the bid-to-cover ratio was just barely above one, or 1.05 times, versus 1.07 times for the previous sale of similar maturity bonds on July 17, while the real subscription rate - which accounts for retentions by the Bundesbank - fell to 0.43 times against 0.86 times at the previous auction. Anything below 1 indicates that there is no real market demand for the entire issuje.

“It is technically a failed auction,” said Jens Peter Sorensen, chief analyst at Danske Bank AS. “I am not all worried about this -- as investors can always just buy in the future and do not need to participate in auctions.”

He may not be worried, but the optics are certainly not pleasant. Worse, it means that a disconnect may be forming between the primary (auction) and secondary market, where foreign investors are willing to send yields to record lows in the open market but stay quiet at auction, resulting in a potential air pocket between market and auction prices.

As Bloomberg adds, Commerzbank AG had expected demand to come from life insurers and macro investors before the sale. It failed to materialize.

Which begs the question: will this mini buyers strike for the historic auction be the catalyst that sends yields sharply higher? So far, it has not - despite the poor demand, the yield on the bonds dropped as low as -.13% after the auction, and was trading at -.117% last, suggesting that buyers are less worried about the failure and more worried about what happens to the European economy in the future.

No comments:

Post a Comment