https://www.zerohedge.com/news/2019-08-17/12-reasons-why-negative-rates-will-devastate-world

12 Reasons Why Negative Rates Will Devastate The World

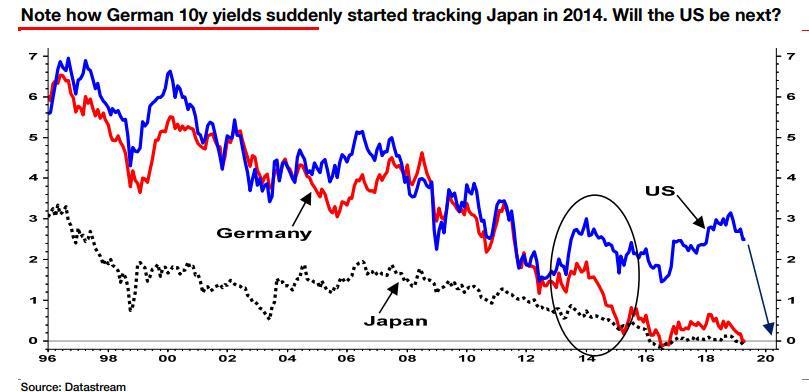

It has been a thesis over 20 years in the making, but with every passing day, SocGen's Albert Edwards - who first coined the term "Ice Age" to describe the state of the world in which every debt issue ends up with a negative yield as capital markets and economies collapse into a deflationary singularity - is that much closer to having the victory lap of a lifetime. Although, we doubt he is happy about it.

Commenting on the interest rate collapse he has been (correctly) predicting ever since he first observed Japan's great bubble bust of the 1980s and which resulted in both NIRP and QE, and which he (correctly) expected would spread across the rest of the world, leading to a "Japanification" of every major bond market...

... Edwards said that what bond markets are telling us is "that the cycle is ending with the central banks having failed to drive core CPI inflation higher. So Japanese-style outright deflation lies ahead at a time when western economies have piled debt sky high."

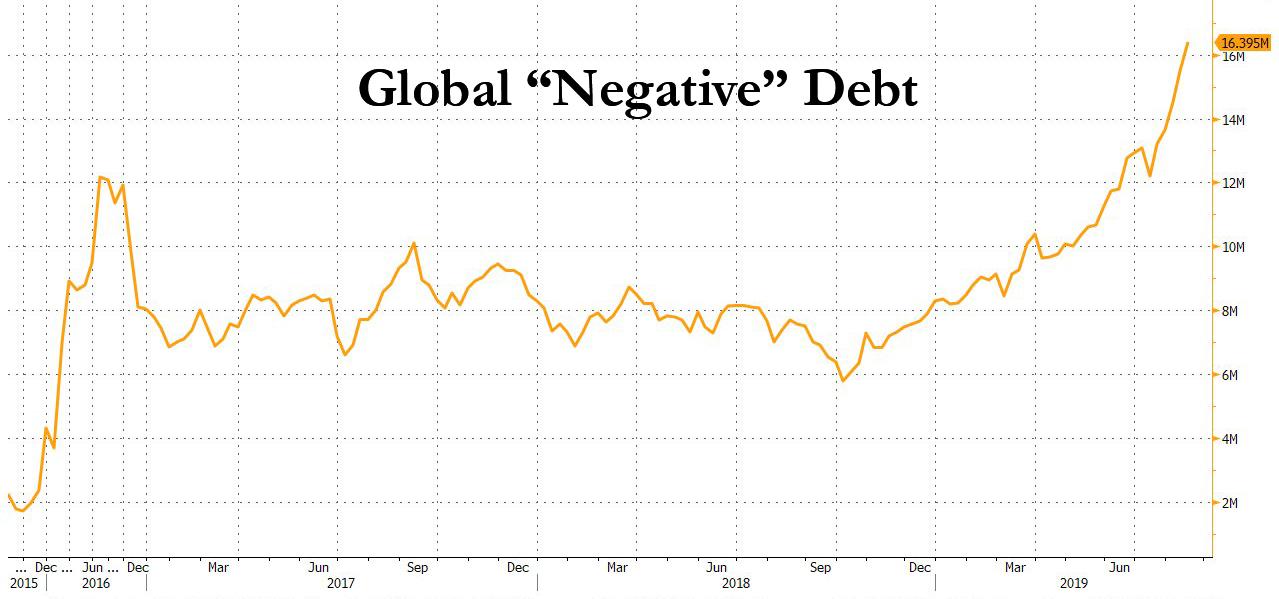

Needless to say that's not good, not least of all because we now live in a world in which the bond universe with negative yields continues to grow at an exponential pace, rising rapidly over the past two weeks and reaching a record $16.4 trillion...

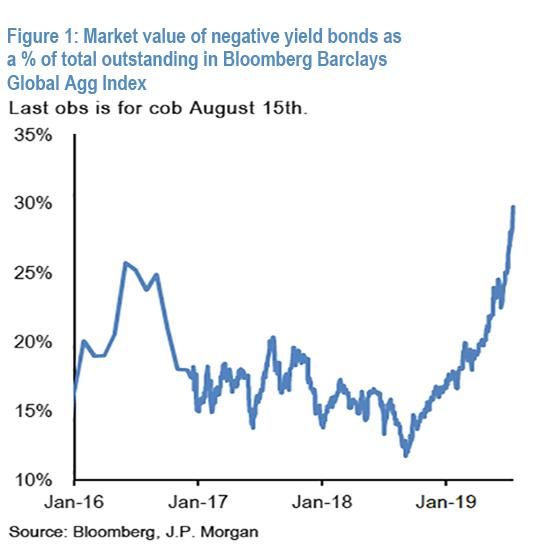

... rising significantly above the previous mid-2016 record high of around $12.2tr. The expansion of the universe of negatively yielding bonds as a percentage of total is shown below: as of the last week, this proportion increased further to around 30.0%, above the mid-2016 record high of 25.8%.

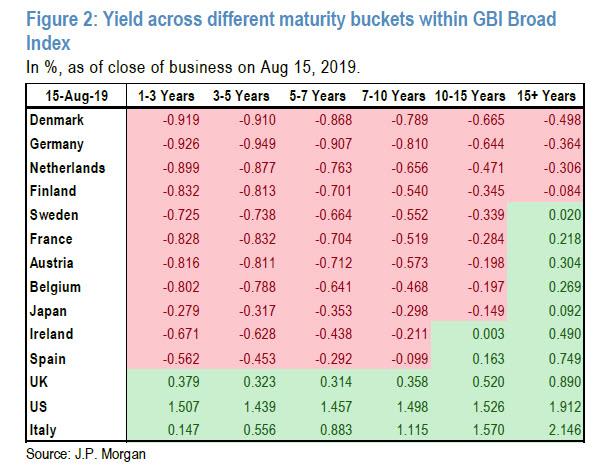

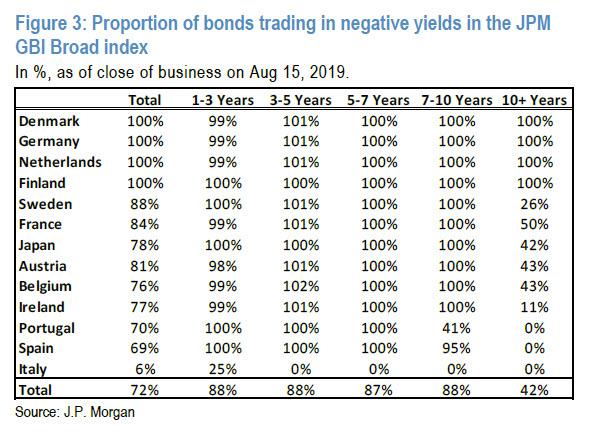

Meanwhile, as the world is blanketed by Edwards' Ice Age, one can see the spread of negative rates both in space and in time. As JPMorgan shows, the spectrum of negative yielding universe expanded this year not only from shorter duration to longer duration government bonds but also down the risk spectrum from core Euro area government bonds to bonds issued by Peripheral countries as shown below.

The next chart shows the proportion of bonds in negative territory as a % of total bonds in each maturity bucket across various countries within the JPM GBI Broad index. In Europe, we now have four counties, Denmark, Germany, Netherlands and Finland with their full maturity spectrum trading with negative yields. Most periphery countries have at least a portion of their maturity spectrum trading with negative yields.

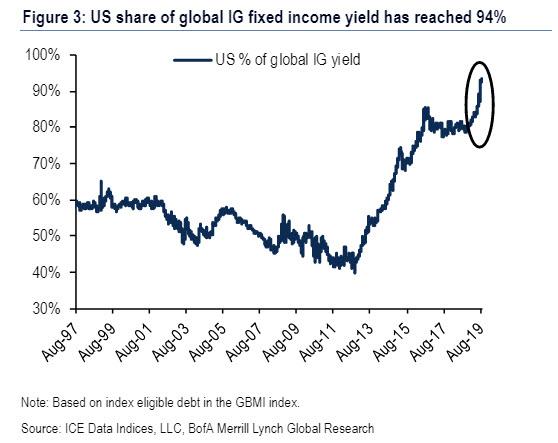

Here, a perverse "negative gamma" type of feedback loop emerges, as this growing universe of negatively yielding bonds becomes self-reinforcing as certain investors such as insurance companies and pension funds rush to avoid locking in negative yields to maturity. This has been a contributing factor to the significant flattening of the Euro area and Japanese curves, with most curves now firmly in negative territory, and leaves USTs as the last high yielder left among core bond markets. Indeed, as BofA shockingly found yesterday, the US share of global investment grade yields has climbed to 94% in the entire world, and is set to become 100% in the coming days..

Making matters worse, when factoring in currency hedging costs, only the very long-end of the UST curve still offers a positive yield for European and Japanese investors, meaning they may be forced to consider spread product such as MBS or HG corporate bonds instead. Indeed, the latest TIC data showed that while USTs have seen cumulative outflows of nearly $30bn YTD, Agency and corporate bonds have seen inflows of $160bn.

And looking at the flows from Japanese and European investors into foreign bonds, both have seen an acceleration in outflows since the turn of the year as the bond market rally has intensified, with the cumulative outflows from Japanese investors YTD in particular running at their fastest pace since January 2016 when the BoJ cut deposit rates into negative territory.

So what are the global, economic and financial implications of this gradual Japanification and relentless decline into ever more negative interest rates?

As JPMorgan Nikolaos Panigirtzoglou writes in this week's Flows and Liquidity, a broader issue concerns the impact of negative rates on asset allocation, noting that "there is little doubt that negative yields are causing a distortion in the pricing of duration and credit risk as pension funds and insurance companies are forced to move further up the maturity and credit curve to avoid negative yields." In other words, both duration, ie term premia and credit risk premia, are likely distorted and are likely to be distorted further if the universe of negatively yielding bonds expands further. The immediate implication is that, according to the JPM analyst, "government yield curves and credit spread curves are losing their information content." Indeed, as Panigirtzoglou adds, "the fact that the 3m10y or 2y10y UST spreads have inverted is less of a reflection of US recession risks and more of a reflection of the desperation for yield by foreign investors flocking into USD denominated bonds as bond yields turned more negative in Europe and Japan."

Meanwhile, US recession risks are elevated by the inversion at the front end of US money market curves which are less distorted by foreign flows, rather than the inversion of 3m10y or 2y10y UST spreads. Similarly, the fact that credit spreads have tightened, especially in Europe, is less of a reflection of an improving economy and more a reflection of European pension funds and insurance companies being forced to shift into corporate bonds to avoid very negative yields in the government space. In addition, it is likely exacerbated by expectations of the ECB restarting QE, including corporate bond purchases.

What about the impact of negative bond yields on equities?

Specifically, will negative rates force pension funds and insurance companies or other investors that dislike negative rates to move to equities? Or will pension funds and insurance companies hoover everything with positive yields in the fixed income space, including alternatives such as private debt, and avoid equity asset classes?

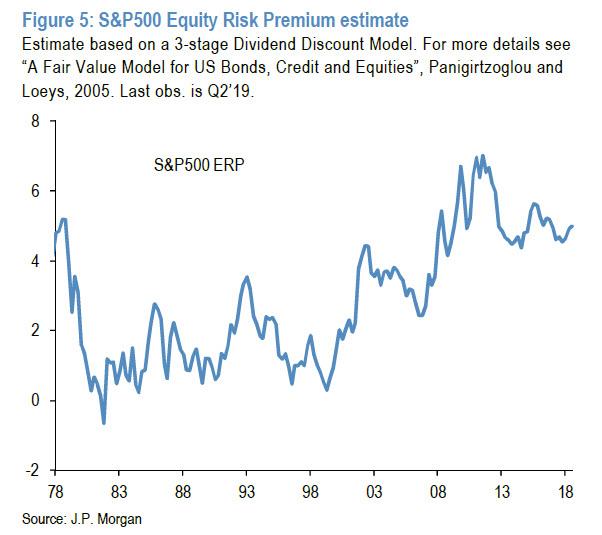

If the latter is the case and pension funds and insurance companies, a $53 trillion AUM universe in the G4 economies, avoid equities either because of regulatory constraints or demographics or simply because negative bond yields create a sense of an abnormal and uncertain environment, then the yield compression in the fixed income space could fail to spill over to equity asset classes, according to JPM. This means that the mirror image of lower bond yields would be higher rather than lower Equity Risk Premia. Indeed, the bank's Equity Risk Premium proxy for the S&P500 index shows that since negative yields started emerging in core bond markets post the first ECB move to negative policy rate territory in June 2014, Equity Risk Premia have risen rather than fallen. This, for central banks hoping that negative rates will force stock prices to record highs, is a truly stunning development.

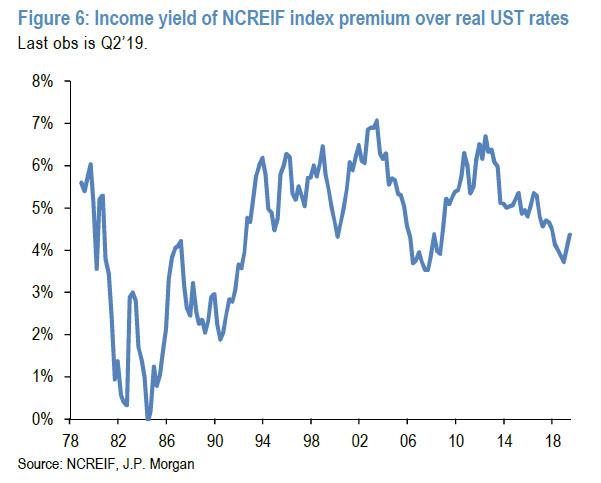

There is a similar picture with real estate. By JPMorgan estimates, property yields for the most liquid real estate markets in the world, i.e. US commercial real estate, show that yields have declined only modestly over the past year despite a compression in government bond yields. The compression in government bond yields has failed to spill over in any strong way into real estate implying that real estate risk premia vs government bonds have risen rather than fallen over the past year

In other words, as the JPMorgan strategist warns, "the hope that central banks experimenting with negative rates have that negative rates will cause a compression in risk premia in riskier asset classes beyond fixed income markets, such as equities and real estate, might not materialize."

Needless to say this would be a historic catastrophe for capital markets, where central banks - in control over interest rates for the past century - will have officially lost control as lower rates no longer lead to easier financial conditions and higher asset prices.

A second and perhaps more important issue is about the unintended consequences of negative rates.

As readers will recall, it was back in February 2016 that we presented a JPMorgan analysis from Panigirtzoglou, in which he argued that there are several unintended consequences from very negative policy rates, with little evidence of a positive impact in Switzerland and Denmark, two of the earliest countries experimenting with very negative policy rates.

So now that there is a new record amount of negative-yielding debt, it is time revisit these unintended consequences below:

1. Lower bank profitability

It is true that a tiered deposit rate scheme, pioneered by Danish and Swiss central banks, introduced later by the BoJ and now considered by the ECB, reduces the burden on banks from taxing reserves. This is because only a portion of bank reserves are subjected to very negative interest rates. Indeed, the experience from Switzerland, Denmark and Japan is that subjecting even a small portion of reserves to the lower deposit rate could be enough to generate the marginal flow needed to push interbank rates or bond yields lower. In other words, a tiered deposit scheme can result in lower interest rates without penalizing banks too much.

However, even if the portion of reserves subjected to deeply negative rates is limited, banks are not immune to a reduction in net interest income, especially if interest rates move deeper into negative territory. This is because banks seem unable or unwilling to pass negative deposit rates to their retail customers, leaving them with few options to offset costs. These costs not only include the negative interest on their reserves with the central bank (which can be limited by a tiered scheme) but also include reduced income from security holdings as government bond yields turn negative and a potential loss in income from reduced credit creation and money market activity.

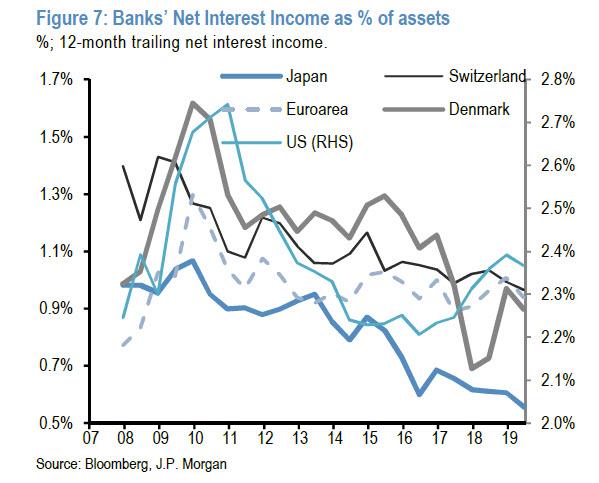

Indeed deeply negative policy rates have taken their toll on Danish, Swiss and Japanese banks’ net interest income

As JPM points out (and as it will find out soon enough personally), net interest income as % of assets has been on a declining trend since early 2015 for both Danish and Swiss banks following the introduction of very negative policy rates in these countries. In Japan, net interest margins had already deteriorated markedly by early 2016 when the BoJ adopted negative rates, but a shallower decline has continued. By contrast, net interest margins for Euro area banks appear to have held up somewhat better at least at the regional level. That said, there has been little decline in new lending rates after the ECB pushed lending rates into more negative territory in end-2015 and early 2016 even as the ECB’s second TLTRO program has helped reduce funding costs by providing funding at -40bp for banks that met relatively generous lending targets, likely supporting net interest margins.

And the contrast between banks in countries where central banks have experimented with negative deposit rates, where net interest margins have at best remained stable as in the case of the Euro area, and the US, is striking. In the latter, banks saw an improvement in net interest margins from a trough in 2016 against a background of rising central bank policy rates and despite credit creation if anything slowing modestly since early 2016, as well as a flattening in the US yield curve.

2. Reduced rather than increased credit creation to the real economy

First the good news: according to Panigirtzoglou, the introduction of modestly negative policy rates appears to have had a positive impact on credit creation. Overall credit creation improved in Denmark during 2013 and 2014 following the introduction of modestly negative policy rates in the summer of 2012. The ECB introduced negative rates in the middle of 2014 and credit creation saw a marked improvement in the Euro area with a shift from contraction to modest expansion. Sweden introduced modestly negative policy rates in 2015 and during last year credit creation to the real economy including households and non-financial corporates improved (to SEK52bn in the first three quarters of last year vs. SEK46bn for the whole of 2014).

Now the bad: there was little evidence that very negative policy rates helped credit creation further. Denmark and Switzerland introduced very negative policy rates in 2015. Credit creation to the real economy deteriorated in Denmark during 2015 vs the previous year. Indeed, it deteriorated from around DKK80bn in 2014 to DKK74bn in 2015, before subsequently increasing above DKK80bn from 2016 onward. In Switzerland the total stock of loans rose by just CHF11bn in 2015 compared to CHF31bn in 2014. Subsequently, growth in the stock of loans has risen to CHF25-40bn per year in 2016-2018, but has not surpassed the CHF46bn seen in 2013. So the evidence from Denmark and Switzerland is that the introduction of deeply negative interest rates was initially accompanied by a deterioration rather than improvement in credit creation. The subsequent recovery in lending is likely at least in part tied to an improving global growth backdrop after 2015, though at least it suggests that credit growth was not permanently weakened.

The initial evidence on credit creation from the Euro area was mixed at best: net credit creation in the Euro area declined sharply during the Euro area crisis and remained weak even as the ECB pushed deposit rates to -20bp in 2014. It subsequently recovered, though to fairly muted growth rates by historical standards. And pushing deposit rates further into negative territory at the Dec15 and Mar16 meetings did not appear to boost lending growth rates further.

So the initial experience of policy rates being pushed into very negative territory was that it was associated at best with little clear impact on credit creation and in some cases in outright contraction in loan creation, and the subsequent recovery seems subdued by historical standards.

3. Higher rather than lower bank lending rates

The message is similar to that from credit creation: the introduction of modestly negative policy rates appears to have resulted in a decline in bank lending rates to the real economy, i.e. to households and non-financial corporations. Overall bank lending rates for new loans improved in Denmark during 2013 and 2104 following the introduction of modestly negative rates in the summer of 2012. The ECB introduced negative rates around the middle of 2014, pushing the deposit rate to - 20bp, and bank lending rates also declined since then. Sweden introduced modestly negative policy rates in 2015 and bank lending rates to the real economy, including households and non-financial corporates declined during 2015.

But there was less support for the idea that deeper negative policy rates helped to further reduce bank lending rates. Denmark and Switzerland introduced very negative policy rates in 2015. In Denmark bank lending rates for new loans to non-financial corporations declined by around 40bp during 2014, but rose from late 2014 to mid-2015 by around 20bp. Bank lending rates for new loans to households declined by around 100bp during 2014 but were essentially flat during 2015 after initially rising by 60bp in 1H15. In Switzerland, bank lending rates for new investment loans to non-financial corporations went marginally higher by around 5bp during both 2015 and 2014. Bank lending rates for 10y fixed-rate mortgage loans declined until January 2015, and increased until mid-2015 before drifting towards Jan-2015 levels over the following year. Bank lending rates for variable-rate mortgage loans linked to a base rate fell until Jan15, before rising modestly by mid-2015. In the Euro area, where lending rates on new business for both households and non-financial companies declined by around 50bp during 2014, declines from late 2015 to mid-2016 when deposit rates were pushed deeper into negative territory, were more modest at around 20bp for NFCs. And while households saw larger declines in mortgage rates, rates for new loans for consumption were essentially flat.

Subsequently, the experience with deeply negative policy rates has been mixed. In Denmark, new loan rates to both NFCs and households declined by around 60bp from late 2016 to mid-2019. In Switzerland, bank lending rates for new investment loans to NFCs stabilized and were little changed in 2016-17, and declined by 5bp during 1H18 before stabilizing again. Lending rates for new 10y fixed-rate mortgages drifted 20bp higher from late 2016 to October 2018, before the bond market rally since then have seen fixed rate mortgages decline. And, despite a 50bp cut in the policy rate to -75bp in early 2015, rates on new variable interest rate mortgages linked to the policy rate declined around 10bp in total from early 2015 to late 2016 before stabilizing. In the Euro area, by contrast, loan rates on new business to NFCs and households have been relatively little changed since mid-2016. And in Sweden, new loan rates to households and NFCs have been largely stable since mid-2015.

So the evidence from Switzerland, the Euro area and Sweden appears to be that deeply negative policy rates have overall seen little further decline of lending rates as banks, whose deposit rates are largely floored at zero, struggle to avoid depressing their net interest margins further. Only in Denmark have lending rates continued to decline in subsequent years

4. Higher rather than lower savings rates by households and non-financial corporates.

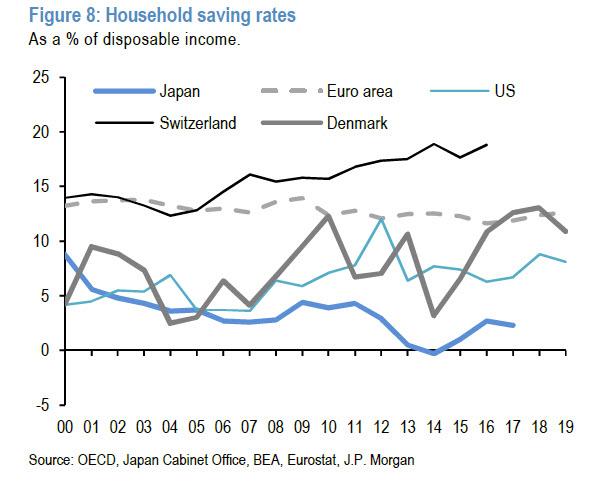

This was a big shock when we first pointed it out back in 2015, and quickly became one of Jeff Gundlach's favorite talking points. For example when we look at household sector savings rates in the US, Euro area and Japan there is little evidence of lower savings rates in the Euro area and Japan, which had introduced negative policy rates in recent years, relative to the US.

Similarly there is little evidence that the non-financial corporate sectors of Euro area and Japan have reduced their financial surplus by more than the US since the introduction of negative policy rates in 2014. Higher uncertainty and the pressure to save more for retirement are likely behind persistently high savings rates by both households and companies.

5. Impaired functioning of money markets

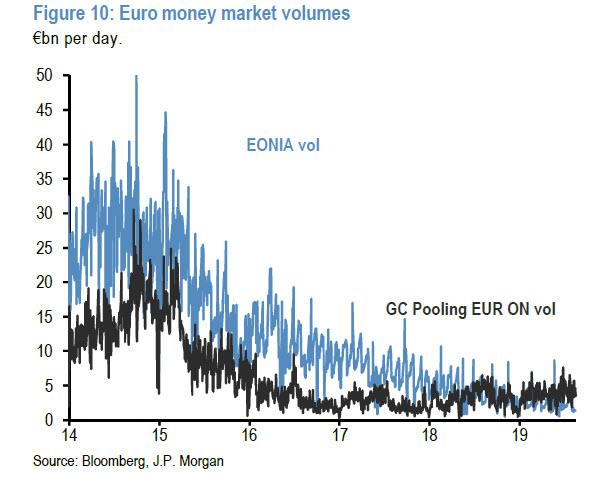

As previously discussed, negative rates coupled with QE had caused significant slowdown in money market activity: they quite literally are an ice age . Indeed, daily data show that both unsecured (EONIA volume) and secured (GC Pooling EUR overnight index volume) money market volumes have downshifted significantly since the ECB introduced negative rates in mid-2014 and accelerated once the ECB started its bond purchase program in early 2015, and pushed rates into more negative territory in late 2015/early 2016.

And there has been at best modest signs of improvement after the ECB ended its QE program more recently. Indeed, unsecured volumes have declined further from a daily average of €4bn in 2018 to €2.4bn in 2019 to-date, though secured volumes have firmed modestly from a daily average of around €3.2bn in 2018 to €3.8bn in 2019 to-date. The collapse in money market volumes over the past years is concerning and shows that negative depo rates can make the functioning of money markets problematic even after QE is halted. Moving deeper into negative territory could exacerbate this problem.

6. Reduced liquidity in bond markets

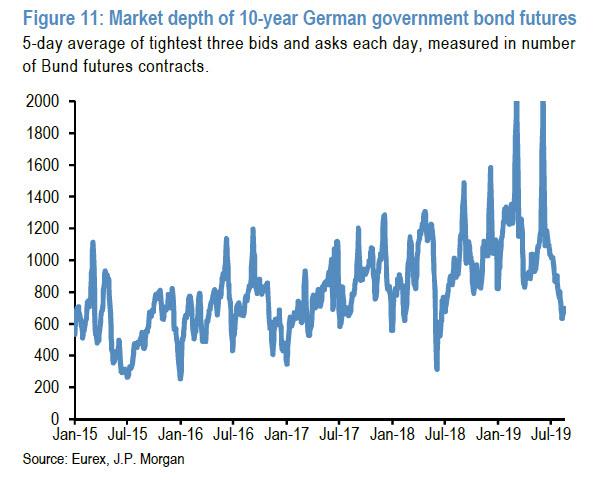

There is also a risk that, not only the functioning of money markets that becomes impaired, but that according to JPM, liquidity in bond markets could also be affected by negative bond yields as real money investors are in principle less

willing to trade bonds with negative yields. The next chart shows that the market depth of 10-year German government bond futures declined sharply this year as yields turned negative, reversing much of the improvement that occurred since mid-2016, when 10y Bund yields also turned negative. Previous sharp declines in market depth have also been associated with sharp sell-offs such as the 2015 VaR shock and in the aftermath of the US presidential election in 4Q16, but the magnitude of decline in market depth since the start of 2019 stands out nonetheless.

willing to trade bonds with negative yields. The next chart shows that the market depth of 10-year German government bond futures declined sharply this year as yields turned negative, reversing much of the improvement that occurred since mid-2016, when 10y Bund yields also turned negative. Previous sharp declines in market depth have also been associated with sharp sell-offs such as the 2015 VaR shock and in the aftermath of the US presidential election in 4Q16, but the magnitude of decline in market depth since the start of 2019 stands out nonetheless.

7. Increased rather than reduced fragmentation

According to JPM's Panigirtzoglou, there has been no improvement in the “fragmentation” of interbank markets since the first ECB depo rate cut in June 2014. ECB data show that the share of cross-border unsecured overnight interbank activity stopped improving in 2014 after rapid improvement during the second half of 2012 and during 2013. Moreover, the Euro Money Market Survey for September 2015 showed that a greater portion of the unsecured market was with national counterparties at 46% in 2015 relative to 41% in 2014. The equivalent shares for the secured market were 27% for 2015 vs. 24% in 2014; i.e. there was also deterioration in cross peripheral government paper in Euro repo markets has in fact declined between mid-2014 and mid 2015 according to the semiannual ICMA repo market survey.

Since then, the latest ECB annual financial integration indicators, from July 2019, suggest the proportion of secured and unsecured money market transactions completed with domestic counterparties has increased from 25% in 2015 to 40% in 2019. The use of cross-border collateral in ECB monetary policy operations, which had recovered from a low of around 20% in late 2013 to close to 30% by early 2015 even as policy rates moved into modestly negative territory before stabilizing, has been declining steadily since mid-2016. And the interquartile range of euro area countries’ average unsecured interbank lending rates drifted higher from mid-2014 to mid-2016 as policy rates were pushed into steadily more negative territory. From mid-2016, when the ECB’s TLTRO 2 operations were conducted, the interquartile range narrowed until early 2018, after which it has widened again sharply.

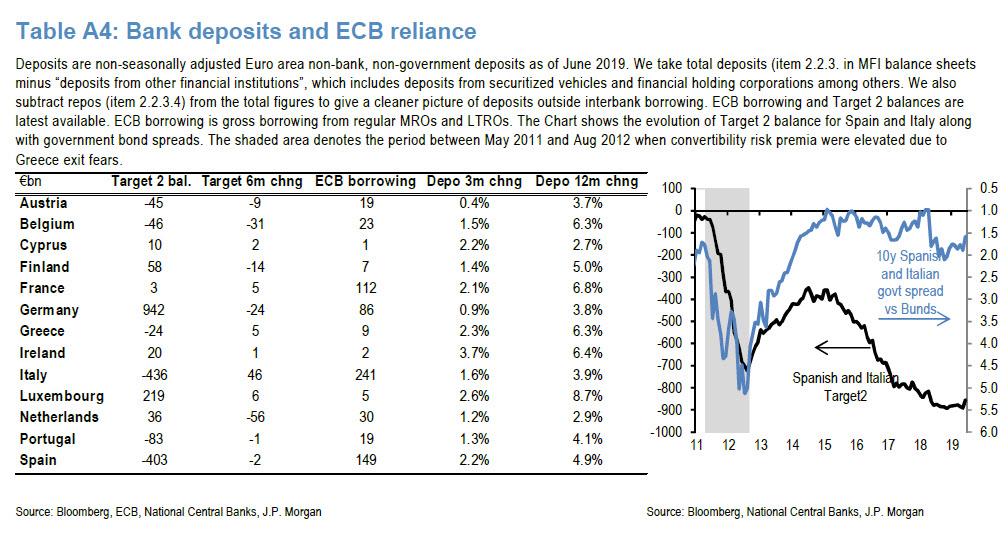

In addition, there has been deterioration in Target 2 balances since mid-2014, the broadest among quantitative measures of fragmentation. The sum of Spanish and Italian Target 2 balances has deteriorated by moving deeply into negative territory since the ECB first cut its depo rate to negative. After hitting a high of -€347bn in July 2014, the sum of Spanish and Italian Target 2 balances have been steadily declining and reached a low of €893bn in November 2018 before increasing slightly.

The reasons for the Target 2 widening have been somewhat different after the ECB started QE compared to the Euro area sovereign crisis. As we have argued previously, the more recent decline has likely been exacerbated by investors from outside the Euro area, who often hold cash accounts in core countries, selling e.g. Italian bonds to the Bank of Italy, this registers as an increase in the Target 2 liability. Nonetheless, this decline in the Target 2 balances still represents a measure of fragmentation.

In all, the evidence from money markets and Target 2 balances is at best mixed in terms of fragmentation, with some deterioration in some metrics, since the ECB introduced negative depo rates in June 2014. This is not to say that negative depo rates didn’t bolster the search for yield in the government space and the velocity of reserves, i.e. passing on the “hot potato” within the Euro area banking system. It did, as evidenced by the collapse in interest rates, the rapid expansion of the universe of negatively-yielding government bonds in the euro area core, and the concentration of reserves in core banks’ balance sheets. But while there have been capital inflows into some periphery countries, notably Spain, Italy has seen outflows particularly from bonds.

What is the channel via which negative policy rates could increase fragmentation? One potential channel is the risk appetite of banks. To the extent that negative policy rates hurt bank profitability, banks might become less willing to take risk and thus less willing to lend in interbank markets or to take credit risk in their bond portfolios. On the latter, there appears to be support from much of the academic literature that negative rates have depressed lending volumes for banks with high deposit shares. At the same time, work by the ECB (by Demiralp et al, May 2019) using Euro area bank level lending data suggests when controlled for both high retail deposit ratios and high negatively yielding excess liquidity ratios, as banks particularly exposed to negative rates, there has been a positive relationship with lending. As the ECB contemplates pushing deposit rates into even more negative territory, this is clearly a key issue – could more negative rates backfire by putting more pressure on bank profitability and curb risk-taking?

8. Lower bond yields increase pension fund and insurance company deficits putting pressure on pension funds to match assets and liabilities.

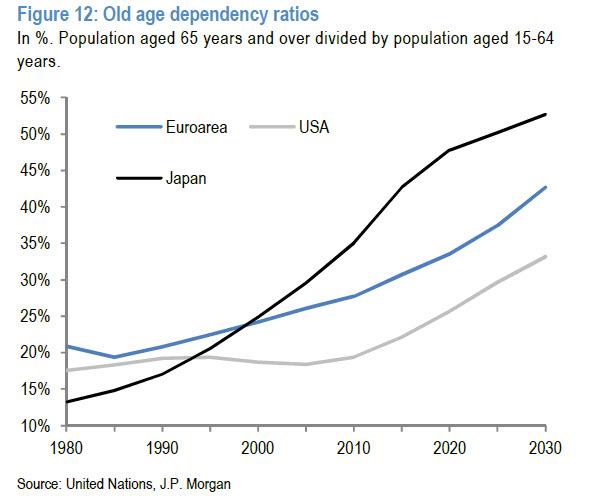

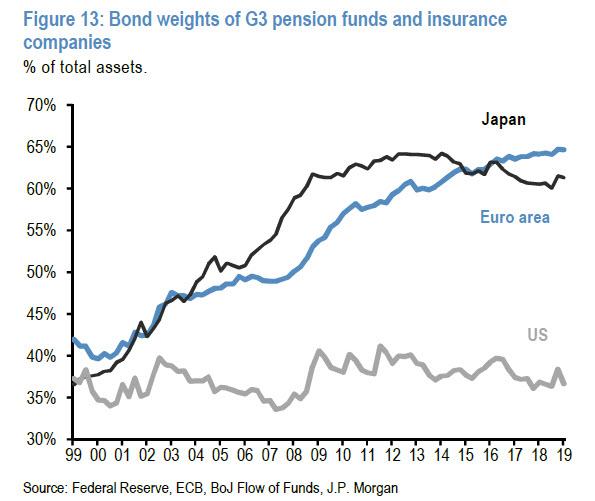

This pressure to move further away from equities and other high risk assets into fixed income is even stronger in countries like Japan where demographic pressures are more intense. For example, old age dependency ratios, i.e. the proportion of the population aged 65 years and over as a percentage of the population aged 15-64 years, have been rising steadily, with Japan aging more rapidly than the US or Europe.

Generally, an aging population means that allocations are likely to shift towards relatively safer instruments as the ability to withstand larger drawdowns on capital diminishes as individuals age. And the effect of these demographic rends is likely a factor in the high share of total assets held in bonds by Japanese pension funds, especially relative to their US counterparts.

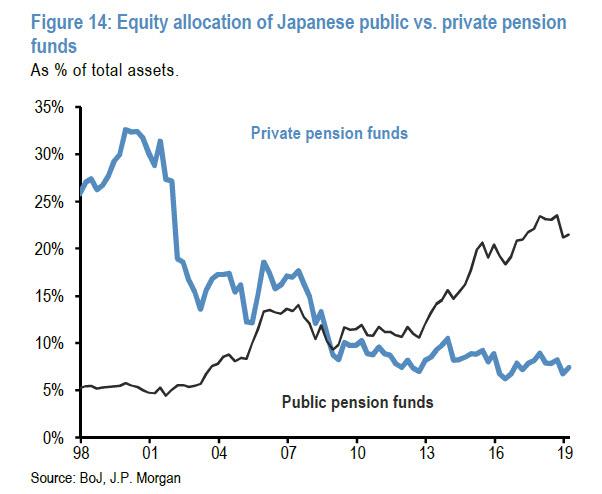

What is striking in Japan is that, in contrast to GPIF, which shifted towards equities post Abenomics most likely under political pressure, private Japanese pension funds have if anything reduced their equity allocations modestly

In general pension funds and insurance companies including those outside Japan are facing an increase in their liabilities and as a result a deterioration in their funded status. And the options pension funds and insurance companies are limited. On the asset side they can increase duration risk by shifting into even longer maturity bonds, increase credit risk by shifting into even riskier spread products, and increase fx risk by shifting into higher yielding foreign bonds. On the liability side they reduce benefits to new and sometimes existing plan beneficiaries, or they ask plan sponsors to increase their contributions.

Pension funds and insurance companies which are facing a big increase in their liabilities have limited options such as taking a lot more fx and credit risk by shifting to foreign government or corporate bond markets, reducing benefits to new and sometimes to existing plan beneficiaries, or ask plan sponsors to increase their contributions. The overall impact is that lower yields can induce households, or companies that act as plan sponsors, to save even more for the future, an argument we have made since 2014, and one which not a single economist appears able to grasp.

9. More income and wealth inequality as households and small businesses fail to benefit or are even hurt from negative rates.

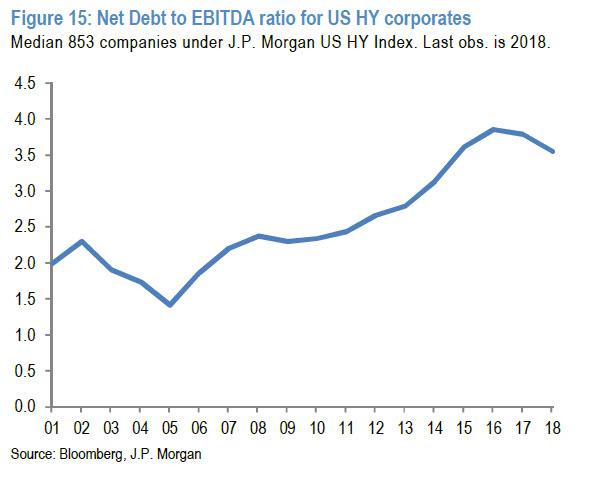

The main beneficiaries of negative rates have been large corporates which have seen a collapse to their interest expense as well as private equity companies that are able to lever by even more than in previous cycles to amplify their profits. Indeed, the median debt to EBITDA ratio for both HG and HY companies has risen in recent years to well above the peaks seen in previous cycles.

10. Central banks are trapped.

Negative rates coupled with QE raise questions about central banks’ exit potentially becoming more difficult in the future and raise the risk of a policy error as well as perceptions about debt monetization. It potentially creates bond bubbles by lowering bond yields below their equilibrium or fair value, creating fears that an eventual return to normality could be accompanied by sharp price declines. Perceptions about bond bubbles can increase long term uncertainty. In turn, higher uncertainty might prevent economic agents such as businesses from spending.

11. The death of creative destruction and the zombification of corporations

Low credit spreads and corporate bond yields are an intended consequence of negative rates as pension funds

and insurance companies are forced to shift up both the maturity and credit curve, but not without distortions. By

potentially allowing unproductive and inefficient companies to survive, helped by low debt servicing costs, negative rates could potentially hinder the creative destruction taking place during a normal economic cycle. In principle, similar to QE, negative rates could thus make economies less efficient or productive over time. The debate about so called "zombie" companies has been particularly intense in Japan given the low business turnover rate. According to OECD, Japan's business startup and closure rate is about 5%, roughly a third of that in other advanced economies with several commentators blaming the BoJ's ultra-accommodative policies for this problem.

and insurance companies are forced to shift up both the maturity and credit curve, but not without distortions. By

potentially allowing unproductive and inefficient companies to survive, helped by low debt servicing costs, negative rates could potentially hinder the creative destruction taking place during a normal economic cycle. In principle, similar to QE, negative rates could thus make economies less efficient or productive over time. The debate about so called "zombie" companies has been particularly intense in Japan given the low business turnover rate. According to OECD, Japan's business startup and closure rate is about 5%, roughly a third of that in other advanced economies with several commentators blaming the BoJ's ultra-accommodative policies for this problem.

12. QE could exacerbate so called “currency wars”.

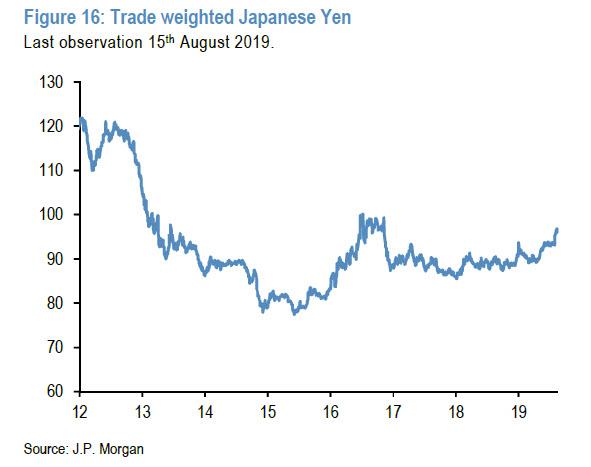

The value of the Japanese yen collapsed after Abenomics started in November 2012 and has stayed at historical lows since then helped by BoJ's ultra-accommodative monetary policy. This is shown in the next chart by the real trade weighted index of the Japanese yen.

Japan's main competitors across EM and DM have been feeling the pressure from this depreciation, though it is not clear that the depreciation necessarily means the yen is undervalued. Similarly, more recently, the ECB's prospective shift towards more negative rates is currently putting downward pressure on the euro vs the dollar risking a response by the US administration

* * *

Putting all of the above together, JPMorgan warns that moving to very negative policy rates - as the world is clearly doing now - by central banks is not without risks or side effects. Modestly negative policy rates had perhaps an overall positive impact initially, but keeping rates in very negative territory for prolonged periods or navigating to even deeper negative territory could unleash more unintended consequences than benefits. Just like QE, which from an emergency medicine to prevent the world from dying became a laxative to be used daily to prop up stock markets for the better part of the past decade.

Still, in JPM's opinion, this does not mean that central banks are without ammunition. Shifting to purchases of assets other than government bonds such as corporate bonds or bank loans has been used only sparingly so far. Even modest amounts of bank loan purchases could be more powerful than large purchases of government bonds, even if this implies central banks assuming more risk. This is especially true in the euro area where several countries face a persistent drag from non-performing loans, and where the ECB is very likely to get actively involved in reducing NPLs further by outright buying the loans.

Ironically, even the JPMorgan strategist warns that he is "rather reluctant to advocate purchases of equities given the lack of a positive impact from BoJ's equity ETF purchases so far, either in terms of the relative performance or the liquidity of the Japanese equity market."

Finally, in a claim that may spark a vendetta between Panigirtzoglou and Albert Edwards, the JPM strategist concludes that "negative rates are neither unavoidable nor necessary." As he explains, "Japanization didn't imply negative yields before the BoJ experimented with negative policy rates, following the experiment of the ECB. And negative rates do not appear to have delivered more effective stimulus and helped Japan to exit its longstanding economic malaise."

Panigirtzoglou goes one further, and in debunking a rather vocal financial troll who somehow has a prime time presence on financial TV and media, says that according to conversations with clients "the experiments of central banks with negative rates are viewed more as a policy mistake rather than stimulus and create a sense of an abnormal and uncertain environment that damages not only banks but also consumer and business confidence."

It is this sense of abnormality and uncertainty that makes businesses and consumers less rather than more keen to spend and banks more rather than less averse to taking risk and extending credit to the real economy.

Which is also why if and when negative rates are adopted by every central bank in the world, the consequences for society, for the economy, and for capital markets will be nothing short of catastrophic.

No comments:

Post a Comment