https://www.zerohedge.com/news/2019-08-20/ice-age-arrives-average-sovereign-yield-ex-us-drops-negative-first-time-ever

The Ice Age Arrives: Average Sovereign Yield Outside The US Turns Negative For The First Time Ever

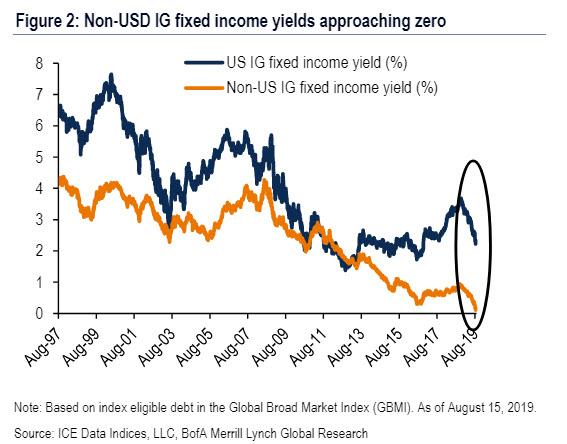

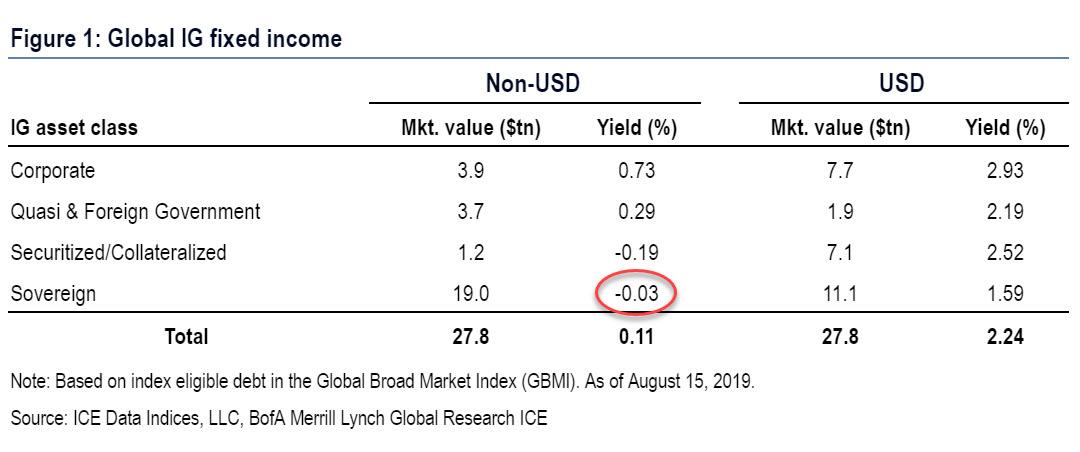

Last Friday afternoon, when what few traders were not on vacation were planning the venue of their evening alcohol consumption, we showed a remarkable analysis by Bank of America, which found that yields on the $27.8 trillion non-USD global investment grade bond market had declined to just 16bps and that the US share of global investment grade yields has climbed to 94%. But the punchline is that, as we said, "non-USD sovereign yields had dropped to just 2bps, meaning that any day now foreign sovereign debt may have no yield at all on average."

Fast forward to Monday, when following another surge in global bond prices, Bank of America refreshed its analysis, and foudn that the striking trends noted last week had become even more fascinating, to wit yields on the $27.8tn non-USD global IG fixed income market had declined to just 11bps (down from 16bps just one day earlier)...

... and the US share of global IG yields climbed to 95%...

... meaning that any foreign investor who is desperate for even the smallest trace of positive yield has no choice but to come to the US, something Kyle Bass echoed earlier on CNBC: "US rates are going to zero because they are the only DM yields with an integer in front of them."

.@Jkylebass on CNBC: “US rates are going to zero because they are the only DM yields with an integer in front of them”

- btw this echoes Pimco comment from earlier. In a race to negative/ zero what do you own?twitter.com/cnbcjou/status…

See Joumanna Bercetche's other Tweets

But the biggest shock is that for Albert Edwards, vindication is here if only outside the US for now: as per the BofA update, non-USD sovereign yields on $19 trillion in global debt - which was a paltry but positive +0.02% on Friday - have now turned negative on average for the first time ever at -3bps.

The silver lining: for now the average US sovereign yield is like a beacon for foreign investors, offering a "juicy" 1.59% but we fully expect this number to keep dropping as offshore pension funds rush to lock in positive yields while they can; naturally any further Fed rate cuts or "some QE" will only bring the US D-Day that much closer.

It's not just us: commenting on the Japanification of the world, Bank of America's Hans Mikkelsen wrote that "we continue to think there is a wall of new money being forced into the global corporate bond market" and adds that "the trigger is lower interest rate volatility or simply the passage of time, as a lot of foreign investors are being charged (negative yields) for being underinvested."

No comments:

Post a Comment