https://www.zerohedge.com/news/2019-07-23/sea-green-global-stocks-jump-us-debt-deal-cable-rebounds-after-bojo-elected

Sea Of Green As Global Stocks Jump On US Debt Deal, Cable Rebounds After BoJo Elected

A sea of green propelled world stocks higher on Tuesday, with U.S. equity futures rising alongside European and Asian stocks amid generally positive corporate earnings, a successful debt-ceiling deal in the US and a wave of central bank easing. The British pound first dropped, then rebounded after Boris Johnson was chosen as the country’s next prime minister. Oil stabilized and the dollar climbed.

In the US, S&P 500 futures were once again on the edge of surpassing 3,000 after President Trump said the White House and Congress reached a deal to extend the debt limit and for a 2-year budget, while reports added the budget deal would raise US discretionary spending to USD 1.37tln in fiscal 2020 from USD 1.32tln this year. Politico suggests that US President Trump has yet to declare support for the budget/debt deal, both GOP and Dems have expected more forceful endorsement from Trump, several sources said. Politico have asked for clarification, White house did not answer, but sources stated that President Trump is waiting to see how it plays out. Shares for United Technologies and Coca Cola rose in pre-market trading in New York as earnings beat estimates.

In the meantime, the U.S. and China are moving closer to resuming face-to-face trade talks, as purchases of American farm products and a ban on sales to China’s Huawei Technologies Co. remain sticking points.

“Markets feel poised for some increased volatility,” Nick Twidale, co-founder of tech platform X-Chainge, said in a note to clients according to Bloomberg. On U.S. earnings, “traders will be looking to see how much trade issues have affected the bottom line of some of the big players, although news the talks between the two trading superpowers could resume next week should support underlying sentiment."

In Europe, the Stoxx 600 index added 0.5% to Monday’s gains, helped by strong corporate results from oil bellwether Halliburton, Swiss bank UBS and Apple supplier AMS. The Stoxx 600 Automobiles & Parts Index rose as much as 3.3%, the most intraday since June 4, making the sector the best-performing group on the Stoxx 600. Faurecia rises as much as 6.6%, sending shares to the highest intraday level since May 6, after the company confirmed its 2019 outlook; peers Valeo, Hella rose as well while tyre maker Continental rose 4% despite a profit warning. Separately, Daimler rose as much as 2.3% after Chinese automaker BAIC took a 5% stake in the German company to boost an alliance between the companies; Daimler is set to report 2Q results Wednesday. A gain for BMW also helps boost the SXAP; shares rose as much as 3.7% after Morgan Stanley upgraded the stock, saying it is cheap and that the new CEO may provide a catalyst for re-rating.

“The results are coming in and have helped the market today and we are still under the influence of interest rates,” said Francois Savary, the chief investment officer of Prime Partners, referring to expectations of U.S. and ECB rate cuts. He noted that Wall Street earnings had provided no real worries so far and this week’s results from Facebook, Amazon.com and Google parent Alphabet would “drive the market up the road.”

Earlier in the session, Asian stocks advanced, led by technology companies, as Washington and Beijing moved closer to their first face-to-face trade talks in months. Japan and South Korea were among the best-performers in the region. President Donald Trump on Monday met with tech chief executives and agreed on making timely decisions on Huawei Technologies. The Topix climbed 0.8%, with SoftBank Group contributing the most. Japanese chip equipment makers rose after Morgan Stanley MUFG said it sees a better outlook for the sector. The Shanghai Composite Index closed 0.5% higher, supported by Agricultural Bank and SAIC Motor. China’s central bank continued to support lenders with cheap money as the economy slows. India’s Sensex advanced 0.4%, with Infosys and ITC among the biggest boosts. Financial firms lagged amid concerns about the quality of credit at some lenders.

In FX, the dollar reached a two-week high after Trump and congressional leaders agreed on Monday to a two-year extension of the U.S. debt limit, ending the threat a government default later this year. The euro fell 0.2% to $1.1189, weighed down by the likelihood of even more negative ECB interest rates in the coming months, which will be announced after the central bank meets on Thursday. "It is going to take a bold stroke by the ECB to both satisfy markets clamoring for incremental easing and make a difference to the economy, all the while remaining inside its institutional setting and not destabilizing the financial system,” wrote Carl Weinberg, chief economist at High Frequency Economics.

The New Zealand dollar led G10 losses after its central bank said it had “begun scoping a project to refresh our unconventional monetary policy strategy and implementation,” although it added it was at a very early stage. Britain’s pound initially slid toward the mid $1.24 region, however it recouped all losses after euroskeptic Boris Johnson was elected to replace Prime Minister Theresa May.

Concern that Britain will crash out of the European Union without a deal have grown since Johnson said he would pull Britain out on Oct. 31 “do or die”. The pound last traded at $1.2473.

In rates, the 10Y Treasury barely budged, and was last trading at 2.05%. Europe’s government bonds similarly were unchanged, with their yields slumping since the start of the year. Some yields did tick higher after the U.S. move on its debt ceiling. Germany’s 10-year bond yield, the benchmark for the euro zone, was up a basis point, but at minus 0.34% was near Monday’s two-week low and not far from the record low posted at the start of the month.

Upcoming events to watch include the first of potentially two confidence votes in Spain. Caretaker prime minister Sanchez needs an absolute majority to form a formal coalition with far-left rivals Podemos.

There was also a rumored meeting between the leaders of the two squabbling parties who make up Italy’s coalition government, 5-Star Movement’s Luigi Di Maio and League’s Matteo Salvini. “Investors are waiting to see whether this government will survive,” said DZ Bank strategist Daniel Lenz. “One possibility is that the coalition continues but both agree to replace (Giuseppe) Conte as prime minister, which would be a very bad signal.” Conte is widely seen as a moderating influence on the anti-establishment Italian government, particularly in terms of its relationship with Brussels.

In commodities, Brent crude added 0.19% to reach $63.38 per barrel. It had risen 1.2% the day before on concern over possible supply disruptions after Iran seized a British tanker last week.

Visa, Coca-Cola, United Technologies and Lockheed Martin are due to report earnings. Economic data include existing home sales, Richmond Fed manufacturing index.

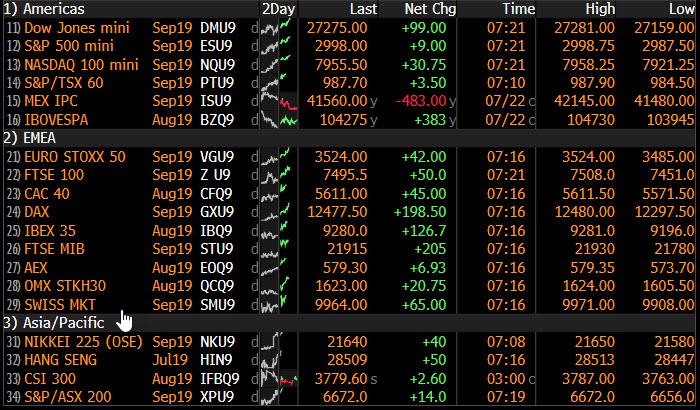

Market Snapshot

- S&P 500 futures up 0.2% to 2,995.75

- STOXX Europe 600 up 0.6% to 390.08

- MXAP up 0.3% to 160.56

- MXAPJ up 0.2% to 528.22

- Nikkei up 1% to 21,620.88

- Topix up 0.8% to 1,568.82

- Hang Seng Index up 0.3% to 28,466.48

- Shanghai Composite up 0.5% to 2,899.95

- Sensex up 0.3% to 38,153.39

- Australia S&P/ASX 200 up 0.5% to 6,724.63

- Kospi up 0.4% to 2,101.45

- German 10Y yield rose 0.6 bps to -0.34%

- Euro down 0.2% to $1.1183

- Brent Futures up 0.2% to $63.38/bbl

- Italian 10Y yield rose 4.8 bps to 1.3%

- Spanish 10Y yield rose 1.8 bps to 0.409%

- Brent Futures up 0.2% to $63.38/bbl

- Gold spot down 0.5% to $1,417.81

- U.S. Dollar Index up 0.3% to 97.52

Top Overnight News from Bloomberg

- President Trump announced a bipartisan deal to suspend the U.S. debt ceiling and boost spending levels for two years, capping weeks of frenzied negotiations

- Iran has handed down death sentences to several nationals accused of being part of a CIA- trained spy network uncovered earlier this year, an official said on Monday

- A group of U.K. lawmakers is planning a Scottish court battle to stop a future prime minister from suspending Parliament in order to force through a no-deal Brexit

- China’s central bank continued to support banks with cheap money, continuing its effort to support bank lending as the economy slows

- People’s Bank of China offered 297.7b yuan ($43b) of targeted medium-term loans at 3.15%, according to a central bank statement and also offered 200b yuan of medium-term lending facility funds at 3.30%

- Australia’s back-to-back rate cuts are helping to weaken the currency, RBA official Christopher Kent said, while quantitative easing is still “pretty unlikely” even as traditional policy ammunition wanes

- Australia adjusted its guaranteed source of liquidity to banks to reflect changes in the bond market, a senior central bank official said

- New Zealand’s central bank is taking another look at its strategy for unconventional monetary policy as its official cash rate looks set to plumb fresh record lows

- Oil held a two-day advance as tensions in the Persian Gulf threatened to disrupt energy flows from the region, while a tepid demand outlook kept a lid on gains

- Brexit vulnerabilities may prevent the Bank of England from raising interest rates even if their forecasts imply a need to do so, policy maker Michael Saunders tells Bloomberg in an interview

- The U.S. and China are moving closer to their first face-to-face trade negotiations in months, with a meeting between tech chief executives and Trump on Monday marking another step toward easing a ban on sales to China’s Huawei Technologies Co.

Asian equity markets were mostly higher as the region took its cue from the gains on Wall St, where all major indices closed higher led by the Nasdaq after White House officials agreed to meet blue-chip tech executives regarding Huawei and with energy stocks also underpinned as geopolitical concerns surrounding Iran lifted oil prices. ASX 200 (+0.5%) and Nikkei 225 (+1.0%) both advanced with Australia led by energy and tech as they tracked the outperformance of the sectors stateside, while the Japanese benchmark coat tailed on currency moves. Hang Seng (+0.3%) and Shanghai Comp. (+0.5%) were relatively indecisive and only edged marginal gains despite the encouraging trade-related reports in which US trade negotiators are likely to visit China next week for the first face-to-face meeting since the G20 and with China said to consider a plan to boost purchases of US soybeans, while the PBoC skipped open market operations but instead announced to lend CNY 200bln in 1yr MLF and CNY 297.7bln in 1yr targeted MLF loans. Finally, 10yr JGBs held near the prior day’s best levels following recent comments from BoJ Governor Kuroda who stated that that it is not easy to continue powerful measures for a long time but suggested that with zero lower bound for short-term interest rates, it might be better to directly affect long-term rates through large-scale asset purchases. Today’s 40yr JGB auction also failed to spur any significant price moves, as the results were mixed in which the b/c declined from prior but saw higher accepted prices.

Top Asian News

- Chinese Property Bonds’ Time in the Sun May Be Coming to an End

- Philippine Peso Falls as Fed Focus Eclipses Duterte’s Promises

- China Says U.S. Should Remove Its ‘Dark Hand’ in H.K. Protests

- Japan Post Share-Sale Plan Clouded by Insurance Unit Scandal

European stocks are higher across the board [Eurostoxx 50 +1.0%], following on from a positive Asia-Pac handover, as the region is bolstered by a pick-up in large-cap European earnings coupled with expectations for a dovish ECB later this week. Sectors are mostly in the green with underperformance seen in defensive sectors (Healthcare -0.2%, Utilities -0.2%), whilst the material (+1.9%) and IT (+1.4%) sectors outperform. The latter has been supported by US’ performance yesterday, after chip names rallied on the back of reports that White House officials have agreed to meet tech executives in regard to the recent Huawei ban. Further fuel was added to the bullish fire as AMS (+1.0%) reported optimistic numbers and opened higher in excess of 8% amid a revision higher to its Q3 revenue guidance, albeit shares have come off highs. As such fellow chip names have received a tailwind, with the likes of STMicroelectronics (+3.2%), Dialog Semiconductor (+0.7%) and Infineon (+3.3%) all higher in sympathy. Elsewhere, Continental (+4.8%) extended on gains despite its profit warning (which dented US peers) as the group noted that its Q2 results (release on August 7th) should be relatively insulated from the revised guidance, meanwhile trader chatter notes that the profit warning was priced earlier this month after shares hit 6yr lows. Thus, European peers Michelin (+2.2%) and Pirelli (+6.1%) are higher in tandem. Another notable mover include DAX-heavyweight Daimler (+3.9%) which is buoyed amid news that China’s BAIC Investment has acquired a 5% stake in the Co. Finally, this morning saw earnings from UBS (+2.2%) who reported a beat on Q2 net (USD 1.39bln vs. Exp. USD 1.38bln), a 23% Y/Y rise in its investment arm’s adj. pretax operating profit, and the intention to spend up to USD 1bln on stock buyback this year.

Top European News

- BOE Isn’t Tethered to Forecasts Suggesting Hikes, Saunders Says

- ECB Rate-Cut Plan Puts Worried Banks on Lookout for Sweeteners

- Santander Sees Americas Surge Make Up for Weak Profit in Europe

- U.K. Intervenes in Inmarsat Sale on National Security Basis

In FX, the Greenback is firmer across the board on several factors including progress on a US debt limit extension and 2 year budget accord that would increase discretionary spending and may avert another Government shutdown. Additionally, President Trump has reportedly taken heed of tech sector concerns over Huawei and agreed to make licensing decisions in a timely manner, while Washington and Beijing looks set to resume trade negotiations in person following recent phone conversations and the truce reached at the G20. The DXY has duly extended gains above the 97.000 handle and the index is now eyeing its prior July peak (97.593) having breached 97.5000, with the aid of independent weakness in several basket components.

- GBP/EUR/NZD - The Pound continues to underperform on UK political and Brexit risk ahead of Conservative leadership vote results that are expected to confirm victory for Boris Johnson, but the latest downturn also coincided with dovish/downbeat comments from BoE’s Saunders (subsequently backed up by a dire CBI trends survey). Cable has now crossed last Thursday’s 1.2429 low and found some underlying bids ahead of 1.2400 where around 700 mn option expiries reside, while Eur/Gbp popped just above 0.9000 before the single currency retreated a bit further through 1.1200 vs the Buck. Eur/Usd has now slipped below support at 1.1188 and 1.1181 (June troughs) to test a key Fib retracement at 1.1178 in the run up to tomorrow’s Eurozone preliminary PMIs and Thursday’s ECB meeting when a 10 bp rate cut is seen as a 2 in 5 prospect compared to nearer evens yesterday. Elsewhere, the Kiwi has been undermined by overnight comments from the RBNZ asserting that research into unconventional policy measures has started, with Nzd/Usd not far off the 200 DMA (0.6720) vs 0.6750 at one stage and close to 0.6800 of late.

- JPY/CHF - Both succumbing to a recovery in risk appetite (albeit selective), with the Yen sub-108.00 again and pulling away from decent expiry interest at 107.95-108.00 (1 bn), but still some distance from offers touted between 108.40-60 and technical resistance in close proximity (50 and 55 DMAs at 108.50 and 108.61 respectively). Similarly, the Franc continues to respect 0.9800, but Eur/Chf is still hovering near 1.1000 amidst the aforementioned Euro weakness that is being exacerbated by Italian and Spanish political uncertainty.

- AUD/CAD - Holding up a bit better than their G10 peers, but still posting losses against the Usd as the Aussie drifts back towards 0.7000 and is arguably only resisting a deeper reversal due to a sharp rebound in the Aud/Nzd cross to almost 1.0450 from sub-1.0400. Note, remarks from RBA Assistant Governor Kent have hardly impacted as he merely noted that the Aud would have been stronger without recent OCR cuts and global easing is constructive for Australia. Meanwhile, the Loonie has stemmed post-Canadian data losses circa 1.3140 and a few pips away from multi-tech levels including earlier monthly highs and a June low spanning 1.3144-51.

- EM - Some volatile trade for the Rand and Lira (once again), with Usd/Zar choppy between a 13.8570-9480 band on further confirmation that extra cash for Eskom is in the pipeline vs a warning from SA’s Finance Minister that initial pointers suggest that tax revenue may be considerably short of target for the 2019/20 fy. Conversely, Usd/Try has pared back within 5.7015-6700 parameters amidst a deterioration in Turkish consumer sentiment, and awaiting the US decision on sanctions before the CBRT delivers its verdict on rates on Thursday.

In commodities, there was little to report on the energy front with WTI/Brent prices contained within a narrow intraday band above the 56/bbl and 63/bbl levels respectively. Revisiting fundamentals, analysts at UBS reaffirm that prices continue to be supported by geopolitical tensions after US sanctioned a state-sponsored Chinese oil trader due a deal involving Iranian oil. Elsewhere on the geopolitical landscape, tensions between Russia and South Korea emerged after the latter fired warning shots at a Russian military plane after it reportedly entered South Korean airspace. Russia has rebuffed these claims, stating that South Korean planes the path of Russian strategic bombers over neutral waters and posed a threat to Russia. Although direct implications may not be felt in the energy market, it’s worth keeping in mind that the addition of further geopolitical tensions could wobble investor sentiment in complex. Another factor to monitor is Venezuela, following its nationwide power outage yesterday which is likely to hit Venezuelan oil production. Meanwhile, gold prices have steadied following its overnight decline as the USD gained further ground above 97.50 in Asia-Pac hours, with some also noting profit taking in the yellow metal. Copper is little changed and tentative heading into key risk events later this week, whilst Dalian iron ore edged lower as the demand outlook for the base metal was dampened by anti-smog curbs in Tangshan, China’s largest steel-making city.

US Event Calendar

- 9am: FHFA House Price Index MoM, est. 0.4%, prior 0.4%

- 10am: Richmond Fed Manufact. Index, est. 5, prior 3

- 10am: Existing Home Sales, est. 5.32m, prior 5.34m; MoM, est. -0.37%, prior 2.5%

DB's Jim Reid concludes the overnight wrap

After mentioning my friend’s unfortunate torn hamstring in a Father’s race at a school sports day, it was my daughter’s turn to have her first ever sports day at her nursery yesterday. I didn’t go but after training Maisie in the garden on Sunday I got a lecture from my wife on ensuring that I didn’t take these things too seriously and that it was a bad example to set if I did. So imagine my surprise when the videos of the events came through on my photo stream and I caught my wife castigating the young girl in the lane next to Maisie for coming into her lane and stealing all the props that had to be picked up en route to the finish line. She was calling “sabotage” and demanding a re-run (I think she was half joking but it was tough to tell). A consolation was that Eddie came second in the siblings race. However on closer inspection only 2 of the 8 under twos actually bothered to run towards the finish line. The other 6 - including his twin Jamie - actually meandered elsewhere on the field and to the best of my knowledge are still yet to finish!!

One race that will finish today is the race to be the new UK PM with Boris Johnson widely tipped to beat Jeremy Hunt. This will start a fascinating 3 months and 8 days for the UK ahead of the next Brexit deadline of October 31st. This is a good moment to remind readers of the latest DB Brexit probabilities courtesy of Oli Harvey. Over the summer Oli has raised his probability of a no deal Brexit to 45%. This reflects the fact that the incoming government will be politically committed to seeing the UK leave the EU by the 31st October without there being sufficient common ground between the incoming UK government and EU27 on changes to the Withdrawal Agreement or backstop during negotiations in the autumn to reach an agreement. This will leave Parliament as the check to a no deal outcome at the end of October, but crucially unless an election is called by the government or triggered by a no confidence motion by the second week of September, there will be insufficient time to hold one before the Brexit deadline. A possible outcome in these circumstances is that MPs in the House of Commons elect an interim national government to request an extension from the EU27. Here is Oli’s last note on the subject.

One interesting angle if a hard Brexit materialises is that it could be the first move in this part of the cycle towards helicopter money in a major economy. If the UK does see a hard Brexit then it seems almost inevitable that the fiscal taps will be turned on and the BoE will do fresh QE. In my humble opinion this will be a dress rehearsal for what will happen across the rest of the world when the next downturn arrives. So one to watch.

Now to markets and it was a slow grind yesterday ahead of the main risk events later this week. For example, in FX, the euro had an intraday range of just 0.16%, which was the second tightest of the year after New Year’s Day. Excluding all New Year’s Day sessions, it was the tightest range since 28 July 2014. Remarkable! Equities were a little more exciting with the S&P 500 advancing +0.29% with tech outperforming, as the NASDAQ and NYFANG indexes rose +0.71% and +0.78%, respectively. There were positive signs on the trade front, including a South China Morning Post article that suggested that Mnuchin and Lighthizer are likely to visit China for direct talks next week. The DOW (+0.07%) lagged, as Boeing (-1.05%) again dragged on the benchmark where it makes up 9.3% of the overall index. Fitch cut its credit outlook for the company while maintain its single-A rating, citing uncertainty around the 737 MAX grounding. Rates rallied slightly alongside equities, with 10-year treasury yields down -0.7bps, perhaps boosted a touch by the funding deal reached between Congress and the White House. The deal will apparently establish new, higher spending caps for the next two years and will suspend the debt ceiling until July 2021. The administration had previously asked for spending cuts.

Adding further to the positive developments around the US/China trade talks, the White House has said overnight that President Trump and senior administration officials met with CEOs from Google, Broadcom, Cisco, Intel, Micron Technology, Western Digital and Qualcomm to discuss economic issues including a possible resumption of sales to Huawei. A statement from the White House further added that the CEOs’, “requested timely licensing decisions from the Department of Commerce” on Huawei, “and the President agreed.” Meanwhile, yesterday Trump also ordered the US Defense Department to spur the production of a slew of rare-earth magnets used in consumer electronics, military hardware and medical research, amid concerns that China will restrict exports of the products. Trump invoked the 69-year-old Defense Production Act, once used to preserve American steelmaking capacity, towards this. Elsewhere, Trump said that the Chinese President Xi Jinping “acted responsibly” towards continued demonstrations in Hong Kong over the proposed extradition bill to China. The protests which began as an effort to stop the legislation from getting enacted have now turned into a list of demands including investigations into police tactics and a direct vote to replace Hong Kong’s Chief Executive Carrie Lam, as over 1 million participants continue to protest.

This morning in Asia markets are largely heading higher with the Nikkei (+1.05%) leading advances. The Hang Seng (+0.11%), Shanghai Comp (+0.07%) and Kospi (+0.53%) are also up. All the G-10 currencies are trading weaker (range -0.2% to -0.4%) this morning with the New Zealand dollar being the weakest (-0.37%) on news that its central bank has done contingency planning for unconventional monetary stimulus. The RBNZ said in a statement that, “this year the Reserve Bank has begun scoping a project to refresh our unconventional monetary policy strategy and implementation. This is at a very early stage.” Elsewhere, futures on both the S&P 500 and Nasdaq are up +0.10%.

On the ECB, there was some attention paid to an MNI story which reported anonymous ECB sources saying that a change in forward guidance is likely at Thursday’s meeting. They could add a reference to keeping rates “at their present levels or lower,” or they could commit to not hiking through end-2020. That is completely consistent with our economists’ expectations ( link ). Michal in my credit team has also summarized his views here ( link ) on a potential re-launch of corporate bond purchases and what we expect in terms of timing and calibration, including whether senior preferred bank bonds might be included. We provide an update on how much the CSPP has been priced in already by the market and whether we see more value in CSPP-eligible or ineligible bonds at this point.

Ahead of the ECB, European core bonds continued to rally with 10yr Bunds falling another -2.2bps to -0.346% and some 15bps lower in yield than the local highs 10 days ago. The former on-the-run 10 year bond (before the roll 2 weeks ago) is now just one basis point away from its all-time low yield of -0.400%. BTPs bucked the global trend with 10yrs rising +4.9bps at the start of a big week for the coalition government. There is speculation that Salvini and Di Maio will meet as early as today to discuss their alliance. The subject of more autonomous laws granting more powers for the northern regions (League’s core support area) will also possibly come to a head. Speculation mounts as to whether Salvini will angle toward snap elections, a move to oust PM Conte, replacing S5M cabinet ministers, or simply maintaining the status quo for now. It’s not clear if he could take any of these moves unilaterally, since President Mattarella could conceivably offer S5M and the centre-left PD the opportunity to form a new government without Salvini’s Northern League, if it came to that. We may find out more this week.

The other set of events to watch this week are earnings, where one-third of the S&P 500 by market cap reports. Yesterday, the schedule was a bit light, with only Halliburton (+9.15%) and Whirlpool (-1.88% in afterhours trade after being up as much as +5.6% at one point) attracting attention. Halliburton – a leading manufacturer of fracking equipment – announced softer demand in the US, but this was offset by an improved outlook abroad, and their stock was helped by a reduction in costs as well. Whirlpool beat earnings estimates as well and raised its forecasts for the rest of the year. Today, we’ll look forward to results from Visa, Coca-Cola, United Technologies, Texas Instruments, and Lockheed Martin. Facebook reports tomorrow, and it’s worth highlighting this report from DB’s payments team which looks at the company’s proposed cryptocurrency, Libra. The report discusses the use cases for the currency, the viability of Libra in transactions, its governance, and the potential regulatory hurdles. The full note is available here .

The data calendar was extremely light yesterday, with the only noteworthy release coming from the Chicago Fed’s national activity index, which stayed negative at -0.02 for June compared to expectations for a rebound to positive 0.08. That now marks eight consecutive months of negative prints, which is the longest such streak since 2009.

Looking at today’s calendar, the highlight will likely be the announcement of the next UK PM. Apart from politics, the IMF will release its latest World Economic Outlook which will get plenty of headlines, plus we’ll see earnings from Harley Davidson, Coca-Cola, United Technologies, and Visa. On the data front, we’ll get final June machine tool orders in Japan, July consumer confidence for the Euro Area and the May FHFA house price index, July Richmond Fed survey and June existing home sales data all in the US.

No comments:

Post a Comment