https://www.zerohedge.com/news/2019-03-08/china-auto-sales-crash-february-amid-accelerating-industry-collapse

China Auto Sales Crash in February Amid Accelerating Industry Collapse

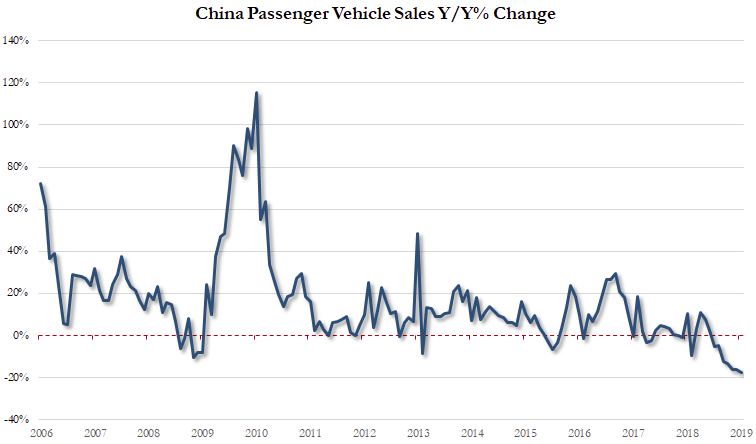

Just days ago, we reported that US auto sales had tumbled to 18 month lows, continuing what has been an abhorrent start to the year for the automotive industry after a dismal 2018. Unfortunately, the global misery doesn't appear to be anywhere near over yet, with arguably the world's most important market, China, set to post another slate of miserable sales numbers for February.

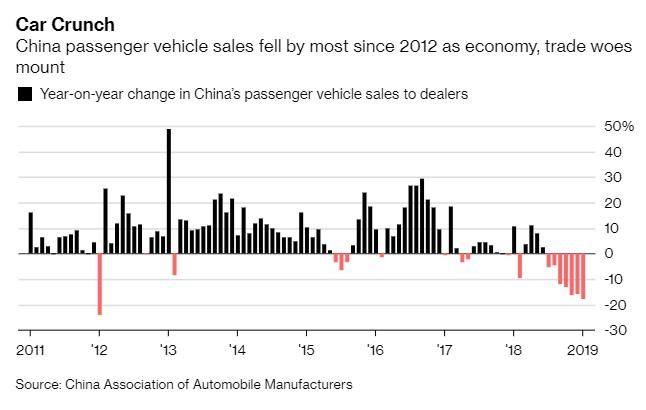

New estimates from China's Passenger Car Association paint an outright terrifying picture for auto demand in the world's most populous nation as we head approach the end of the first quarter. Unofficial auto sales data for February includes China's passenger vehicle sales down 16.9% YOY to 1,207,538 units for wholesale, and down 19.0% YOY to 1,169,751 units for retail. Luxury brands saw a 2.9% retail sales decline and mainstream JV brands had a 13.8% decline. Domestic brands had a 27.5% decline.

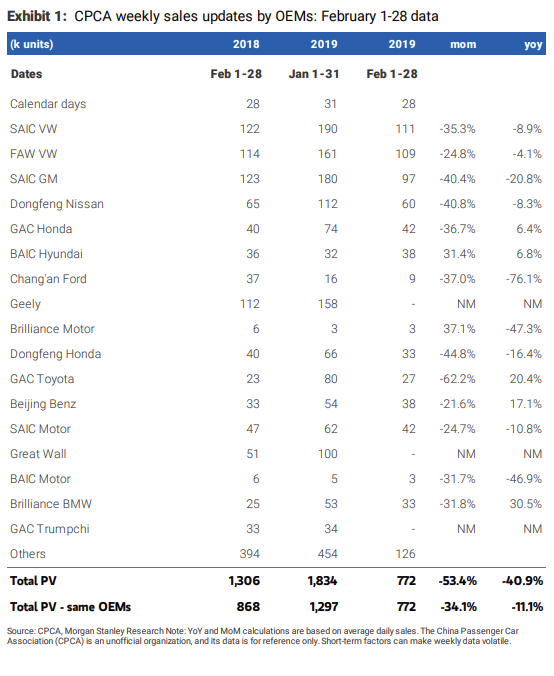

Meanwhile, the latest weekly sales estimates for OEMs released by Morgan Stanley show that Chang'an Ford will see a stunning drop of 76.1% in sales, followed by China's Brilliance Motor, who is set to see a 47.3% decline in sales. BAIC Motor estimates are for sales down 46.9% and SAIC GM expects a drop in sales of 20.8%. SAIC VW and FAW VW will fall 8.9% and 4.1%, respectively, while Dongfeng Nissan is set to fall 8.3%.

Bucking the trend will be names like GAC Honda and BAIC Hyundai, rising 6.4% and 6.8%, respectively. GAC Toyota and Beijing Benz also will see positive traction in YOY sales, rising 20.4% and 17.1% YOY despite falling 62.2% and 21.6% sequentially, while the oddly named GAC Trumpchi is flat Y/Y.

That said, almost all manufacturers are expected to experience significant double digit sequential drops.

The CPCA also expects a "lackluster" market in March with limited effect from discounts offered to rural customers. We reported just days ago that car dealers in China, especially those in rural areas, were unable to lure in new buyers with traditional incentives, even as price reductions of more than 10% from the sticker price are now common, while interest free loans are also being offered to try and lure car buyers to showrooms, especially outside of China’s major cities. For now, however, buyers aren’t taking the bait.

Making matters worse, amid the slowdown of the world's second largest economy consumers are starting to do away with big purchases in general. There’s also an argument surfacing that heavy incentivizing could wind up doing more harm than good to automakers' finances, possibly setting up for more layoffs, restructurings and mergers in the industry. Shi Jianhua, a deputy secretary general of China Association of Automobile Manufacturers, said "2019 should be a year of the survival of the fittest and we may see more merger and reorganization cases in the auto industry."

In late January, Beijing urged authorities to roll out measures to help boost vehicle sales in rural areas, noting that a similar effort about a decade ago helped revive demand. While local governments have yet to make any announcements, automakers are moving ahead with offers of their own.

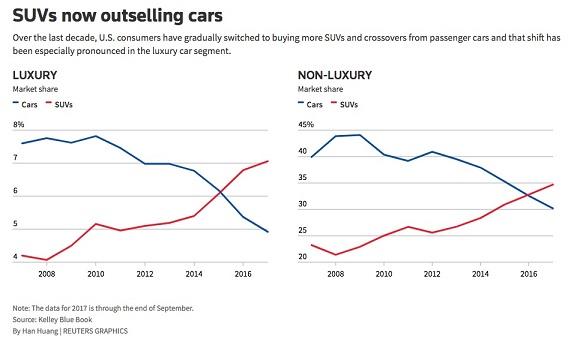

In the U.S., we noted earlier this month that SUV demand had finally dried up. SUVs were, until this month, one of the sole remaining bright spots in the rapidly slowing U.S. auto market. Despite the fact that they were crippling traditional sedan sales, Americans' transition to SUVs was seen as a silver lining, prompting many automakers to make infrastructure changes to account for the change in demand.

Those days, however, seem to be over, according to the latest, February U.S. auto sales data. Fiat Chrysler posted its first monthly sales decline in a year, according to Bloomberg. The kicker? Jeep, the company's driving force for the past several years, showed a rare back-to-back drop in deliveries. Charlie Chesbrough, senior economist of Cox Automotive said: “The results today suggest a much bigger story: The sales pace has finally shifted into a lower gear.”

One thing is for sure: misery in the auto industry isn't limited to just one country, and doesn't look like it'll be stopping anytime soon.

No comments:

Post a Comment